OIL PRICE: NEAR $82 YET

REUTERS - Oil prices inched up on Friday, with investors trying to gauge the potential impact on supply from looming sanctions by the United States on Iran's crude exports.

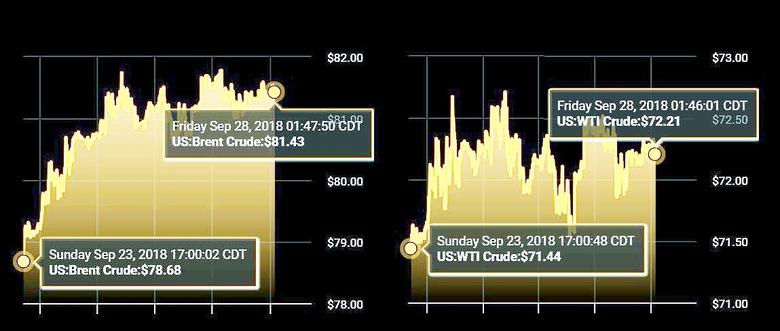

The most-active Brent crude futures contract, for December,LCOZ8 was up 15 cents, or 0.2 percent, at $81.53 per barrel at 0548 GMT.

The front-month LCOc1 November contract will expire later on Friday and is at $81.73 a barrel. The contract rose to four-year high of $82.55 on Tuesday. Brent is set to rise 5.6 percent in September, on track for the biggest monthly gain since April.

U.S West Texas Intermediate (WTI) futures CLc1 were up 19 cents, or 0.3 percent, at $72.32 per barrel. It is set to gain rose 3.6 percent this month, the biggest increase since June.

"The market has been focusing on trading headlines on the Iran sanctions for a whole week. But views on how much OPEC and Russia can make up for the losses vary," said Chen Kai, head of commodity research at Shengda Futures.

The sanctions on Iran, the Organization of the Petroleum Exporting Countries (OPEC) third-largest producer, start on Nov. 4, with Washington asking buyers of Iranian oil to cut imports to zero to force Tehran to negotiate a new nuclear agreement and to curb its influence in the Middle East.

Concerns around the sanctions also led to a widening difference between WTI and Brent prices as it created positive conditions for U.S. oil exports.

"Oil exporters will take advantage of the looming discount with heightened buying activities on the WTI benchmark", Benjamin Lu from Philip Futures said in note.

Saudi Arabia is expected to quietly add extra oil to the market over the next couple of months to offset the drop in Iranian production, but is worried it might need to limit output next year to balance global supply and demand as the United States pumps more crude.

Two sources familiar with OPEC policy said Saudi Arabia and other producers discussed a possible production increase of about 500,000 barrels per day (bpd) among OPEC and non-OPEC producers.

However, ANZ said in a note on Friday that major suppliers were unlikely to offset losses due to the sanctions estimated at 1.5 million bpd.

At its 2018 peak in May, Iran exported 2.71 million bpd,nearly 3 percent of daily global crude consumption.

-----

Earlier:

2018, September, 26, 09:50:00

OIL PRICE: NEAR $82REUTERS - Brent crude futures were down 4 cents at $81.83 a barrel by 0342 GMT, after gaining nearly 1 percent the previous session. Brent rose on Tuesday to its highest since November 2014 at $82.55 per barrel. U.S. crude futures were down 13 cents, or 0.2 percent, at $72.15 a barrel. They rose 0.3 percent on Tuesday to close at their highest level since July 11. |

2018, September, 26, 09:15:00

IRANIAN OIL EXPORTS DOWNREUTERS - Exports of crude oil and condensates have declined by 0.8 million barrels a day (mbd) from April to September 2018, the IIF, which represents major banks and financial institutions from around the world, said.

|

2018, September, 24, 15:35:00

OIL PRICE: NEAR $80REUTERS - Benchmark Brent crude LCOc1 hit its highest since November 2014 at $80.94 per barrel, up $2.14 or 2.7 percent, before easing to around $80.75 by 1150 GMT. U.S. light crude CLc1 was $1.25 higher at $72.03.

|

2018, September, 24, 15:30:00

BALANCED OIL MARKETOPEC - The JMMC noted that, despite growing uncertainties surrounding market fundamentals, including the economy, demand and supply, the participating producing countries of the DoC continue to seek a balanced and sustainably stable global oil market, serving the interests of consumers, producers, the industry and the global economy at large. The Committee also expressed its satisfaction regarding the current oil market outlook, with an overall healthy balance between supply and demand. |

2018, September, 24, 15:25:00

СОТРУДНИЧЕСТВО РОССИИ И САУДОВСКОЙ АРАВИИМИНЭНЕРГО РОССИИ - «Благодаря нашей с Вами работе, прежде всего по линии ОПЕК+, отношения между нашими странами значительно укрепились. Видим постоянно растущую заинтересованность российских компаний в налаживании более тесных связей с саудовскими партнерами. Это особенно важно в свете той ответственной роли, которую наши страны играют на региональной и международной арене, особенно в сфере энергетики», - сказал глава энергетического ведомства.

|

2018, September, 21, 11:00:00

OIL PRICE: NEAR $79 STILLREUTERS - International benchmark Brent crude for November delivery LCOc1 was up 26 cents, or 0.33 percent, at $78.96 a barrel by 0647 GMT. U.S. West Texas Intermediate crude for October delivery CLc1 was up 7 cents, or 0.10 percent, at $70.39 a barrel. |

2018, September, 21, 10:45:00

UNEXPECTED OIL PRICESSHANA - What is common in oil market is that no price levels could be forecast for the future there. Only its unpredictability is predictable. Rarely may you find an expert to say with full certainty in which direction oil prices are headed. |