THE TRADE WAR LIMITING U.S.

API - the American Petroleum Institute released its industry outlook for the third quarter of 2018. The report shows the U.S. celebrated another new record for crude oil production of 10.8 million barrels per day (MBD) over the past two months. but U.S. petroleum exports decreased by 1.3 million barrels per day since June. The overall United States' petroleum trade balance went from net imports of 2.9 MBD in June to 4.54 MBD in August, which is more than a 56 percent increase in two months.

"Placing constraints on exports of American-made energy works against America's energy future," said API Chief Economist Dean Foreman. "While the picture is still a bit muddied, it seems to be getting clearer – the trade war appears to be limiting the United States' access to crude export markets. As we produce more energy here at home, the U.S. needs markets for its products in order for our economy to continue to grow. There's no question that the 1.6 MBD increase U.S. petroleum net imports, which undid a full year's worth progress, is a setback to the United States' goal of energy dominance."

The administration's trade and tariff policies involving steel that the energy sector relies on also are raising concern. Prices of many tubular and specialty steel products, which are main inputs to pipelines, refineries and natural gas liquefaction and petrochemical facilities, increased by more than 25 percent as import tariffs were recently imposed on them.

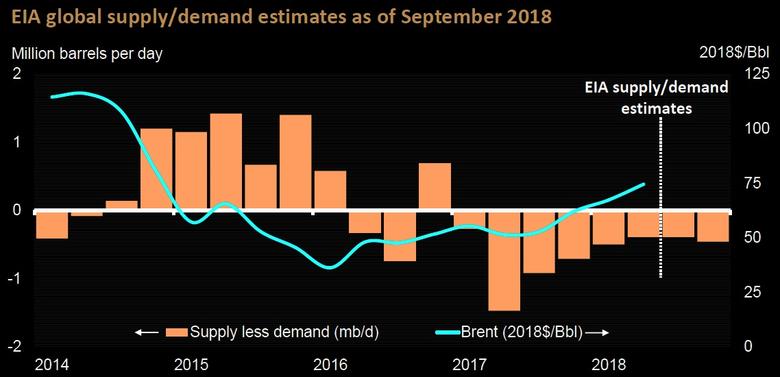

The latest API Monthly Statistical Report (MSR) showed a record 18 million barrels a day of refined products produced for the month of August. U.S. liquid fuels production remained up by more than 2.0 MBD year-over-year in August, and the United States continued to supply virtually all global oil demand growth and compensate for production losses in some OPEC nations.

In August, U.S. petroleum demand, led by motor gasoline, distillate and refinery feedstocks, grew by 250 thousand barrels per day from July to 20.8 million barrels per day. This was the strongest demand for any month since August 2007 and reflected solid economic growth, industrial activity, and consumer confidence.

"The backdrop for petroleum demand and the end of the summer driving season appeared to be solid in August, and indicators of the business climate, consumer sentiment, and employment conditions were strong," said Foreman.

September MSR Highlights:

- U.S. petroleum demand accelerated to 20.8 million barrels a day

- Gasoline demand notches its third highest August on record since 1945.

- Strongest jet fuel demand year-to-date since 2001.

- U.S. crude oil and gasoline prices declined on strong production and the U.S. dollar.

- Solid indictors despite rising price inflation.

- U.S. petroleum inventories stable in the 5-year range.

More information is here.

-----

Earlier:

2018, September, 21, 10:30:00

U.S. CAPITAL EXPENDITURES UPU.S. EIA - Second-quarter 2018 financial results for 45 U.S. oil exploration and production companies that the U.S. Energy Information Administration (EIA) regularly tracks reveal that most companies increased their capital expenditure budgets for 2018 compared with initial budgets made at the beginning of the year. |

2018, September, 21, 10:25:00

U.S. ENERGY CASH: $119 BLNU.S. EIA - Energy companies’ free cash flow—the difference between cash from operations and capital expenditure—was $119 billion for the four quarters ending June 30, 2018, the largest four-quarter sum during 2013–18 Companies reduced debt for seven consecutive quarters, contributing to the lowest long-term debt-to-equity ratio since third-quarter 2014 |

2018, September, 21, 10:20:00

WORLD OIL DEMAND: 100.23 MBDOPEC - Total oil demand for 2018 is now estimated at 98.82 mb/d. In 2019, world oil demand growth is forecast to rise by 1.41 mb/d. Total world oil demand in 2019 is now projected to surpass 100 mb/d for the first time and reach 100.23 mb/d. |

2018, September, 19, 13:35:00

U.S. PRODUCTION: OIL + 79 TBD, GAS + 961 MCFDU.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 79,000 b/d month-over-month in October from 7,515 to 7,594 thousand barrels/day , gas production to increase 961 million cubic feet/day from 72,127 to 73,088 million cubic feet/day . |

2018, September, 19, 13:30:00

U.S. - CHINA SANCTIONS: $60 BLNREUTERS - Beijing on Tuesday said it would tax U.S. products worth $60 billion effective Sept. 24 in retaliation for tariffs imposed by U.S. President Donald Trump in an escalating trade war. |

2018, September, 13, 14:10:00

U.S. SANCTIONS AGAINST THE WORLDCNBC - "We can see that the pricing situation today depends not just on the supply/demand balance or the general economic situation but also on the uncertainty that we observe today in the global markets: the trade wars, the sanctions that the U.S. pursue," Novak said, speaking to CNBC's Geoff Cutmore at the Eastern Economic Forum (EEF) in Vladivostok, Russia. |

2018, September, 7, 12:45:00

U.S. PETROLEUM EXPORT RECORDU.S. EIA - The United States exported 7.3 million barrels per day (b/d) of crude oil and petroleum products in the first half of 2018, when exports of crude oil and hydrocarbon gas liquids (HGL) set record monthly highs. Crude oil surpassed HGLs to become the largest U.S. petroleum export, with 1.8 million b/d of exports in the first half of 2018. U.S. exports of crude oil, HGLs, and motor gasoline grew in the first half of 2018 compared with the same period in 2017, while distillate exports decreased 84,000 b/d |