OIL PRICE: NEAR $79 AGAIN

REUTERS - Oil steadied on Wednesday, as concerns that producers may fail to cover a shortfall in supply once U.S. sanctions on Iran come into force outweighed an increase in U.S. inventories.

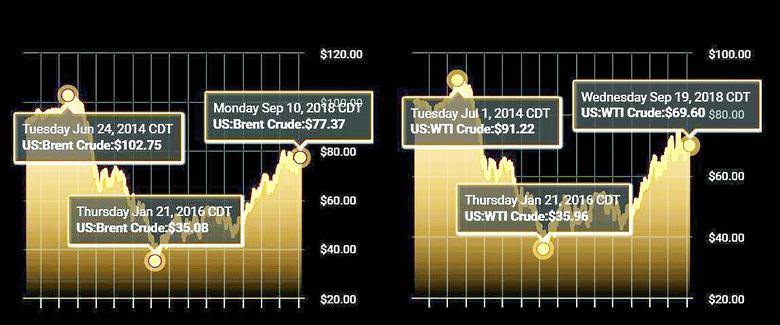

Brent crude futures LCOc1 were up 2 cents at $79.05 a barrel by 0854 GMT, having gained 1.3 percent on Tuesday following media reports that Saudi Arabia, the world's largest oil exporter, was comfortable with prices above $80.

U.S. crude futures CLc1 were up 15 cents at $70.00, after gaining 1.4 percent the day before.

"Whether or not this (price) development was justified, it is a supply-side development and the market has reacted to it," PVM Oil Associates strategist Tamas Varga said.

"Trade wars, if anything, should impact oil demand, but that's being completely ignored, which goes to tell me that the market is much more sensitive to supply-side developments ... I think that is going to remain the theme for the next six weeks until the next round of U.S. sanctions against Iran kick off."

The focus on oil supply has been reflected in the options market this week, where investors have scooped up large amounts of bullish buy, or call, options.

Data from the InterContinental Exchange shows open interest in calls that give the owner the right to buy Brent futures at $80 and $85 by next week grew by nearly 45 percent on Monday and Tuesday to an equivalent of 54 million barrels of oil.

Reuters reported on Sept. 5 that Saudi Arabia wants oil to stay between $70 and $80 a barrel to keep a balance between maximizing revenue and keeping a lid on prices until U.S. congressional elections.

The Organization of the Petroleum Exporting Countries and other producers including Russia meet on Sept. 23 in Algeria to discuss how to allocate supply increases within their quota framework to offset the loss of Iranian supply.

U.S. sanctions affecting Iran's oil exports come into force on Nov. 4. Although many buyers have scaled back purchases, it is unclear how easily other producers can compensate for any lost supply.

Traders took the Saudi comments "as a sign that they (Saudi Arabia) won't be aggressively responding to the rise in prices with supply increases", ANZ bank said in a note.

Concern over supply overshadowed a surprise increase in U.S. oil inventories.

U.S. crude stockpiles rose by 1.2 million barrels to 397.1 million in the week to Sept. 14, the American Petroleum Institute said.

Official inventory data from the U.S. Energy Information Administration will be released on Wednesday.

-----

Earlier:

2018, September, 17, 15:25:00

OIL PRICE: NOT ABOVE $79 YETREUTERS - Brent crude oil was up 40 cents a barrel at $78.49 by 1155 GMT. U.S. light crude was up 45 cents at $69.44.

|

2018, September, 17, 15:20:00

РОССИЯ И САУДОВСКАЯ АРАВИЯ: СТАБИЛЬНОСТЬ НА РЫНКЕМИНЭНЕРГО РОССИИ - Министры обсудили динамику спроса и предложения на рынке с фокусом на макроэкономические тренды и потенциальные сценарии развития ситуации в среднесрочной перспективе. Стороны подтвердили приверженность обеспечению стабильности на рынке и готовность оперативно реагировать на изменения рыночной конъюнктуры, чтобы совместно с партнерами обеспечить стабильность рынка в любых условиях. |

2018, September, 14, 12:45:00

OIL PRICE: NOT ABOVE $79REUTERS - Brent crude was up 3 cents at $78.21 a barrel by 0634 GMT, after falling 2 percent on Thursday. The global benchmark rose on Wednesday to its highest since May 22 at $80.13. U.S. West Texas Intermediate (WTI) futures were up 18 cents, or 0.2 percent, at 68.76 a barrel, after dropping 2.5 percent on Thursday. |

2018, September, 14, 12:40:00

IEA: OIL PRICES COULD RISEIEA - If Venezuelan and Iranian exports do continue to fall, markets could tighten and oil prices could rise without offsetting production increases from elsewhere.

|

2018, September, 14, 12:30:00

FIXED U.S. OIL PRICEREUTERS - U.S. shale producers are locking in prices for their production as much as three years into the future in a sign that strong domestic crude pricing is nearing a peak, according to market sources familiar with money flows.

|

2018, September, 13, 14:35:00

OIL PRICE: NEAR $79 YETREUTERS - Benchmark Brent crude oil LCOc1 was down 70 cents a barrel at $79.04 by 0830 GMT. U.S. light crude CLc1 fell $1.15 to a low of $69.22 a barrel.

|

2018, September, 12, 12:30:00

OIL PRICE: NEAR $79REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $69.93 per barrel at 0646 GMT, up 68 cents, or 1 percent, from their last settlement. WTI futures gained 2.5 percent in the previous session. Brent crude futures LCOc1 climbed 30 cents, or 0.4 percent, to $79.36 a barrel. Brent has climbed for four straight sessions, gaining 2.2 percent the previous day. |