OIL PRICE: NEAR $82

REUTERS - Oil benchmark Brent traded little changed on Wednesday after rising to its highest in nearly four years in the previous session while U.S. crude futures fell as United States' officials tried to assure that the market would be well-supplied before sanctions are re-imposed on producer Iran.

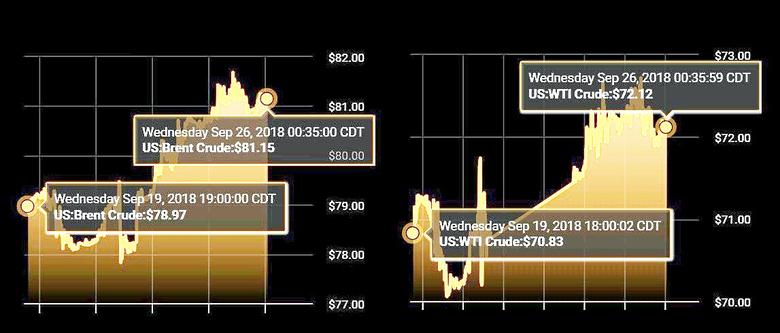

Brent crude futures were down 4 cents at $81.83 a barrel by 0342 GMT, after gaining nearly 1 percent the previous session. Brent rose on Tuesday to its highest since November 2014 at $82.55 per barrel.

U.S. crude futures were down 13 cents, or 0.2 percent, at $72.15 a barrel. They rose 0.3 percent on Tuesday to close at their highest level since July 11.

The United States will apply sanctions to halt oil exports from Iran, the third-largest producer in the Organization of the Petroleum Exporting Countries (OPEC), starting on Nov. 4. The pending loss of Iranian supply has been a major factor in the recent surge in crude prices.

U.S. officials, including President Donald Trump, are trying to assure consumers and investors that enough supply will remain in the oil market while requesting producers raise their output.

"We will ensure prior to the re-imposition of our sanctions that we have a well supplied oil market," Washington's special envoy for Iran, Brian Hook, told a news conference at the United Nations General Assembly on Tuesday evening.

In an earlier speech at the UN, Trump reiterated calls on OPEC to pump more oil and stop raising prices. He also accused Iran of sowing chaos and promised further sanctions on the country.

"Trader focus remains on the Brent contract trading at four-year highs," said Michael McCarthy, chief market strategist at CMC Markets in Sydney.

"The impending sanction of Iranian output not only removes around 1 million barrels per day (bpd), but the potential supply response of a further 2 million bpd," he said.

The so-called 'OPEC+' group, which includes other oil producers, including the world's biggest Russia, as well as Oman and Kazakhstan, met over the weekend to discuss a possible increase in crude output, but the group did not see the need to add new output as the market is well-supplied currently.

Oil prices, however, have trended higher amid concerns about supply. Brent is on course for its fifth consecutive quarterly increase, the longest such stretch for the global benchmark since early 2007, when a six-quarter run led to a record high of $147.50 a barrel.

Meanwhile, in the United States, the world's biggest oil user, an industry report on Tuesday showed crude stockpiles unexpectedly climbed last week.

Crude inventories rose by 2.9 million barrels in the week to Sept. 21 to 400 million, compared with analyst expectations for a decrease of 1.3 million barrels, the American Petroleum Institute said.

Official figures on stockpiles and refinery runs from the U.S. Department of Energy's Energy Information Administration are due at 10:30 a.m. EDT (1430 GMT) on Wednesday.

-----

Earlier:

2018, September, 24, 15:35:00

OIL PRICE: NEAR $80REUTERS - Benchmark Brent crude LCOc1 hit its highest since November 2014 at $80.94 per barrel, up $2.14 or 2.7 percent, before easing to around $80.75 by 1150 GMT. U.S. light crude CLc1 was $1.25 higher at $72.03.

|

2018, September, 24, 15:30:00

BALANCED OIL MARKETOPEC - The JMMC noted that, despite growing uncertainties surrounding market fundamentals, including the economy, demand and supply, the participating producing countries of the DoC continue to seek a balanced and sustainably stable global oil market, serving the interests of consumers, producers, the industry and the global economy at large. The Committee also expressed its satisfaction regarding the current oil market outlook, with an overall healthy balance between supply and demand. |

2018, September, 24, 15:25:00

СОТРУДНИЧЕСТВО РОССИИ И САУДОВСКОЙ АРАВИИМИНЭНЕРГО РОССИИ - «Благодаря нашей с Вами работе, прежде всего по линии ОПЕК+, отношения между нашими странами значительно укрепились. Видим постоянно растущую заинтересованность российских компаний в налаживании более тесных связей с саудовскими партнерами. Это особенно важно в свете той ответственной роли, которую наши страны играют на региональной и международной арене, особенно в сфере энергетики», - сказал глава энергетического ведомства.

|

2018, September, 21, 11:00:00

OIL PRICE: NEAR $79 STILLREUTERS - International benchmark Brent crude for November delivery LCOc1 was up 26 cents, or 0.33 percent, at $78.96 a barrel by 0647 GMT. U.S. West Texas Intermediate crude for October delivery CLc1 was up 7 cents, or 0.10 percent, at $70.39 a barrel. |

2018, September, 21, 10:45:00

UNEXPECTED OIL PRICESSHANA - What is common in oil market is that no price levels could be forecast for the future there. Only its unpredictability is predictable. Rarely may you find an expert to say with full certainty in which direction oil prices are headed. |

2018, September, 21, 10:40:00

OIL MARKET UNCERTAINTYPLATTS - 1.4 million b/d of Iranian oil supplies to leave the market by November, when the US sanctions go into force. Venezuela, which pumped 1.22 million b/d in August could see output fall to 1 million b/d in 2019. Politically unstable Libya also presents a supply risk. |

2018, September, 21, 10:35:00

OPEC-NON-OPEC DECISIONSSHANA - Iran’s Minister of Petroleum Bijan Zangeneh said the Joint OPEC/Non-OPEC Ministerial Monitoring Committee (JMMC) is not legally competent to make decisions about adjustment of production quotas. |