OIL PRICES 2018-19: $73-$74

U.S. EIA - SHORT-TERM ENERGY OUTLOOK

Global liquid fuels

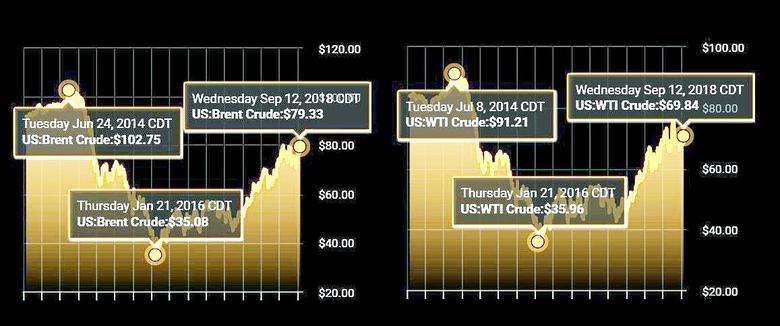

Brent crude oil spot prices averaged $73 per barrel (b) in August, down almost $2 from July. EIA expects Brent spot prices will average $73/b in 2018 and $74/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average about $6/b lower than Brent prices in 2018 and in 2019. NYMEX WTI futures and options contract values for December 2018 delivery that traded during the five-day period ending September 6, 2018, suggest a range of $56/b to $85/b encompasses the market expectation for December WTI prices at the 95% confidence level.

EIA estimates that U.S. crude oil production averaged 10.9 million barrels per day (b/d) in August, up by 120,000 b/d from June. EIA forecasts that U.S. crude oil production will average 10.7 million b/d in 2018, up from 9.4 million b/d in 2017, and will average 11.5 million b/d in 2019.

EIA forecasts total global liquid fuels inventories to decrease by 0.4 million b/d in 2018 compared with 2017, followed by an increase of 0.1 million b/d in 2019. This outlook of relatively stable inventory levels during the forecast period contributes to a forecast of monthly average Brent crude oil prices remaining relatively stable, between $72/b and $76/b, from September 2018 through the end of 2019.

Natural Gas

EIA estimates dry natural gas production in the United States was 82.2 billion cubic feet per day (Bcf/d) in August, up 0.7 Bcf/d from July. Dry natural gas production is forecast to average 81.0 Bcf/d in 2018, up by 7.4 Bcf/d from 2017 and establishing a new record high. EIA expects natural gas production will continue to rise in 2019 to an average of 84.7 Bcf/d.

EIA forecasts that U.S. natural gas inventories will total 3.3 trillion cubic feet (Tcf) at the end of October. This level would be 13% lower than the 2017 end-of-October level and 14% below the five-year (2013–17) average for the end of October, while also marking the lowest level for that time of year since 2005.

EIA expects Henry Hub natural gas spot prices to average $2.99/million British thermal units (MMBtu) in 2018 and $3.12/MMBtu in 2019. NYMEX futures and options contract values for December 2018 delivery that traded during the five-day period ending September 6, 2018, suggest a range of $2.31/MMBtu to $3.77/MMBtu encompasses the market expectation for December Henry Hub natural gas prices at the 95% confidence level.

Elecriticty, coal, renewables, and emissions

EIA expects the share of U.S. total utility-scale electricity generation from natural gas-fired power plants to rise from 32% in 2017 to 34% in 2018 and to 35% in 2019. EIA's forecast electricity generation share from coal averages 28% in 2018 and 27% in 2019, down from 30% in 2017. The nuclear share of generation was 20% in 2017 and is forecast to be 20% in 2018 and 19% in 2019. Nonhydropower renewables provided slightly less than 10% of electricity generation in 2017, and EIA expects them to provide more than 10% in 2018 and nearly 11% in 2019. The generation share of hydropower was 7% in 2017 and is forecast to be about the same in 2018 and 2019.

In 2017, EIA estimates that U.S. wind generation averaged 697,000 megawatthours per day (MWh/d). EIA forecasts that wind generation will rise by 8% to 756,000 MWh/d in 2018 and by 4% to 784,000 MWh/d in 2019.

Solar power generates less electricity in the United States than wind power, but solar power also continues to grow. EIA expects solar generation will rise from 211,000 MWh/d in 2017 to 263,000 MWh/d in 2018 (an increase of 24%) and to 289,000 MWh/d in 2019 (an increase of 10%).

EIA forecasts U.S. coal production will decline by 1% to 768 million short tons (MMst) in 2018, despite a 10% (10 MMst) increase in coal exports. The production decrease is largely attributable to a forecast decline of 2% (17 MMst) in domestic coal consumption in 2018. EIA expects coal production to decline by 2% (12 MMst) in 2019, because coal exports and coal consumption are both forecast to decrease.

EIA estimates U.S. coal exports through the first half of 2018 were 32% (14 MMst) higher than in the same period of 2017, and June was the second month of this year that exports exceeded 10 MMst. EIA forecasts total coal exports to be 107 MMst in 2018 and 101 MMst in 2019, with U.S. coal exports to Asia expected to remain strong. Three of the top five destinations for U.S. coal exports are in Asia, with India, South Korea, and Japan accounting for more than one-third of U.S. exports through March, the most recent month for which EIA has actual data.

After declining by 0.9% in 2017, EIA forecasts that U.S. energy-related carbon dioxide (CO2) emissions will rise by 2.3% in 2018. The increase largely reflects higher natural gas consumption because of a colder winter and a warmer summer than in 2017. Emissions are forecast to decline by 0.9% in 2019. Energy-related CO2 emissions are sensitive to changes in weather, economic growth, energy prices, and fuel mix.

-----

Earlier:

2018, July, 23, 13:25:00

GLOBAL ENERGY INVESTMENT DOWN 2%IEA - For the third consecutive year, global energy investment declined, to USD 1.8 trillion (United States dollars) in 2017 – a fall of 2% in real terms. The power generation sector accounted for most of this decline, due to fewer additions of coal, hydro and nuclear power capacity, which more than offset increased investment in solar photovoltaics. |

2018, July, 12, 10:45:00

OPEC: OIL DEMAND UP BY 1.65 MBDOPEC - In 2018, oil demand is expected to grow by 1.65 mb/d, unchanged from the previous month’s assessment, with expectations for total world consumption at 98.85 mb/d. In 2019, the initial projection indicates a global increase of around 1.45 mb/d, with annual average global consumption anticipated to surpass the 100 mb/d threshold. The OECD is once again expected to remain in positive territory, registering a rise of 0.27 mb/d with the bulk of gains originating in OECD America. The non-OECD region is anticipated to lead oil demand growth in 2019 with initial projections indicating an increase of around 1.18 mb/d, most of which is attributed to China and India. Additionally, a steady acceleration in oil demand growth is projected in Latin America and the Middle East. |

2018, July, 2, 11:50:00

THE WORLD ECONOMY GROWTH & RISKSIMF - Our latest forecast in April therefore projected the global economy to grow by 3.9 percent in 2018 and 2019 – 0.2 percent higher than our forecast last October. This acceleration is driven by both advanced countries and emerging and developing economies.

|

2018, June, 27, 11:05:00

IEA: GLOBAL GAS DEMAND UPIEA - Global gas demand will grow at an average rate of 1.6% a year, reaching just over 4,100 billion cubic meters (bcm) in 2023, up from 3,740 bcm in 2017,

|

2018, June, 22, 13:20:00

GLOBAL OIL RESERVES UP BY 8.2BLN BBLU.S. EIA - Collectively, these companies added a net 8.2 billion barrels of oil equivalent (BOE) to their proved reserves during 2017, which totaled 277 billion BOE at the end of the year. Exploration and development (E&D) spending in 2017 increased 11% from 2016 levels, but remained 47% lower than 2013 levels.

|

2018, June, 15, 11:10:00

BP: GROWTH IN ENERGY DEMAND UPBP - In 2017 global energy demand grew by 2.2%, above its 10-year average of 1.7%. This above-trend growth was driven by stronger economic growth in the developed world and a slight slowing in the pace of improvement in energy intensity.

|

2018, June, 8, 13:25:00

WBG: GLOBAL ECONOMY UP 3.1%WBG: Despite recent softening, global economic growth will remain robust at 3.1 percent in 2018 before slowing gradually over the next two years, as advanced-economy growth decelerates and the recovery in major commodity-exporting emerging market and developing economies levels off |