SAUDIS OIL FOR U.S. UP

BLOOMBERG - Saudi Arabia has markedly increased oil exports to America, a sign OPEC's leading producer is responding to pressure from U.S. President Donald Trump to cool down the energy market.

While the export boost started earlier this year, it accelerated over the past three months after Trump repeatedly -- both through private diplomacy and public Twitter harangues -- asked the Saudis to lift production to keep energy prices in check.

Saudi oil shipments into the U.S. reached a four-week average of one million barrels a day last week for the first time since late 2017, according to government data, and are up roughly 250,000 barrels a day since late May.

"The Middle East producers are becoming much more aggressive, wanting to bring their barrels back into this market," Gary Heminger, the chief executive of Marathon Petroleum Corp., the second-largest U.S. refiner by distillation capacity, said at an investor conference earlier this week.

The increase in Saudi exports into the U.S. equates to almost half the overall output increase the kingdom has implemented since late May after the Organisation of Petroleum Exporting Countries and allies including Russia agreed in June to boost output.

Saudi oil shipments into the U.S. plunged to a 30-year low in October last year. This prompted talk that America's freedom from Saudi oil -- a rhetorical aspiration for generations of American politicians, from Jimmy Carter to George W. Bush -- was within reach, even if it was largely the choice of supplier rather than customer.

In late October, the four-week average of U.S. imports of Saudi crude hit a low of 506,000 barrels a day, compared with last week's four-week average surge to 1,009,000 barrels a day, according to government data.

OPEC Undertaking

Last year, the Saudi export drop was part of a wider undertaking by OPEC to fight a global glut that weighed on oil prices. Because the U.S. is the most transparent oil market, with the government publishing weekly data about the size of crude stockpiles, the Saudis specifically targeted the American market trying to reduce the inventories.

Saudi Arabia has been able to entice U.S. refiners to buy more crude in part by lowering the price it charges to customers in America. In June, Riyadh sold its flagship export grade -- Arab Light -- at just 60 cents a barrel above a basket of crude pumped in the U.S. Gulf of Mexico, down from $1.30 a barrel in late 2017. The kingdom lowered even more the price of its lower-quality crude -- Arab Medium and Arab Heavy.

The surge in Saudi exports has returned Riyadh to the second position in the ranking of top U.S. crude oil suppliers, which it briefly lost to Iraq and Mexico in late 2017 and early 2018. Historically, the American market has long been Saudi Arabia's most prized, both for economic and political reasons. Aramco, the kingdom's state-owned company, controls the largest refinery in the U.S., the Motiva plant in Port Arthur, Texas.

Traditional Diet

Motiva cut its imports of Saudi crude sharply last year, at one point even importing more Iraqi crude than Saudi. But in recent months the company, owned 100 percent by Aramco, has returned to a more traditional diet. According to data from the U.S. Energy Information Administration, Motiva bought more than 70 percent of its crude from Saudi Arabia.

As Saudi Arabia has regained its market share in the U.S., Iraq, the Middle East's number two exporter, lost out. The four-week average of Iraqi shipments into the U.S. has dropped to less than 400,000 barrels a day, down from 500,000 to 800,000 in late 2007 and early 2008. Kuwait has also lost market share.

In ramping up shipments into the U.S., the Saudis also appear to be responding to American lawmakers threats to resurrect the so-called "No Oil Producing and Exporting Cartels Act," or NOPEC, which proposes making the cartel subject to the Sherman antitrust law, used more than a century ago to break up the oil empire of John Rockefeller.

-----

Earlier:

2018, September, 5, 10:55:00

SAUDIS OIL PRICE: $70 - $80REUTERS - “The Saudis need oil at about $80 and they don’t want prices to go below $70. They want to manage the market like this,” one of the sources told.

|

2018, September, 3, 15:20:00

OIL CONFORMITY LEVEL: 109%OPEC - The JMMC noted that countries participating in the “Declaration of Cooperation” have achieved a conformity level of 109% in July 2018, which shows significant progress towards the goal set at the 4th OPEC and Non-OPEC Ministerial Meeting of 23 June 2018, which followed and endorsed decisions taken at the 174th Meeting of the OPEC Conference convened on 22 June 2018.

|

2018, September, 3, 15:15:00

SAUDIS OIL PRODUCTION: 10.4 MBDPLATTS - Saudi Arabia will report August crude oil production of 10.424 million b/d, an OPEC source told S&P Global Platts on Friday. The figure represents a 136,000 b/d increase from July, when Saudi Arabia, OPEC's largest producer and the world's largest crude exporter, self-reported production of 10.288 million b/d.

|

2018, August, 20, 14:20:00

U.S. OIL PRODUCTION 10.7 MBDU.S. API - The American Petroleum Institute’s latest monthly statistical report shows the U.S. set a record for the production of natural gas liquids (NGL) last month producing 4.4 million barrels per day (mb/d). July also saw the U.S. tie its record for crude oil production at 10.7 mb/d.

|

2018, June, 15, 10:45:00

U.S. - OPEC TIESREUTERS - OPEC and U.S. representatives have met at least twice this year, with a third high-profile meeting set for Vienna next week. Finding the optimal balance of crude supply and demand will be the hot topic.

|

2018, May, 23, 10:40:00

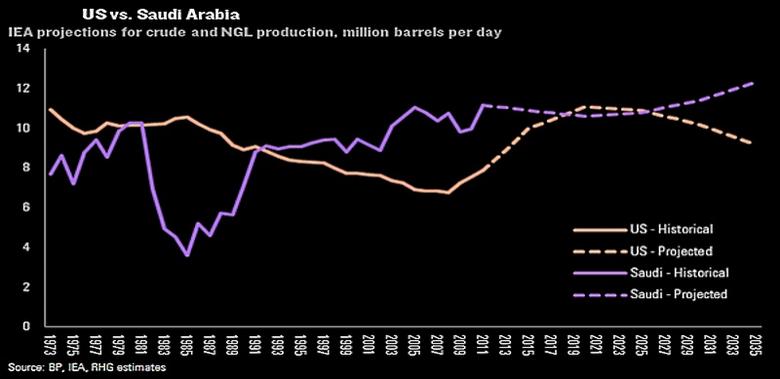

U.S. THE WORLD'S TOPEIA - The United States remained the world's top producer of petroleum and natural gas hydrocarbons in 2017, reaching a record high. The United States has been the world's top producer of natural gas since 2009, when U.S. natural gas production surpassed that of Russia, and the world's top producer of petroleum hydrocarbons since 2013, when U.S. production exceeded Saudi Arabia’s. Since 2008, U.S. petroleum and natural gas production has increased by nearly 60%. |

2018, March, 30, 11:15:00

U.S. - ARAMCO COOPERATION: $10 BLNSAUDI ARAMCO - Saudi Aramco announces commercial cooperation worth over $10 billion with 14 American companies during Saudi-US CEOs forum in New York |