OPEC: GLOBAL ENERGY DEMAND WILL UP BY 33%

OPEC - World Oil Outlook 2040

Total primary energy demand is expected to increase by 91 mboe/d between 2015 and 2040 to reach 365 mboe/d in 2040

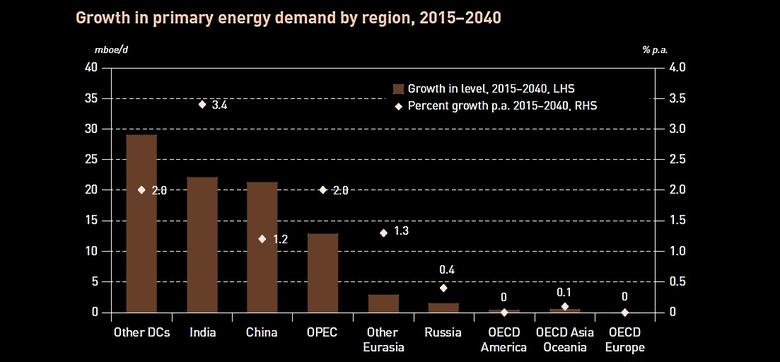

The Reference Case sees energy demand increasing from 274 million barrels of oil equivalent a day (mboe/d) in 2015 to around 365 mboe/d in 2040, with an average annual growth of 1.2% p.a. Almost 95% of the increase is accounted for by Developing countries (including China and India), with an average annual growth of 1.9% p.a.

A modest increase of around 4.5 mboe/d is projected for Eurasia between 2015 and 2040, an average annual growth of 0.7% p.a. The OECD is estimated to witness only a small increase of less than 1 mboe/d, which points to stagnating energy demand in this country group as the market increasingly saturates. The imbalance between the world regions is the result of stronger population and economic growth, as well as accelerating urbanization rates in Developing countries, where an increasing number of people are expected to gain access to modern energy services.

Primary energy demand in China and India is the most significant contributor to overall energy demand growth

Energy demand in Developing countries is projected to increase by almost 86 mboe/d between 2015 and 2040, with India and China the most important contributors to this growth. Energy demand in India and China in this period is forecast to increase by 22 mboe/d and 21 mboe/d, respectively, which is more than 50% of the energy demand growth in Developing countries during this period.

At the same time, the group of Other Developing countries (excluding India, China and OPEC) is projected to grow by around 2% p.a., increasing by around 29 mboe/d over the forecast period. This includes countries at different stages of development, predominantly in Asia, Africa and Latin America. Significant growth is also expected in OPEC countries, increasing from 20 mboe/d in 2015 to almost 33 mboe/d in 2040. This comprises an annual average growth rate of around 2%.

Natural gas and 'other renewables' show the largest growth in the long-term

The fuel with the largest estimated demand growth is natural gas, increasing by almost 32 mboe/d between 2015 and 2040, an annual average growth rate of 1.7%. Consequently, the share of natural gas in the global energy mix accounts for 25% in 2040, up 3.3 percentage points from 2015. 'Other renewables' are projected to have the highest average growth rate of around 7.4% p.a. during the forecast period. Nevertheless, due to the current low base, the increase in absolute terms is estimated at around 19 mboe/d between 2015 and 2040.

Strong demand growth is also expected for nuclear, increasing by around 9 mboe/d, due to strong expansion in Developing countries and supported by the anticipated return of nuclear energy in Japan. The utilization of biomass (including solid biofuels, waste, biogas, liquid biofuels) is projected to increase by 8.5 mboe/d between 2015 and 2040. Coal has the lowest average growth of just 0.2% p.a. Moreover, coal is the only fuel projected to reach a global demand peak during the forecast period, hitting a high of around 82 mboe/d by 2030. Oil sees a relatively low average growth rate of 0.6% between 2015 and 2040. However, due to a large base, oil demand is expected to increase by almost 15 mboe/d to just above 101 mboe/d in 2040.

Oil retains the highest share in the global energy mix in the period to 2040

Oil is forecast to remain the largest contributor to the energy mix throughout the forecast period, with a share of nearly 28% in 2040, higher than gas and coal. Despite relatively low demand growth rates (especially for coal and oil), fossil fuels are projected to remain the dominant component in the global energy mix, with a share of 75% in 2040, albeit a drop of 6 percentage points from 2015.

Coal will continue to be the largest source of CO2 emissions

Total annual energy-related carbon dioxide (CO2) emissions are set to increase from around 33 billion tonnes (bt) in 2015 to around 39 bt by 2040. Despite the low growth in global coal demand and its expected peak towards the end of the forecast period, coal is still forecast to be the largest source of CO2 emissions, accounting for 15.7 bt of emissions in 2040. However, the largest increase in emissions, on an annual basis, is expected for natural gas (+3.3 bt) as demand for this energy source is set to increase significantly over the forecast period.

Medium-term oil demand growth to average 1.2 mb/d p.a.

Oil demand at the global level is expected to continue growing at healthy rates over the medium- term to reach a level of 104.5 million barrels a day (mb/d) by 2023. This is 7.3 mb/d higher than 2017 levels and represents an average annual increase of 1.2 mb/d .

These solid global growth numbers, however, mask significant variations, as well as diverging trends, at the regional, sectoral and product levels. Oil demand from Developing countries is projected to grow at a relatively steady rate of around 1.1 mb/d each year over the mediumterm, except for 2020, when the implementation of International Maritime Organization (IMO) regulations on lower sulphur limits in the marine bunker sector will likely provide a one-off spur for oil demand. Incremental oil demand in the OECD is projected to flip from the positive territory observed in the past few years, and which is projected to continue until 2020, to negative growth thereafter. The contribution of Eurasia to overall demand growth is marginal, in the range of just 0.1 mb/d p.a. on average.

Implementation of IMO regulations will challenge refiners and likely impact global demand levels

The implementation of the IMO regulations to limit the global sulphur content in all bunker fuels to 0.5%, effective January 2020, will not only pose a challenge to the refining industry, but it will also likely affect overall demand levels, especially in the one-to-two years following its implementation. Oil demand is expected to decelerate from 1.6 mb/d in 2018 to 1.4 mb/d in 2019. However, instead of a continued growth deceleration in 2020, incremental oil demand in this year is expected to bounce back to 1.7 mb/d, driven by specific market circumstances as a result of the IMO regulations. Nevertheless, this extraordinary growth in 2020 will largely be balanced out by lower incremental growth during the latter part of the medium-term period.

Oil demand projected to increase by 14.5 mb/d to reach 111.7 mb/d by 2040, but growth decelerates over time

Long-term oil demand is expected to increase by 14.5 mb/d, rising from 97.2 mb/d in 2017 to 111.7 mb/d in 2040. However, the Reference Case projections to 2040 show a contrasting picture between the three major regions: declining long-term demand in the OECD, a moderately rising to flattening oil demand pattern in Eurasia, which both stand in stark contrast to growing demand in Developing countries.

Driven by an expanding middle class, high population growth rates and stronger economic growth potential, oil demand in Developing countries is expected to increase by more than 22 mb/d between 2017 and 2040, rising from 44.4 mb/d in 2017 to 66.6 mb/d in 2040.

Another important observation is the steadily decelerating oil demand growth at the global level. Global growth is forecast to slow from a level of 1.6 mb/d p.a. during the initial forecast years to 2020 to just 0.2 mb/d p.a. in the period from 2035–2040.

India is projected to see the largest additional oil demand and the fastest growth in the period to 2040

In terms of incremental demand over the forecast period, India is projected to have the fastest average demand growth (3.7% p.a.), as well as the largest additional demand of 5.8 mb/d. With this fast demand growth, India will likely pass the mark of 10 mb/d sometime towards the end of the forecast period. Despite this impressive growth, its total demand will still be far below the level of China.

Light products will continue to dominate the future product slate, with ethane/LPG leading the way

Compared to last year's Outlook, the faster expansion of the petrochemicals sector, the anticipated quicker penetration of electric vehicles and less long-term diesel consumption in the marine sector has further shifted the projected composition of oil demand. More than half of the incremental oil demand over the forecast period is expected to be satisfied by light products, which account for 7.8 mb/d out of a total demand growth of 14.5 mb/d. Within the light products, demand for ethane/LPG is set to increase by 3.3 mb/d. It should be noted that this is the largest increase amongst all major products. The demand for middle distillates is expected to increase by 5.5 mb/d, which will be almost equally shared between gasoil/diesel and jet/kerosene. A growth of 1.2 mb/d is projected for heavy products.

Road transportation continues to lead demand, but petrochemicals see the largest increase and aviation is the fastest growing sector

Among all transport modes, the largest demand for oil comes from road transportation. In 2017, this sector represented 45% of global demand with 43.6 mb/d and significant demand growth is expected in the long-term to reach 47.8 mb/d by 2040. This is followed by aviation, which is estimated to be the fastest growing sector, with average oil demand growth at 1.5% p.a.

Demand growth in industry is driven mainly by the petrochemical sector, with demand forecast to increase by 4.5 mb/d from 2017–2040. Oil demand in the rest of industry – comprising primarily iron and steel, glass and cement production, construction and mining – is anticipated to continue to face strong competition from alternative fuels. Global demand in 'other industry' is expected to increase by 1.2 mb/d between 2017 and 2040, representing an average growth rate of 0.4% p.a. Electricity generation is the only sector where declining demand is forecast at a global level.

Total vehicle fleet is estimated to reach 2.4 billion by 2040

The increase in vehicle stock is the key driver contributing to the rise in oil consumption in the road transportation sector. The total vehicle stock is estimated to grow by around 1.1 billion between 2017 and 2040 to reach 2.4 billion vehicles. Out of this, passenger cars are estimated to grow by around 877 million, with 768 million cars in Developing countries. China is set for the highest increase in additional passenger cars over the forecast period, at 291 million, followed by Other Asia with an increase of around 167 million cars. The passenger car fleet in the OECD is foreseen to increase marginally.

The total commercial stock is forecast to more than double during the period 2017–2040, rising from 230 million vehicles in 2017 to 462 million by 2040. The majority of the increase comes from Developing countries, particularly from China, Other Asia, and India. The total amount of additional commercial vehicles in Developing countries is estimated to be around 183 million, which represents almost 80% of the total growth.

Share of electric vehicles in the total fleet is projected at around 13% by 2040

Electric vehicles, including battery electric and plug-in hybrid electric vehicles (PHEVs), are set to experience a significant growth in numbers and are forecast to reach around 320 million units in 2040. Out of this, passenger electric vehicles are estimated to account for more than 300 million in 2040, representing around 15% of the passenger fleet. Natural gas passenger cars are not expected to witness the same growth as electric vehicles, as there are only expected to be 77 million additional units on the road in 2040. An even slower expansion is projected for fuel cell vehicles (FCVs), which are forecast to remain a niche market over the forecast period.

Out of an expected 442 million commercial vehicles by 2040, a large majority of around 370 million will remain conventional. Natural gas vehicles (NGVs) are forecast to account for 6% of the commercial fleet by 2040. Electric vehicles are forecast to gradually increase their share and reach a high of 4% of commercial vehicles in 2040. Combined, the share of electric vehicles in the total fleet is projected at around 13%, while the penetration of alternative fuel vehicles (AFVs, including electric vehicles) is expected to reach around 18% by 2040.

Road transportation oil demand is sensitive to the expansion of electric vehicles

To account for uncertainty related to future penetration levels of electric vehicles, two alternative sensitivities have been developed: 'Electric vehicles fast penetration' and 'Electric vehicles slow penetration'. The implication of these sensitivity cases is fairly limited over the next ten years, within the range of 1 mb/d, but start widening during the last decade of the forecast period. The range of uncertainty is more than 4 mb/d by 2040.

Strong resurgence improves outlook for medium-term US tight oil growth

Medium-term non-OPEC supply is projected to grow by 8.6 mb/d from 2017–2023, an upward revision from the WOO 2017. This is due to US tight oil's stronger-than-expected recent performance, a healthier demand outlook, and more supportive prices. Total non-OPEC liquids supply is expected to rise from 57.5 mb/d in 2017 to 66.1 mb/d in 2023, of which 5.6 mb/d or 65% is in the US. In addition to the US, only a handful of other countries are forecast to drive non-OPEC mediumterm supply growth, including Brazil (+1.4 mb/d), Canada (+0.8 mb/d) and Kazakhstan (+0.3 mb/d).

Non-OPEC supply peaks in late 2020s, mainly driven by the US tight oil outlook

Non-OPEC liquids supply is projected to peak at just below 67 mb/d in the late 2020s, as US tight oil supply peaks. Thereafter, it declines slowly to average 62.6 mb/d by 2040, with modest growth in Kazakhstan, Canada and Brazil insufficient to offset natural decline in most other parts of the non-OPEC supply picture. However, over the full 2017–2040 period, non-OPEC crude oil supply, including tight crude, is estimated to decrease by 1.1 mb/d, while natural gas liquids (NGLs), global biofuels and other liquids (including Canadian oil sands) each grow in a range of 1 to 3 mb/d.

Global tight oil to see a quarter share of non-OPEC supply at its peak

Global tight oil supply is set to grow to 15.6 mb/d by the late 2020s, thus making up nearly 25% of non-OPEC supply at its peak, or 15% of global supply. The overwhelming majority of this will be US tight oil, which is expected to constitute around 90% of global tight oil supply. Canada, already a significant producer of tight oil, is anticipated to contribute nearly 1 mb/d, while more modest volumes are envisaged to emerge in Russia, Argentina, Bahrain and China.

However, there is considerable uncertainty related to the outlook for US tight oil supply, which is dependent on prices, investment, technology, regulation and the resource base. Alternate sensitivity cases for tight oil suggest an upside/downside of around 1–2 mb/d in the late 2020s, and an even higher range of around +/– 3–4 mb/d in the long-term.

Demand for OPEC crude to decline in the medium-term, but recovers after US tight oil peaks

Given strong US and other non-OPEC medium-term supply growth, the implied demand for OPEC crude is estimated to decline from 32.6 mb/d in 2017 to 31.6 mb/d in 2023. However, it rises again to current levels in the latter half of the 2020s, when US tight oil, and as a result, total non-OPEC supply peaks.

Thereafter, a gradual decline in non-OPEC liquids supply, coupled with moderate, but sustained global demand growth, leads to a steady increase in demand for OPEC crude, which rises to nearly 40 mb/d by 2040.

Medium-term distillation capacity additions estimated at 7.8 mb/d, located mostly in the Middle East and Asia-Pacific

The pace and location of refinery investments continue to follow oil demand growth trends, with the majority of investments expected in developing countries underpinned by local demand. The level of medium-term additions and investments are expected to recover from the effects of the 2014–2016 crude oil price drop. From levels of no more than 1 mb/d annually for 2016 through 2018, additions for 2019 through 2021 are projected to average 1.6 mb/d p.a., before reverting to levels of 1 mb/d in 2022 and 2023. Over the medium-term period, total additions are projected at 7.8 mb/d.

These additions will continue to show a pattern seen in previous Outlooks, with most concentrated in developing regions, predominantly the Asia-Pacific and the Middle East. Indeed, the trend will remain in line with the concentration of demand growth. Around 88% of the distillation capacity projects assessed as viable for the period 2018–2023 will be located in developing regions.

Medium-term outlook points at excess refining capacity towards the end of the period

Global demand growth from 2018–2023 is projected to average 1.2 mb/d p.a., whereas the requirement for incremental crude-based products, and hence crude runs, equates to 0.8 mb/d p.a. The net result is for an outlook where incremental refinery output potential and incremental refinery product demand are closely in balance through 2019, but a gap progressively opens up, especially from 2021 onward. By 2023, the cumulative 7.4 mb/d refinery production potential is 2.5 mb/d in excess of the requirement. The largest excess builds are expected in the US & Canada and Europe, due to decreasing demand post-2020, and the Middle East, due to strong medium-term capacity additions. At the same time, some deficits are projected for Latin America and Asia-Pacific (excluding China) in 2023.

Long-term distillation capacity additions projected at around 17.8 mb/d

Cumulative crude distillation capacity additions are projected to reach 17.8 mb/d by 2040, primarily in Developing countries (Asia-Pacific, Middle East, Africa and Latin America). It is important to recognize that the long-term additions are driven mainly by the shift in global demand from industrialized regions to developing regions. Therefore, declining oil demand in some regions, such as Europe and Japan, is projected to result in utilization rates coming under pressure. Consequently, a number of closures in these regions can be expected in the medium- and long-term.

Refinery net closures estimated at around 1 mb/d in the medium-term

Total net closures of 1.0 mb/d are expected in the medium-term, slightly lower than in previous Outlooks. Several regions, including Europe and Japan, have gone a long way toward removing the worst regional capacity excesses. At the same time, upward medium-term demand revisions have led to fewer refinery closure announcements. The clear impact of these higher short- and medium-term demand outlooks is to diminish the need for refinery closures, relative to previous WOOs.

Secondary capacity additions rise in step with increasing demand and stricter product specifications

At the global level, projections for secondary capacity additions indicate the need to add some 10.4 mb/d of conversion units, 20.2 mb/d of desulphurization capacity and 5.5 mb/d of octane units in the period to 2040. The majority of these additions are expected to materialize before 2030, in line with demand growth and the implementation of stricter product specifications.

Global crude exports increase in the long-term, due to additional volumes from the Middle East destined for the Asia-Pacific

Global crude exports are expected to increase by around 5.4 mb/d, mostly driven by increasing demand and falling domestic supply in the Asia-Pacific. In the short-term, global crude exports are likely to increase to around 40 mb/d in 2020, up from 38.5 mb/d in 2017, driven by increasing export volumes from the US & Canada, which are estimated to grow by more than 2 mb/d between 2017 and 2020. By 2025, the global crude export level is projected to drop to around 39 mb/d, mainly due to lower volumes coming from Latin America and Africa, as more volumes are refined in these regions. At the same time, US & Canada crude exports are expected to peak at just under 4 mb/d in 2025.

Post-2025, global crude exports are expected to increase gradually to levels just below 43 mb/d, driven by increasing demand from the Asia-Pacific and increasing exports from the Middle East. Middle East crude exports are seen to increase by more than 6 mb/d between 2025 and 2040.

Another region contributing to the increase of global crude exports is Russia & Caspian, with volumes estimated to rise to above 7 mb/d, mainly due to output increases in Kazakhstan. Traditional exporting regions, such as Latin America and Africa, are expected to see lower crude exports to global markets, as increasing domestic demand results in additional refinery runs in those regions.

Almost $11 trillion of investments in the oil industry are required up to 2040

Global oil upstream investments required over the period 2018–2040 are estimated at $8.3 trillion. Most of this is in non-OPEC countries, and over the medium-term they are estimated to invest on average around $350 billion p.a. The medium-term number for OPEC Member Countries is an estimated average of more than $40 billion p.a., and then over $60 billion annually in the long-term. Average annual long-term upstream investment requirements for non-OPEC are forecast to decline to around $280 billion on the back of declining crude supply. The OECD's share in global investment is anticipated to be more than 60% of the global total given the high costs – for both conventional and unconventional crudes – and decline rates.

The total investment volume of the three downstream categories – known projects, required additions and maintenance/capacity replacement – is estimated at just under $1.5 trillion in the period 2018–2040. Of this, $283 billion is expected to be invested in known medium-term projects, while $306 billion is anticipated to be invested into additions beyond known projects in the long-term. The investment requirement for maintenance and replacement is estimated at around $895 billion for the whole period 2018–2040.

Overall, including midstream investments of around $1 trillion, in the period up to 2040 the required global oil sector investment is estimated at almost $11 trillion.

Integrated and coherent approach is needed to achieve the SDG 7 targets

Energy has a prominent role in the 2030 Agenda for Sustainable Development. Sustainable Development Goal 7 (SDG 7) calls for universal access to energy and eradicating energy poverty. Nonetheless, the achievement of SDG 7 targets on the increased use of renewable energy and energy efficiency improvements will have significant effects on the future energy mix and levels. Coal is projected to be the most affected fuel as a reduction of about 65% in demand for coal is estimated to be necessary to achieve the SDG 7 targets on renewables and energy efficiency, along with an almost 15% decline in oil demand and a 13% reduction from gas in 2040, compared to the Reference Case projections. It should be noted that the corresponding global CO2 emission reductions are not sufficient to put the world on a pathway consistent with a 2°C temperature target.

In this context, an integrated and coherent approach is needed for implementing 'win-win' strategies to achieve the SDG 7 targets. International cooperation, as well as the provision of means of implementation regarding financial support, technology transfer and capacity building are equally important to achieving SDG 7 targets.

More information is here.

-----

Earlier:

2018, September, 24, 15:30:00

BALANCED OIL MARKETOPEC - The JMMC noted that, despite growing uncertainties surrounding market fundamentals, including the economy, demand and supply, the participating producing countries of the DoC continue to seek a balanced and sustainably stable global oil market, serving the interests of consumers, producers, the industry and the global economy at large. The Committee also expressed its satisfaction regarding the current oil market outlook, with an overall healthy balance between supply and demand. |

2018, August, 29, 10:50:00

РОССИЯ - ГЛОБАЛЬНЫЙ ЭНЕРГЕТИЧЕСКИЙ ЛИДЕРМИНЭНЕРГО РОССИИ - Президент добавил, что по итогам 2017 года Россия подтвердила свой статус одного из лидеров глобального энергетического рынка: «Мы заняли первое место в мире по объему добычи нефти, второе – по добыче газа. Россия входит в число ведущих стран по объему выработки электроэнергии и добыче угля: по электроэнергии – на четвертом месте, по углю – шестое место в мире». По словам Владимира Путина, в прошлом году сумма инвестиций в отрасли выросла на 10 процентов и составила 3,5 триллиона рублей. |

2018, August, 3, 09:20:00

БРИКС: 40% МИРОВОЙ ЭНЕРГИИМИНЭНЕРГО РОССИИ - «Страны БРИКС являются одними из самых крупнейших экспортеров, производителей энергоресурсов и потребителей. На долю стран БРИКС приходится почти 40% общемирового потребления энергоресурсов», - отметил замминистра. |

2018, July, 23, 13:25:00

GLOBAL ENERGY INVESTMENT DOWN 2%IEA - For the third consecutive year, global energy investment declined, to USD 1.8 trillion (United States dollars) in 2017 – a fall of 2% in real terms. The power generation sector accounted for most of this decline, due to fewer additions of coal, hydro and nuclear power capacity, which more than offset increased investment in solar photovoltaics. |

2018, June, 8, 13:15:00

OIL DEMAND UP TO 2030PLATTS - Global oil demand will peak around 2030 at 111 million b/d as a sharp rise in electric vehicles and energy efficiency gains offset growing demand from the aviation and petrochemical sectors, Norwegian producer Equinor said |

2018, March, 28, 11:15:00

GLOBAL ENERGY DEMAND + 2.1%IEA - Global energy demand rose by 2.1% in 2017, more than twice the previous year’s rate, boosted by strong global economic growth, with oil, gas and coal meeting most of the increase in demand for energy, and renewables seeing impressive gains. |

2018, February, 16, 23:35:00

ФУНДАМЕНТАЛЬНЫЕ ПРЕОБРАЗОВАНИЯ РЫНКАМИНЭНЕРГО РОССИИ - Александр Новак поделился своим видением будущего углеводородной энергетики: «Она обладает огромным потенциалом цифровизации своих процессов, гибкой подстройки под нужды потребителей. Доля углеводородов, безусловно, будет снижаться, но с учетом роста населения, автопарка, спроса на энергию, абсолютное потребление продолжит расти. Если мы хотим надежно обеспечить мир энергией, нам придется найти разумный баланс между традиционной и новой энергетикой». |