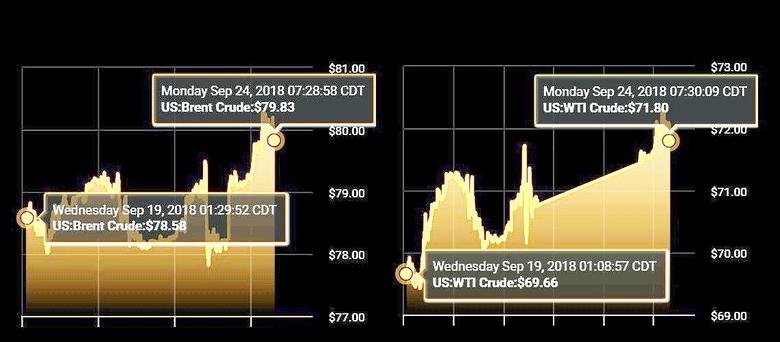

OIL PRICE: NEAR $80

REUTERS - Oil prices jumped more than 2 percent to a four-year high on Monday after Saudi Arabia and Russia ruled out any immediate increase in production despite calls by U.S. President Donald Trump for action to raise global supply.

Benchmark Brent crude LCOc1 hit its highest since November 2014 at $80.94 per barrel, up $2.14 or 2.7 percent, before easing to around $80.75 by 1150 GMT. U.S. light crude CLc1 was $1.25 higher at $72.03.

"This is the oil market's response to the OPEC+ group's refusal to step up its oil production," said Carsten Fritsch, commodities analyst at Commerzbank in Frankfurt.

OPEC leader Saudi Arabia and its biggest oil-producer ally outside the group, Russia, on Sunday effectively rebuffed a demand from Trump for moves to cool the market.

"I do not influence prices," Saudi Energy Minister Khalid al-Falih told reporters as OPEC and non-OPEC energy ministers gathered in Algiers for a meeting that ended with no formal recommendation for any additional supply boost.

Trump said last week that OPEC "must get prices down now!", but Iranian Oil Minister Bijan Zanganeh said on Monday OPEC had not responded positively to Trump's demands.

"It is now increasingly evident, that in the face of producers reluctant to raise output, the market will be confronted with supply gaps in the next three-six months that it will need to resolve through higher oil prices," BNP Paribas oil strategist Harry Tchilinguirian told Reuters Global Oil Forum.

Commodity traders Trafigura and Mercuria said on Monday that Brent could rise to $90 per barrel by Christmas and pass $100 in early 2019, as markets tighten once U.S. sanctions against Iran are fully implemented from November.

JPMorgan said U.S. sanctions on Iran could lead to a loss of 1.5 million barrels per day, while Mercuria warned that as much as 2 million bpd could be knocked out of the market.

The Organization of the Petroleum Exporting Countries as well as top producer Russia has been discussing raising output to counter falling supply from Iran, although no decision has been made public yet.

A source familiar with OPEC discussions told Reuters on Friday that OPEC and other producers have been discussing the possibility of raising output by 500,000 bpd.

"We expect that those OPEC countries with available spare capacity, led by Saudi Arabia, will increase output but not completely offset the drop in Iranian barrels," said Edward Bell, commodity analyst at Emirates NBD bank.

U.S. commercial crude oil inventories are at their lowest since early 2015 and although U.S. oil production is near a record high of 11 million bpd, subdued U.S. drilling points toward a slowdown in output.

-----

Earlier:

2018, September, 21, 11:00:00

OIL PRICE: NEAR $79 STILLREUTERS - International benchmark Brent crude for November delivery LCOc1 was up 26 cents, or 0.33 percent, at $78.96 a barrel by 0647 GMT. U.S. West Texas Intermediate crude for October delivery CLc1 was up 7 cents, or 0.10 percent, at $70.39 a barrel. |

2018, September, 21, 10:45:00

UNEXPECTED OIL PRICESSHANA - What is common in oil market is that no price levels could be forecast for the future there. Only its unpredictability is predictable. Rarely may you find an expert to say with full certainty in which direction oil prices are headed. |

2018, September, 21, 10:40:00

OIL MARKET UNCERTAINTYPLATTS - 1.4 million b/d of Iranian oil supplies to leave the market by November, when the US sanctions go into force. Venezuela, which pumped 1.22 million b/d in August could see output fall to 1 million b/d in 2019. Politically unstable Libya also presents a supply risk. |

2018, September, 21, 10:35:00

OPEC-NON-OPEC DECISIONSSHANA - Iran’s Minister of Petroleum Bijan Zangeneh said the Joint OPEC/Non-OPEC Ministerial Monitoring Committee (JMMC) is not legally competent to make decisions about adjustment of production quotas.

|

2018, September, 21, 10:20:00

WORLD OIL DEMAND: 100.23 MBDOPEC - Total oil demand for 2018 is now estimated at 98.82 mb/d. In 2019, world oil demand growth is forecast to rise by 1.41 mb/d. Total world oil demand in 2019 is now projected to surpass 100 mb/d for the first time and reach 100.23 mb/d.

|

2018, September, 19, 14:07:00

OIL PRICE: NEAR $79 AGAINREUTERS -Brent crude futures LCOc1 were up 2 cents at $79.05 a barrel by 0854 GMT, having gained 1.3 percent on Tuesday following media reports that Saudi Arabia, the world’s largest oil exporter, was comfortable with prices above $80. U.S. crude futures CLc1 were up 15 cents at $70.00, after gaining 1.4 percent the day before.

|

2018, September, 19, 13:47:00

OIL PRICES: $70 - $80PLATTS - Current global oil prices at around $70-80/b are due to the volatile situation on the market and include a premium for risks associated with sanctions and oil supply cuts, but they are expected to fall to around $50/b in the long term, Russian energy minister Alexander Novak said Tuesday. |