FLAT US E&P CAPEX

PLATTS - US onshore E&P capital investments in 2019 are likely to be flat to slightly down from last year, with international activity outside North America picking up slowly over the next several months, Schlumberger's top executive said Friday.

Paal Kibsgaard, CEO of the world's largest oilfield service company, said during a fourth-quarter earnings call that US land activity should also start slowly but pick up gradually in the second half.

"In this scenario, it is likely that the E&P operators would gradually lower drilling activity and instead focus on drawing down the large inventory of drilled uncompleted wells," Kibsgaard said.

Assuming WTI oil prices "reasonably" recover to average roughly 2018 levels of at least $60/b, operator focus on some of the thousands of drilled but unproduced wells (DUCs) would still drive US production growth, but at a rate "substantially" lower than the 1.9 million b/d in 2018, Kibsgaard said.

On Friday, NYMEX WTI for February closed at $53.80/b.

In November, there were 8,723 DUCs in the US, 46% of which were in the Permian Basin, US Energy Information Administration data showed. Permian DUCs have grown relatively rapidly, from 1,127 in August 2016 to 4,039 in November 2018.

'SOLID' REVENUE GROWTH OUTSIDE NORTH AMERICA

On the other hand, Schlumberger's projected "solid" year-over-year revenue growth in 2019 from markets outside North America. Increases are expected in mid-single digits during the first half of the year, signaling operators' intentions to spend more money in those arenas, Kibsgaard said.

Those companies will probably start the year at "conservative" spending levels in view of global oil prices that fell in Q4 2018 and remain $10-$20/b lower than last year, he added. ICE Brent closed Friday at $62.73/b.

Activity pickups internationally will be led by Latin America, Asia and Africa as new investment programs are kicked-off in those regions, with more nominal activity growth in the North Sea, Russia and the Middle East.

"The underlying decline from the aging production base in key oil producing countries like Norway, the UK, Brazil and Nigeria are being offset by new project startups, as well as more exploration activity," Kibsgaard said.

"After four years of under-investments and a focus on maximizing short-term cash flows, national oil companies and independents are starting to see the need to invest in their resource base simply to keep production at current levels," he said.

Fresh investment is also evident in Mexico, Angola and Indonesia, where production has been in decline for several years.

Schlumberger earned $32.8 billion in revenues in 2019, 36% coming from North America, with pretax operating income of $4.2 billion.

FUNDAMENTALS SHOULD IMPROVE

Both oil prices and supply-demand fundamentals should improve in 2019 as the OPEC-Russia production cuts take full effect, lower North American activity results in lower production growth, and waivers from Iran export contracts expire and aren't renewed, Kibsgaard said.

Schlumberger warned it could end efforts to purchase a stake in Eurasia Drilling, a move it has eyed since mid-2017, if it fails to receive regulatory approvals from Russian authorities.

"Our plan is that we're going to make one final attempt and approach over the coming weeks; and if we see no clear path to obtaining the needed approvals, we are likely going to withdraw our application," Kibsgaard said.

Instead, Schlumberger will seek "alternative avenues in partnership" with Russia's top drilling company to further its participation in the conventional land drilling market in that country, he added.

Despite volatile oil prices and expected slower activity in early 2019, Schlumberger is "more or less sold out" of its high-end product lines and advanced technologies, Kibsgaard said.

A large part of the company's 2019 field equipment capex of $1.5 billion-$1.7 billion will focus on making sure it has enough capacity to take on more work requiring that equipment, he said.

-----

Earlier:

2019, January, 14, 11:00:00

U.S. RIGS UP 0 TO 1,075BHGE - U.S. Rig Count is unchanged from last week at 1,075 rigs, with oil rigs down 4 to 873 and gas rigs up 4 to 202. Canada Rig Count is up 108 rigs from last week to 184, with oil rigs up 83 to 103 and gas rigs up 25 to 81.

|

2018, December, 24, 11:55:00

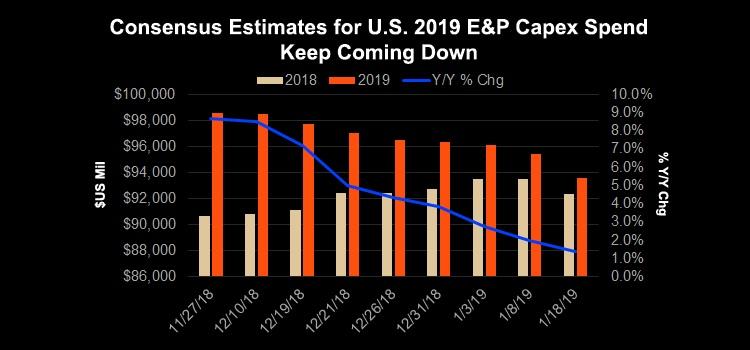

U.S. OIL CAPEX DOWNPLATTS - Three aggressive independent Permian Basin upstream operators released capital budgets for 2019 in the last few days that are lower than either prior expectations or actual 2018 spending by at least 12% to 15%, as corporate executives attributed reduced activity to the recent plunge in oil prices.

|

2018, December, 21, 14:25:00

U.S. OIL PRODUCTION 11.6 MBDAPI - The U.S. produced a record 11.6 million barrels of oil per day (mb/d) and a record 4.8 mb/d of NGLs in November. Crude exports also hit a record high at 2.4 million barrels per day last month, and U.S. petroleum net imports fell at their lowest monthly level in more than 50 years at 2.2 million barrels per day.

|

2018, December, 21, 14:20:00

U.S. PRODUCTION: OIL + 134 TBD, GAS + 1,127 MCFDU.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 134,000 b/d month-over-month in January from 8,032 to 8,166 thousand barrels/day , gas production to increase 1,127 million cubic feet/day from 75,789 to 76,916 million cubic feet/day .

|

2018, December, 3, 11:55:00

U.S. PRODUCTION: OIL +1.1%, GAS +1.8%U.S. EIA - Crude oil production increases 1.1% in September from 11,346 to 11,475 thousand barrels/day , gas production increases 1.8% from 102,659 to 104,461 million cubic feet/day .

|

2018, December, 3, 11:50:00

U.S. GAS PRODUCTION UP BY 13.8%U.S. EIA - In September 2018, for the 17th consecutive month, dry natural gas production increased year to year for the month. The preliminary level for dry natural gas production in September 2018 was 2,590 billion cubic feet (Bcf), or 86.3 Bcf/d. This level was 10.5 Bcf/d (13.8%) higher than the September 2017 level of 75.8 Bcf/d.

|

2018, November, 28, 12:55:00

U.S. ENERGY PRESSUREFT - in the third quarter of this year the US E&P sector was able to cover its capital spending from its operating cash flows, if only barely. The plunge in oil prices over the past two months is bringing those concerns gushing to the surface again. |