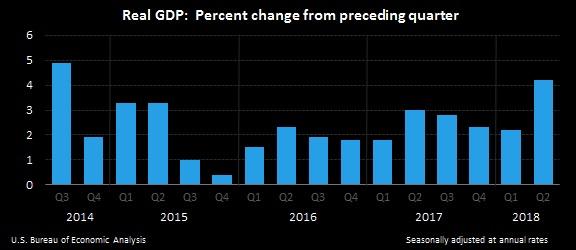

U.S. GDP UP 4.2%

U.S. BEA - Real gross domestic product (GDP) increased at an annual rate of 4.2 percent in the second quarter of 2018, according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 2.2 percent.

Real gross domestic income (GDI) increased 1.6 percent in the second quarter, compared with an increase of 3.9 percent in the first quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 2.9 percent in the second quarter, compared with an increase of 3.1 percent in the first quarter.

The increase in real GDP in the second quarter reflected positive contributions from PCE, nonresidential fixed investment, exports, federal government spending, and state and local government spending that were partly offset by negative contributions from private inventory investment and residential fixed investment. Imports decreased.

The acceleration in real GDP growth in the second quarter reflected accelerations in PCE, exports, federal government spending, and state and local government spending, as well as a smaller decrease in residential fixed investment. These movements were partly offset by a downturn in private inventory investment and a deceleration in nonresidential fixed investment. Imports decreased after increasing in the first quarter.

Current-dollar GDP increased 7.6 percent, or $370.9 billion, in the second quarter to a level of $20.41 trillion. In the first quarter, current-dollar GDP increased 4.3 percent, or $209.2 billion.

The price index for gross domestic purchases increased 2.4 percent in the second quarter, compared with an increase of 2.5 percent in the first quarter. The PCE price index increased 2.0 percent, compared with an increase of 2.5 percent. Excluding food and energy prices, the PCE price index increased 2.1 percent, compared with an increase of 2.2 percent.

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $65.0 billion in the second quarter, compared with an increase of $26.7 billion in the first quarter.

Profits of domestic financial corporations increased $16.5 billion in the second quarter, in contrast to a decrease of $9.3 billion in the firstquarter. Profits of domestic nonfinancial corporations increased $53.0 billion, compared with an increase of $32.3 billion. Rest-of-the-world profits decreased $4.5 billion, in contrast to an increase of $3.7 billion. In the second quarter, receipts increased $0.5 billion, and payments increased $5.0 billion.

-----

Earlier:

2018, September, 26, 09:25:00

U.S. OIL EXPORT RECORDU.S. EIA - Crude oil surpassed hydrocarbon gas liquids (HGL) to become the largest U.S. petroleum export, with 1.8 million barrels per day (b/d) of exports in the first half of 2018. U.S. crude oil exports increased by 787,000 b/d, or almost 80%, from the first half of 2017 to the first half of 2018 and set a new monthly record of 2.2 million b/d in June. |

2018, September, 24, 15:15:00

THE TRADE WAR LIMITING U.S.API - “Placing constraints on exports of American-made energy works against America’s energy future,” said API Chief Economist Dean Foreman. “While the picture is still a bit muddied, it seems to be getting clearer – the trade war appears to be limiting the United States’ access to crude export markets. As we produce more energy here at home, the U.S. needs markets for its products in order for our economy to continue to grow. There’s no question that the 1.6 MBD increase U.S. petroleum net imports, which undid a full year’s worth progress, is a setback to the United States’ goal of energy dominance.” |

2018, September, 21, 10:30:00

U.S. CAPITAL EXPENDITURES UPU.S. EIA - Second-quarter 2018 financial results for 45 U.S. oil exploration and production companies that the U.S. Energy Information Administration (EIA) regularly tracks reveal that most companies increased their capital expenditure budgets for 2018 compared with initial budgets made at the beginning of the year. |

2018, September, 21, 10:25:00

U.S. ENERGY CASH: $119 BLNU.S. EIA - Energy companies’ free cash flow—the difference between cash from operations and capital expenditure—was $119 billion for the four quarters ending June 30, 2018, the largest four-quarter sum during 2013–18 Companies reduced debt for seven consecutive quarters, contributing to the lowest long-term debt-to-equity ratio since third-quarter 2014

|

2018, September, 21, 10:05:00

U.S. DEFICIT DOWN TO $101.5 BLNU.S. BEA - The U.S. current-account deficit decreased to $101.5 billion (preliminary) in the second quarter of 2018 from $121.7 billion (revised) in the first quarter of 2018, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit was 2.0 percent of current-dollar gross domestic product (GDP) in the second quarter, down from 2.4 percent in the first quarter. |

2018, September, 17, 14:45:00

U.S. INDUSTRIAL PRODUCTION UP 0.4%U.S. FRB - Industrial production rose 0.4 percent in August for its third consecutive monthly increase. Manufacturing output moved up 0.2 percent on the strength of a 4.0 percent rise for motor vehicles and parts; motor vehicle assemblies jumped to an annual rate of 11.5 million units, the strongest reading since April. Excluding the gain in motor vehicles and parts, factory output was unchanged. |

2018, September, 13, 14:10:00

U.S. SANCTIONS AGAINST THE WORLDCNBC - "We can see that the pricing situation today depends not just on the supply/demand balance or the general economic situation but also on the uncertainty that we observe today in the global markets: the trade wars, the sanctions that the U.S. pursue," Novak said, speaking to CNBC's Geoff Cutmore at the Eastern Economic Forum (EEF) in Vladivostok, Russia. |