U.S. SANCTIONS FOR THE WORLD

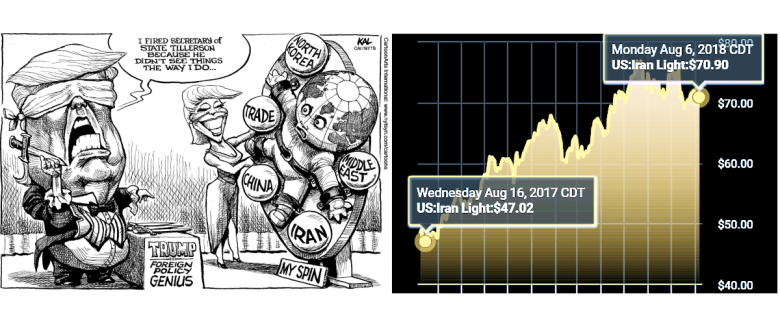

ARAB NEWS - Oil prices are unlikely to rise significantly following the reintroduction of some US sanctions on Iran because the market has already priced in the expected reduction in Iranian output, analysts say.

"While there is still some uncertainty about what will happen to Iranian oil, we think there probably won't be a significant impact on prices," William Jackson, chief emerging markets economist at Capital Economics, said in a research note.

Brent rose slightly on Tuesday to reach more than $74 per barrel after the sanctions were reintroduced, while WTI edged above $69 per barrel.

US President Donald Trump tweeted on Tuesday: "These are the most biting sanctions ever imposed, and in November they ratchet up to yet another level. Anyone doing business with Iran will NOT be doing business with the US."

The US sanctions planned for November are expected to affect oil exports.

Hussein Sayed, chief market strategist at FXTM, said he expects oil prices to remain stable.

"I think prices will remain well supported in the near term. However, a break above $80 needs a supply shock, but we are not there yet," he said in a research note.

While the US wants to reduce Iranian exports to zero by November, the Trump administration still needs to persuade China, Russia and the EU signatories to the Joint Comprehensive Plan of Action (JCPOA) — otherwise known as the Iran deal, to cut ties with the country.

They all still oppose Trump's decision in May to withdraw from the deal brokered in 2015 and revive sanctions against Iran.

"It's becoming a difficult guess as to how many barrels will be off the market by then (November)," said Sayed.

Any reduction of Iranian output will be likely offset by increased production by the Gulf producers, said Jackson.

"It does look like the Gulf economies will raise oil output further over the rest of the year under the revised OPEC deal, in part, to offset the impact of lower Iranian output," he said. In June, OPEC, Russia and other oil-producing countries agreed to increase production from July.

"It is possible that a potential shortfall in Iranian output could be offset from other oil producers, but this is somewhat of a speculative subject and no one will truly know in the near-term," said Jameel Ahmad, global head of currency strategy and market research at FXTM.

It is, however, the impact of sanctions on regional stability in the Middle East that could be of greater concern than any fluctuations in oil markets, commentators warn.

"The geopolitical implications for the Gulf could present a bigger threat," said Jackson.

"Tehran might respond to the sanctions by stoking tensions in the region, including in Yemen, Syria and Lebanon.

"Heightened geopolitical tensions appear to be behind the poor performance of the region's financial markets over the past year. Stock markets have risen by much less than would have been expected given the increase in oil prices," Jackson said.

Iran and Saudi Arabia have been embroiled in a proxy war in Yemen for more than three years, with Saudi Arabia accusing Iran of supplying arms and support to Houthi forces who are battling against government forces.

"Iran isn't clamoring for a fight at the moment," said Naysan Rafati, Iran analyst at the International Crisis Group in Washington DC.

"But if sanctions — and the key here will be the sanctions against Iran's oil exports — really start to impact Iran's economy, there is certainly a possibility that Iran will respond," he said.

He noted Iran's warning last month about its ability to close off the Strait of Hormuz in retaliation to US pressure. The strait transports around a fifth of the world's traded oil.

"There are also several flashpoints across the region, from Yemen to the Golan Heights, where we could see an inadvertent clash between Iranian or Iran-backed forces and US allies that leads to a wider escalation," Rafati said.

Ghanem Nuseibeh, founder of the London-based strategy consultancy, Cornerstone Global Associates, said that Iran's options for retaliation are limited, in part due to the impact of the sanctions.

"There is little Iran can do. They have failed diplomatically to get the Europeans to stand for them and they are practically facing isolation," he said.

"Iran may want to intensify supporting its proxy groups in Yemen and other places, but the renewed sanctions will make it difficult for them to both cushion the effects of the sanctions internally and at the same time expand their foreign expenditure to support foreign fighting," he said.

Neil Quilliam, senior research fellow with the Middle East and North Africa program, at Chatham House in London, countered growing fears that Iran may look to incite more regional instability.

He said Iran will more likely consider diplomatic options to fight back against the US.

"I don't think they will look to take further action to unsettle the region. Iran will want to 'isolate' the US and drive a wedge between the EU3, Russia, China and the US," he said.

"It will want to demonstrate to the remaining partners of the Joint Comprehensive Plan of Action that it is committed to the deal and wants to continue working with them," at least until Nov. 4 which is when the US is scheduled to reimpose a further raft of sanctions including those affecting the oil sector, he said.

-----

Earlier:

2018, July, 25, 09:50:00

TURKEY OPPOSES IRAN SANCTIONSREUTERS - Turkey has told American officials it opposes U.S. sanctions on Iran and is not obliged to implement them, Foreign Minister Mevlut Cavusoglu said on Tuesday.

|

2018, July, 25, 09:45:00

THE DIFFICULT IRANIAN SANCTIONSOGJ - “Russia already has improved its relations with Iran. Given its foreign policy stance toward the US, this could grow if it believes it would undermine the US position. Russia is taking a long-term view. It sees several obstacles, which it is determined to overcome.” |

2018, July, 6, 11:50:00

ИРАН ЭКСПОРТИРОВАЛ 2,6 МБД НЕФТИИРНА - Иран в течение прошедшего месяца (июнь), экспортировал 2,6 миллиона баррелей нефти в день в страны Азии и Европы, начиная с 20 марта 2017 года. Экспорт включал 2,280 млн баррелей нефти в сутки и 330 тыс. баррелей конденсата в сутки в течение одномесячного периода. |

2018, July, 6, 11:45:00

IRAN'S OIL IS IMPORTANTSHANA - Donald Trump's call on other countries to stop buying crude oil from Iran and putting European companies under pressure would be a kind of self-harm for the US leading to dramatic price hikes in the oil market, given Nigeria and Libya being crisis-stricken, Venezuela's crude oil output having plunged and Saudi Arabia's domestic consumption spike in summer, Iran's OPEC Governor says. |

2018, June, 29, 10:45:00

U.S. - IRAN SANCTIONS FOREWERWSJ - Iran exports more than 2 million barrels a day of oil. President Donald Trump in May withdrew from a nuclear deal with Iran and reimposed sanctions that seek to force companies not to buy any Iranian oil. |

2018, June, 13, 13:00:00

CHINA - IRAN PARTNERSHIPPLATTS - China and Iran have agreed to strengthen strategic cooperation during Iranian President Hassan Rouhani's visit to China, possibly paving the way for steady crude flows between the two countries. |

2018, May, 30, 13:45:00

INDIA IGNORES SANCTIONSBLOOMBERG - India, a long-time buyer of oil from both Iran and Venezuela, only complies with United Nations-mandated sanctions and not those imposed by one country on another, said foreign minister Sushma Swaraj at a press conference in New Delhi on Monday. |