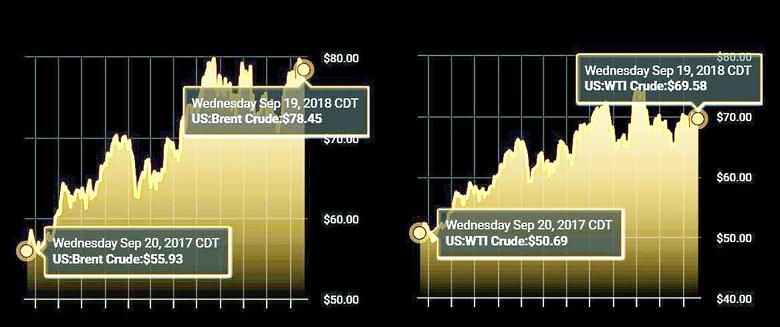

OIL PRICES: $70 - $80

PLATTS -Current global oil prices at around $70-80/b are due to the volatile situation on the market and include a premium for risks associated with sanctions and oil supply cuts, but they are expected to fall to around $50/b in the long term, Russian energy minister Alexander Novak said Tuesday.

"According to estimates by experts and companies, oil price will be at around $50/b in the long term. That means that the current situation, when oil prices have risen to $70-80/b, is linked to the temporary situation on the market and includes a premium to the price linked to various risks associated with the introduction of sanctions and oil supply cuts," Novak said, as reported by Russia's Prime news agency.

ICE November Brent futures closed at $78.05/b on Monday, according to S&P Global Platts data.

RUSSIAN OUTPUT

Novak also said he expects Russia's crude production to reach a peak of 570 million mt, or about 11.445 million b/d, in 2021, before declining to 310 million mt in 2035, if no additional measures are taken to stimulate oil producers.

This year, Novak expects Russia to produce 553 million mt, of crude, he said. The volume would represent a 1% rise compared with the volume produced last year, when the country was holding back its output as agreed under the OPEC/non-OPEC deal.

The coalition's agreement to cut a combined 1.8 million b/d, in place since January 2017, was aimed at lifting and stabilizing oil prices. With Brent trading above $70/b, the coalition decided in late June on a joint output lift as of July.

Russia boosted its output to 11.21 million b/d last month, up from 11.066 million b/d produced in June, according to the Central Dispatching Unit, the statistical arm of the energy ministry.

Along with reducing crude production after 2021, Novak said he also expects the state revenues to start dropping as of 2022.

"As of 2022, we may see negative dynamics of budget revenues. The total yearly tax revenue may drop by Rb3.3 trillion [$48.5 billion] per year, and investment by Rb1.3 trillion," he said. "This is...an inevitable result of rising production costs and excessive tax burden at existing fields and regions of West Siberia."

-----

Earlier:

2018, September, 17, 15:25:00

OIL PRICE: NOT ABOVE $79 YETREUTERS - Brent crude oil was up 40 cents a barrel at $78.49 by 1155 GMT. U.S. light crude was up 45 cents at $69.44.

|

2018, September, 17, 15:20:00

РОССИЯ И САУДОВСКАЯ АРАВИЯ: СТАБИЛЬНОСТЬ НА РЫНКЕМИНЭНЕРГО РОССИИ - Министры обсудили динамику спроса и предложения на рынке с фокусом на макроэкономические тренды и потенциальные сценарии развития ситуации в среднесрочной перспективе. Стороны подтвердили приверженность обеспечению стабильности на рынке и готовность оперативно реагировать на изменения рыночной конъюнктуры, чтобы совместно с партнерами обеспечить стабильность рынка в любых условиях. |

2018, September, 14, 12:40:00

IEA: OIL PRICES COULD RISEIEA - If Venezuelan and Iranian exports do continue to fall, markets could tighten and oil prices could rise without offsetting production increases from elsewhere.

|

2018, September, 14, 12:30:00

FIXED U.S. OIL PRICEREUTERS - U.S. shale producers are locking in prices for their production as much as three years into the future in a sign that strong domestic crude pricing is nearing a peak, according to market sources familiar with money flows.

|

2018, September, 12, 11:35:00

OIL PRICES 2018-19: $73-$74U.S. EIA - EIA expects Brent spot prices will average $73/b in 2018 and $74/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average about $6/b lower than Brent prices in 2018 and in 2019. NYMEX WTI futures and options contract values for December 2018 delivery that traded during the five-day period ending September 6, 2018, suggest a range of $56/b to $85/b encompasses the market expectation for December WTI prices at the 95% confidence level. |

2018, September, 5, 10:55:00

SAUDIS OIL PRICE: $70 - $80REUTERS - “The Saudis need oil at about $80 and they don’t want prices to go below $70. They want to manage the market like this,” one of the sources told.

|

2018, September, 3, 15:20:00

OIL CONFORMITY LEVEL: 109%OPEC - The JMMC noted that countries participating in the “Declaration of Cooperation” have achieved a conformity level of 109% in July 2018, which shows significant progress towards the goal set at the 4th OPEC and Non-OPEC Ministerial Meeting of 23 June 2018, which followed and endorsed decisions taken at the 174th Meeting of the OPEC Conference convened on 22 June 2018. |