THREATS FOR IRANIAN OIL

SHANA - Iran's OPEC governor Hossein Kazempour Ardebily said regarding the current market conditions and the production level of the producing countries in or outside of the Organization of the Petroleum Exporting Countries (OPEC), threats to bring Iran's oil exports are not practical.

Speaking to IRNA in Algiers on Monday, the official said, "The market conditions and the production level of countries are not such that a replacement for Iranian oil could be found to remove it from the oil market."

The global demand for oil will persist in the event of insistence on reducing Iran's oil exports through US sanctions, but the question is who will be able to enter the market and offset this potential supply shortage, he said.

Mr. Ardebily said: "Some parties, like Saudi Arabia, claim to have a surplus capacity, but we have not witnessed any supply increases from production augmentation and surplus capacity from this country."

Saudi Arabia may tap its inventories to supply the market and have some spare production capacity in winter due to reduced domestic consumption, but it will not be able to offset Iran's oil in the market alone, therefore other parties must join US president in squeezing Iran out of the oil market, he added.

He added that Russia now has surplus production capacity, as it has already cut its production by 300,000 barrels per day and has now returned 265,000 b/d of that to the market.

Iran's OPEC boss said he believed that there were not much oil left in Russia to supply as excess capacity. "We know that in some parts of northern Siberia, in winter, part of the production is reduced and Russia cannot maintain production in those areas."

"We think the total output of producers cannot replace the amount of production that Donald Trump claims. For this reason, Trump has to show some flexibility in dealing with Iranian oil buyers. For example, about one and a half million or 1.2 million barrels. Given the current circumstances, he has to soften its plans to totally wipe Iranian oil out of the market. Of course, it is possible that they withdraw from their strategic reserves for, say, two months, and sell them to offset the shortage caused by removing Iran from the market, but this is not possible in the long run."

"All OPEC producers cannot offset the shortage caused by removing 2.3 mbd of Iranian oil in the market by November, unless they decide to tap their inventories which would not be enough for supplying the market demand."

Mr. Ardebily said: "What is certain is that Tehran's resistance to the situation that has not yet happened has been good. Iran has maintained its production level and supplied about 3.805 mbd to the market...Iran's oil production is about seven or eight thousand barrels above its designated quota in OPEC.

He also said domestic refineries were operating at full capacity to consume the produced oil domestically.

The official said prolonged US sanctions on Iran would dramatically soar up the prices which would stimulate the global community against the US and spur them into criticizing Trump's policies.

-----

Earlier:

2018, September, 21, 10:45:00

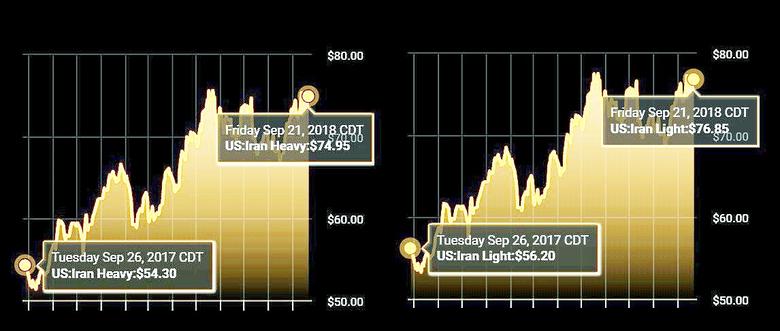

UNEXPECTED OIL PRICESSHANA - What is common in oil market is that no price levels could be forecast for the future there. Only its unpredictability is predictable. Rarely may you find an expert to say with full certainty in which direction oil prices are headed. |

2018, September, 21, 10:40:00

OIL MARKET UNCERTAINTYPLATTS - 1.4 million b/d of Iranian oil supplies to leave the market by November, when the US sanctions go into force. Venezuela, which pumped 1.22 million b/d in August could see output fall to 1 million b/d in 2019. Politically unstable Libya also presents a supply risk. |

2018, September, 21, 10:35:00

OPEC-NON-OPEC DECISIONSSHANA - Iran’s Minister of Petroleum Bijan Zangeneh said the Joint OPEC/Non-OPEC Ministerial Monitoring Committee (JMMC) is not legally competent to make decisions about adjustment of production quotas.

|

2018, September, 17, 15:15:00

IRAN'S SUPPLIES COMPENSATIONREUTERS - Saudi Arabia, the United States and Russia can between them raise global output in the next 18 months to compensate for falling oil supplies from Iran and elsewhere, U.S. Energy Secretary Rick Perry said on a visit to Moscow on Friday. |

2018, September, 17, 15:10:00

IRAN'S OIL TO S.KOREA DOWN 86%PLATTS - South Korea's crude oil imports from Iran plunged 86.5% in August from a year earlier due to pending re-imposition of US sanctions on Tehran, according to preliminary data released by the Korea Customs Service Monday. |

2018, September, 13, 14:10:00

U.S. SANCTIONS AGAINST THE WORLDCNBC - "We can see that the pricing situation today depends not just on the supply/demand balance or the general economic situation but also on the uncertainty that we observe today in the global markets: the trade wars, the sanctions that the U.S. pursue," Novak said, speaking to CNBC's Geoff Cutmore at the Eastern Economic Forum (EEF) in Vladivostok, Russia. |

2018, September, 7, 12:09:00

IRANIAN OIL FOR CHINA: 874 TBDMEOG - China's crude imports from Iran are likely to have peaked in August at 874,000 b/d ahead of the looming re-imposition of US sanctions in November, |