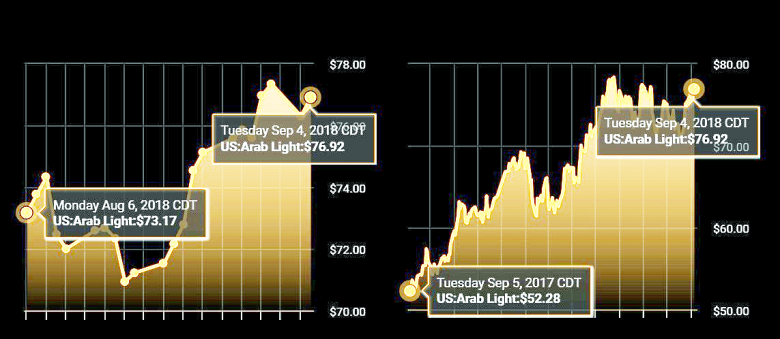

SAUDIS OIL PRICE: $70 - $80

REUTERS - Saudi Arabia wants oil to stay between $70 and $80 a barrel for now as the world's biggest crude exporter strikes a balance between maximizing revenue and keeping a lid on prices until U.S. congressional elections, OPEC and industry sources said.

After announcing the flotation of Saudi Aramco in 2016, the kingdom began pushing for higher crude prices partly to help maximize the valuation of the state oil company ahead of an initial public offering (IPO), originally scheduled for 2018.

That changed in April when U.S. President Donald Trump put public pressure on Riyadh to keep crude prices in check, wanting to stop U.S. fuel costs rising ahead of the U.S. midterm elections in November.

Now, even though the IPO has been shelved, Saudi Arabia still wants to keep oil prices as high as possible without offending Washington, the sources said. Saudi needs cash to finance a series of economic development projects.

OPEC and Saudi Arabia do not have an official price target and are unlikely to adopt one formally.

"The Saudis need oil at about $80 and they don't want prices to go below $70. They want to manage the market like this," one of the sources told Reuters.

"They need cash. They have plans and reforms and now the IPO is delayed. But they don't want anyone else talking about oil prices now. It's all because of Trump," the source said.

An informal target of $70 to $80 raises the prospect of Saudi Arabia making regular tweaks to its output to influence the cost of crude as the market responds to other factors affecting global supply and demand.

One industry source said it may have done precisely that last week.

With Brent heading toward $80 a barrel, Saudi Arabia told the market about an increase in its production last month sooner than it would have usually released such information, the source, who follows Saudi output policy, said.

"The Saudis will probably put a few more dampening signals out, given where prices have gone," the industry source said.

OPEC U-TURN

The aspiration for $70 to $80 is similar to that of other producers within the Organization of the Petroleum Exporting Countries. Algeria, for example, says it sees $75 as fair.

"Everybody has been talking about these kinds of numbers," said an OPEC delegate from outside the Gulf.

Brent crude has fluctuated between $70 and $80 since April 10. After hitting $70.30 on Aug. 15 the oil price has climbed steadily to touch $79.72 on Tuesday.

Earlier this year, Riyadh hoped to see oil prices above $80 and was ready to continue with a supply cut pact until the end of 2018, only to make a U-turn after Trump called on OPEC in April to boost supplies.

Riyadh has long been a close Washington ally. But ever since Trump became president in 2017, Saudi Arabia has become even more sensitive to U.S. requests and both countries have coordinated policy more closely than under Trump's predecessor.

In June, for example, OPEC agreed with Russia and other oil-producing allies last month to raise output from July - with Saudi Arabia pledging a "measurable" supply boost.

Saudi industry sources briefed the market about record oil production in which Aramco was planning to pump 10.6-10.8 million barrels per day (bpd) in June and as much as 11 million bpd in July, the highest in its history.

In the end, Saudi Arabia's production in June was 10.488 million bpd and in July it fell to 10.29 million.

'DIFFICULT TASK'

The plan to boost output to record highs had been driven mainly by worries of a sudden supply shock after U.S. officials said Washington aimed to reduce Iran's oil revenue to zero, the sources said.

But since then, Washington has said it would consider waivers on Iranian sanctions and worries about a trade war between Washington and Beijing have threatened to hit future demand for oil, the sources said.

One industry source said the kingdom's crude production plans were made according to its customers' needs and that oil demand has not materialized as forecast.

"We can raise production as high as 11 (mln bpd) or even 12 but then where will it go? We can't push oil to the market," that industry source said.

In an August report, the Oxford Institute for Energy Studies said Saudi Arabia was trying to manage the Brent price within a very narrow range of $70 to $80 - and it was not an easy task.

It said the strategy was mainly to put a ceiling on crude amid concerns about the impact of high prices on demand as the trade war between Washington and Beijing escalates - and to keep a floor under prices to maintain revenues and market stability.

This echoes Saudi price aspirations from a decade ago, when the kingdom identified $75 as a fair price. This held for a few years, only to be dropped as prices moved much higher.

"Striking a balance between the various objectives, and doing it within a narrow price range, is an extremely difficult task given the wide uncertainties and the different shocks hitting the oil market," the Oxford Institute's note said.

"Saudi Arabia is in need of flexibility in its output policy."

-----

Earlier:

2018, September, 3, 15:20:00

OIL CONFORMITY LEVEL: 109%OPEC - The JMMC noted that countries participating in the “Declaration of Cooperation” have achieved a conformity level of 109% in July 2018, which shows significant progress towards the goal set at the 4th OPEC and Non-OPEC Ministerial Meeting of 23 June 2018, which followed and endorsed decisions taken at the 174th Meeting of the OPEC Conference convened on 22 June 2018. |

2018, September, 3, 15:15:00

SAUDIS OIL PRODUCTION: 10.4 MBDPLATTS - Saudi Arabia will report August crude oil production of 10.424 million b/d, an OPEC source told S&P Global Platts on Friday. The figure represents a 136,000 b/d increase from July, when Saudi Arabia, OPEC's largest producer and the world's largest crude exporter, self-reported production of 10.288 million b/d. |

2018, August, 24, 11:25:00

SAUDI ARAMCO IPOARAB NEWS - The Government remains committed to the IPO of Saudi Aramco at a time of its own choosing when conditions are optimum. This timing will depend on multiple factors, including favorable market conditions, and a downstream acquisition which the Company will pursue in the next few months, as directed by its Board of Directors. |

2018, August, 3, 09:55:00

SAUDIS OIL PRICES DOWNBLOOMBERG - Saudi Aramco, as the state-owned company is known, cut pricing for September shipments of all grades to Asia, its largest market. Aramco set the premium for Arab Light crude to Asia at $1.20 a barrel above the Middle East benchmark, it said Thursday in an emailed price list. The reduction of 70 cents for Arab Light was the second consecutive monthly cut for the grade and was 10 cents deeper than the median estimate of five traders in a Bloomberg survey. |

2018, July, 25, 09:20:00

SAUDI ARABIA'S PROGRESSIMF - Real GDP growth is expected to increase to 1.9 percent in 2018, with non-oil growth strengthening to 2.3 percent. Growth is expected to pick-up further over the medium-term as the reforms take hold and oil output increases. Risks are balanced in the near-term. The employment of Saudi nationals has increased, especially for women, but the unemployment rate among Saudi nationals rose to 12.8 percent in 2017. |

2018, July, 11, 09:25:00

OIL PRICES 2018 - 19: $73 - $69EIA - Brent crude oil spot prices averaged $74 per barrel (b) in June, a decrease of almost $3/b from the May average. EIA forecasts Brent spot prices will average $73/b in the second half of 2018 and will average $69/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average $6/b lower than Brent prices in the second half of 2018 and $7/b lower in 2019. NYMEX WTI futures and options contract values for October 2018 delivery that traded during the five-day period ending July 5, 2018, suggest a range of $56/b to $87/b encompasses the market expectation for October WTI prices at the 95% confidence level. |

2018, July, 6, 11:55:00

КОРРЕКТИРОВКА ДО 100%МИНЭНЕРГО РОССИИ - В ходе телефонного разговора Министр энергетики Российской Федерации Александр Новак и Министр энергетики, промышленности и природных ресурсов Саудовской Аравии Халид аль-Фалих обсудили последние тенденции на мировом рынке нефти. Министры обменялись информацией о планах своих стран по производству нефти для удовлетворения спроса в летний период в свете решений, принятых в последние месяцы на 174-й встречи Конференции ОПЕК и 4-й Министерской встречи стран ОПЕК и не входящих в ОПЕК государств в Вене, направленных на корректировку коллективного уровня снижения добычи нефти со 147 процентов в мае 2018 до 100 процентов, начиная с 1 июля 2018 г., что соответствует увеличению добычи примерно на один миллион баррелей нефти в день. |