EUROPE'S GAS PRICES DOWN

BLOOMBERG - European natural gas prices look set to fall for the first time in four years in 2019 as buyers keep a close eye on flows from Russia that reached a record last year.

With a healthy amount of fuel in storage after a mild start to this winter, the outlook is bearish. That's being exacerbated by an expected increase in imports, which would help offset declining production in the region. While Russia intends to maintain its grip on about 40 percent of the European market, fluctuations in that dependency will be closely monitored.

"The question is how much gas Russia ends up delivering into the European markets -- that will be a key determinant," said Murray Douglas, research director for European gas at Wood Mackenzie Ltd. "Russia expressed publicly it wants to keep deliveries. That could generate a real collapse in prices in the summer months, when we will see a big LNG supply."

The Dutch next-month gas contract is expected to end 2019 at 22 euros a megawatt-hour ($7.35 a million British thermal units), according to the median of seven analysts surveyed by Bloomberg. That's a bit below the average of 22.28 euros during 2018 and well below the peak for the year of more than 29 euros.

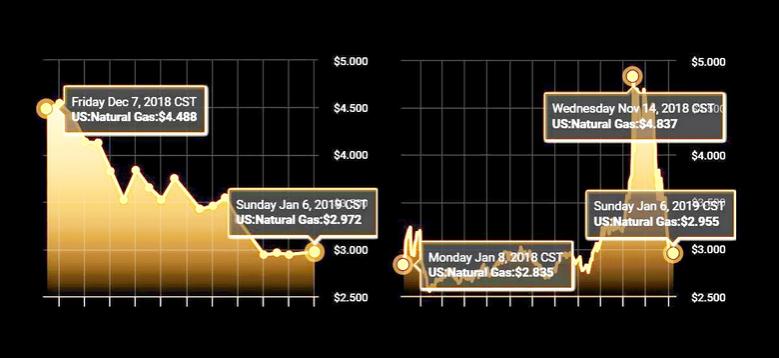

Dutch Gas Price

Kremlin-backed energy giant Gazprom PJSC reported a record 201 billion cubic meters of natural gas exports to Europe in 2018 and plans to maintain those volumes into 2020. Exports were up 2 percent in the year through Dec. 15.

There's questions whether Russia will be able to follow through on that ambition later in the year when a flood of liquefied natural gas is set to enter European markets. Europe's LNG imports are expected to increase by 14 percent to 56 billion cubic meters, according to Morgan Stanley, after achieving records over the past month. Russia could follow the initial plan focusing on its market share, or it could decide to protect prices, putting the brakes on exports.

"Russia's strategy will always have a big influence in the natural gas market," said Vattenfall AB's head of gas trading, Guy Smith. "I have the impression that we will always see Russian gas flowing to Europe. The question is how much. We will probably see an increase on exports from Russia, or at least the same level of exports."

Europe is an easy destination for spare LNG cargoes thanks to its numerous terminals, liquid trading hubs and a sophisticated transportation network. And global production of the super-chilled fuel is on the rise.

Russia's Novatek PJSC is ramping up production from its third production line at its Yamal plant in the Arctic. In the U.S., Cheniere Energy Inc. began output from its second plant, Corpus Christi, and started a fifth unit at its Sabine Pass export facility. Wood Mackenzie says a record amount of capacity is set to start this year, boosting LNG's importance in global gas markets.

Shift Towards LNG

Not only the rise of LNG volumes, but also more flexible contracts that allow cargoes to go to the highest priced destinations, is turning trading into a more active business and increasing the market liquidity, according to John Twomey, who leads Bloomberg NEF's European power and natural gas analysis team.

"A huge wave of LNG in Europe is pushing the natural gas market," said Twomey. "The willingness of the U.S. to sign deals that are not destination-defined are also reframing the market."

Other Key Themes

Gazprom in Moscow and the Kiev-based natural gas company NJSC Naftogaz Ukrainy have argued for years over transit fees linked to a 2009 gas-shipment contract that expires this year. Gazprom aims to cut its dependence on Ukraine, which transports almost half of Russian flows into western Europe. Its plan is to build new export pipelines through the Baltic and the Black Seas by the end of this year -- including the controversial Nord Stream 2 link.

"We need to see an agreement in the summer," said Jonathan Stern, a senior research fellow at Oxford Institute for Energy Studies. "We still see very substantial volumes going through Ukraine, so there are no big changes in prices. If they don't come to some agreement on the transit, we can see prices going up, giving the uncertainties."

Weather

Although the general expectation is for a mild winter, which would damp gas demand, there is still a risk that there will be a cold snap at the end of the heating season. A rare weather event known as sudden stratospheric warming is possible by the end of February, according to Vattenfall's Smith. That could see a repetition of last February's "beast from the east," a high pressure area, which drew cold air from Siberia across Europe and helped boost gas prices to a record.

"The question will be how much storage Europe has in order to meet an unseasonable cold event? If we see more prolonged cold period then predicted, the reaction will be very fast," Smith said.

Carbon and Coal

Carbon is expected to extend a rally that saw its price more than triple last year. That makes natural gas more competitive against dirtier coal in power generation.

"The market will be looking at what happens to coal and carbon prices very closely," said Wood Mackenzie's Douglas.

"Higher carbon prices may help spur gas demand, but increased LNG supply could offset the effects," BNEF's Twomey said.

-----

Earlier:

2018, December, 12, 08:40:00

VENEZUELA - RUSSIA OIL: $17 BLNPLATTS - Russia will invest $5 billion to raise Venezuela's oil production by 1 million b/d under a new economic agreement, Venezuelan President Nicolas Maduro said Thursday.

|

2018, December, 7, 07:50:00

RUSSIA'S INVESTMENT TO VENEZUELA: $5 BLNREUTERS - Venezuela has signed deals securing investment from Russia in the South American country’s oil and gold sectors, President Nicolas Maduro said on Thursday at the end of a three-day trip to Moscow.

|

2018, November, 26, 13:25:00

VENEZUELA'S OIL DOWN TO 1.17 MBDREUTERS - The country’s oil production has fallen to just 1.17 million barrels-per-day, a 37 percent drop in the last year, according to reports from secondary sources to OPEC, leaving itstruggling to ship Russian entities the roughly 380,000 bpd it has agreed to send, according to PDVSA

|

2018, November, 23, 12:05:00

VENEZUELA'S ECONOMY DOWN 17%REUTERS - Preliminary data compiled by Venezuela’s central bank shows the economy shrank by 16.6 percent in 2017 compared with the year before, two sources familiar with the matter said on Thursday, the country’s sharpest decline on record.

|

2018, September, 17, 15:00:00

VENEZUELA - CHINA COOPERATIONREUTERS - Venezuela gave China another stake in the OPEC nation’s oil industry and signed several other deals in the energy sector, but Beijing made no mention of new funds for Caracas during President Nicolas Maduro’s visit to his key financier on Friday.

|

2018, July, 25, 09:15:00

VENEZUELA'S ECONOMIC COLLAPSEIMF - On Venezuela, it is difficult to discuss because it is in a state of economic collapse. We have not engaged with them in over a decade on their economic policies.

|

2018, June, 25, 12:15:00

VENEZUELA CAN UP BY 1 MBDREUTERS - Venezuela has the ability to boost crude output by 1 million barrels per day (bpd) by end of the year in its bid to recover lost production, but the oil minister also said on Friday this goal would be “a challenge” for state oil firm PDVSA. |