KUWAIT'S GDP GROWTH 2.5-2.9%

IMF - Kuwait: Staff Concluding Statement of the 2018 Article IV Mission

Higher oil prices in 2017–18 lifted growth and improved fiscal and external balances. The uncertainty about their future though, as demonstrated by the recent drop, underscores the need to reduce Kuwait’s dependence on oil and save adequately for future generations. Successfully tackling these challenges hinges on the emergence of a vibrant private sector that can create jobs for the large number of nationals joining the labor force over the next decade. Ample financial assets, low debt, and a sound banking sector allow Kuwait to undertake the needed reforms from a position of strength and at a measured pace.

Against this backdrop, the authorities have taken welcome steps to contain government spending and boost private sector growth and job creation. The key priority now is to build a national consensus around an equitable and well-sequenced package of measures to reform the high public wage bill, subsidies, and transfers; raise nonoil revenue; and strengthen governance. These steps would support fiscal consolidation while creating room and increasing the efficiency of spending on human and physical capital. Promoting private sector-led growth and job creation for nationals requires lowering the high public-private wage premia, reducing the role of the public sector in the economy through privatization and public-private partnerships, and improving the business environment.

The IMF team highly values the candid discussions with the Kuwaiti authorities and expresses its gratitude for their hospitality and excellent cooperation.

Recent Macro-Financial Developments

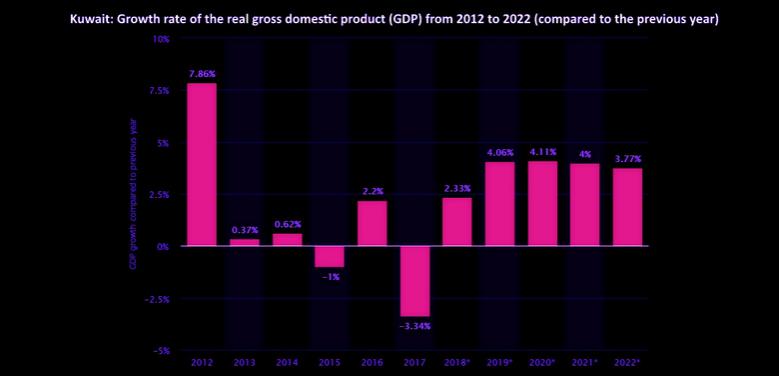

1. Higher oil prices in 2017-18 lifted growth and the current account balance.Hydrocarbon output is estimated to have risen by 1.2 percent in 2018 following a contraction a year earlier. Buoyed by a confidence rebound and some fiscal loosening, non-oil growth has accelerated to 2.5 percent. Thanks to higher oil prices, the current account balance moved back into surplus in 2017 (almost 6 percent of GDP), which further rose to an estimated 13.2 percent in 2018. Inflation reached a multiyear low of 0.7 percent in 2018 due to weakness in housing rents, easing international food prices, and a strengthening dinar.

2. While the overall fiscal balance has improved, the financing needs remain large. Higher oil revenues and investment income helped improve the FY2017/18 overall balance to an estimated surplus of 8 percent of GDP. It is expected to reach almost 12 percent of GDP in FY18/19. However, fiscal financing needs—overall balance excluding investment income and compulsory transfers to the Future Generations Fund (FGF)—remained large at 12.5 percent of GDP in FY2017/18. Delays in the passage of a new debt law have rendered the government unable to issue debt since October 2017. As a result, it has had to draw on the General Reserve Fund (GRF) assets for financing, including to pay for maturing debt.

3. Credit is recovering after a slow start in 2018. As the U.S. Federal Reserve raised its policy rate, the Central Bank of Kuwait (CBK) skillfully deployed various monetary policy instruments to maintain dinar’s attractiveness while helping support lending to the economy. For example, the CBK raised its repo rate several times, but kept the policy lending rate at 3 percent. Private credit grew 3 percent year-on-year in November, supported by lending to households and the oil sector. Government debt redemption in 2018 meant ample dinar liquidity, though some banks raised funding in international markets to boost foreign currency holdings.

4. The banking sector remains sound. Banks report high capitalization (CAR of 18 percent) and a rising return on assets (1.3 percent in September 2018). Asset quality has improved, with NPLs net of specific provisions falling to a historical low of 1.4 percent of gross loans.

5. Real estate is starting to recover, and equity markets have outperformed regional peers. The monthly sales of investment and residential properties have rebounded since mid-2018. Kuwaiti stocks have outperformed other Gulf Cooperation Council (GCC) markets and market capitalization has grown, especially following the March 2018 announcement of Kuwait’s inclusion in the FTSE Russell Emerging Market Index.

Macro-financial Outlook and Risks

6. Medium-term macro-financial prospects are broadly favorable, having slightly improved compared to a year ago.

- Growth is expected to strengthen. The mission has assumed an average oil price of US$57 per barrel in 2019–20, increasing to US$60 per barrel over the medium term. As capital project implementation accelerates, non-oil growth is projected to increase to about 3.5 percent in 2020. The recent OPEC decision to cut production is expected to hold oil output to 2 percent growth in 2019, which could rebound to 2.5 percent in 2020 given the spare capacity. Inflation is expected to rise in 2019–20 to about 2.5 percent as the deflationary factors in 2018 unwind.

- The underlying fiscal position is projected to gradually improve over the medium term. The mission’s baseline scenario assumes the introduction of excises on tobacco and sugary drinks in FY2020/21 and a value-added tax (VAT) in FY2021/22, small increases in fees for government services, and stricter enforcement of eligibility rules for transfers. As a result, the underlying fiscal position (non-oil fiscal balance excluding investment income) is projected to improve by 13.5 percentage points of non-oil GDP by FY2024/25. However, the overall fiscal balance will deteriorate by almost 8.5 percentage points of GDP over the same period, mainly reflecting the projected decline in oil revenues in 2019.

- Gross financing needs will remain large. The authorities’ principal measure of fiscal balance—overall balance excluding compulsory transfers to the FGF and investment income—will average 13.5 percent of GDP deficit over the medium term. This will give rise to gross financing needs of US$127 billion over the next 6 years. The mission’s baseline assumes that parliament will approve the new debt law, allowing borrowing to resume in FY2019/20. If the approval is delayed, the government will have to solely rely on the GRF for financing. Continued fiscal consolidation will be needed to reduce financing needs over the medium term.

- Credit is expected to accelerate. As growth recovers, and capital projects come on stream, credit growth should pick up, supported by ample banking sector liquidity and the recent easing of lending limits on personal loans.

7. A sustained drop in oil prices and delays in reforms are the main sources of risk. Oil prices could decline if trade tensions were to heighten and global growth were to weaken. A sustained drop in oil prices would generate unfavorable macro-financial dynamics, with twin deficits, large financing needs, and tightening credit conditions with asset quality deterioration. Delays in fiscal and structural reforms could slow growth and increase fiscal deficits at a time when the global environment is becoming more challenging and financial conditions have tightened. Should investors’ appetite for exposure to Kuwait wane under these conditions, the government and banks could face higher funding costs and rollover risks. Should these risks materialize, Kuwait could draw on its large financial assets to meet its fiscal financing needs while mitigating the impact on the financial sector and the real economy. Heightened security tensions and a challenging geopolitical environment in the region are an additional source of risk that could dampen confidence, investment, and growth.

Policy Discussions

A. Bolstering Long-term Fiscal and Macroeconomic Sustainability

8. The mission supports the authorities’ efforts to strengthen the fiscal accounts.The mission considers that the fiscal adjustment should be primarily expenditure-based, supported by non-oil revenue mobilization. Government spending as a share of GDP in Kuwait rose fastest in the GCC during a period of high oil prices and is currently the highest in the region.

- Reducing government spending while cutting inefficiencies . The authorities took initial steps to cut current spending by rationalizing some employment benefits and reducing energy and water subsidies. Facing opposition for further such reforms, the government has identified a menu of streamlining measures that could be implemented with greater social acceptance. These include: (i) closing loopholes in administration of various transfers, (ii) improving procurement, (iii) limiting grants to priority sectors, and (iv) rationalizing capital expenditure.

- Increasing non-oil revenue. The mission encourages the government to redouble its efforts to secure parliamentary support for the GCC-wide excise taxes on tobacco and sugary drinks and value-added tax (VAT), which Saudi Arabia, the UAE, and Bahrain have already implemented. With the low 5 percent proposed rate, the VAT would have a moderate and temporary adverse impact on growth and inflation, but would yield stable revenue, help upgrade tax administration, and contribute to more informed policy-making. Given its complexity and scope, the mission encourages the government to continue the preparatory work to build administration capacity. Facing a delay in VAT introduction, the government has explored alternative means to boost non-oil revenue: (i) repricing government services, (ii) enforcing penalties on businesses for not meeting Kuwaitization quotas, and (iii) strengthening revenue collection, including for public utilities.

9. Kuwait needs deeper reforms to secure adequate savings for future generations. Even if implemented fully and on time, the measures under consideration would not close the intergenerational equity gap. The government’s non-oil balance would fall well short of levels needed to ensure equally high living standards for future generations—a gap of 13.5 percent of non-oil GDP by 2024. Additional fiscal consolidation will therefore be needed to close this gap, which would also reduce financing needs and preserve liquid buffers.

10. The mission sees scope for building consensus around a more ambitious fiscal package. Such a package would support gradual fiscal consolidation, build on contributions from key stakeholders, introduce targeted compensatory measures to protect the vulnerable, and boost growth-enhancing infrastructure spending. Crucially, to gain broad support, the package would include reforms to foster a vibrant private sector that creates jobs for Kuwaitis who are no longer absorbed into the public sector, reduce inefficiencies and improve the quality of public services, and strengthen government transparency and accountability. A vigorous communications campaign will be key.

11. To that end, the mission proposes a path that would close the intergenerational savings’ gap over the next decade. It would entail additional measures to tackle current spending rigidities and increase non-oil revenue while boosting capital outlays. Most of the adjustment would come from spending, which would decline to about 75 percent on non-oil GDP by 2024—a level broadly consistent with that experienced in 2000-10.

- Curtailing the public wage bill . The authorities concur that reforming the large public wage bill (18 percent of GDP) will have to be an essential component of fiscal adjustment and are considering reform options. Comprehensive reform that centralizes compensation policy, harmonizes the public wage grid structure, better aligns public sector wages with those in the private sector, and fosters merit-based compensation would generate sizeable savings over time. Reducing the high public-private wage premia and limiting public employment growth would incentivize nationals to seek opportunities in the private sector, thereby enhancing its productivity and competitiveness. In this regard, the early retirement bill recently approved by parliament could further increase the relative attractiveness of civil service employment while imposing a cost on the budget.

- Gradually phasing out fuel, electricity, and water subsidies and transfers. Despite earlier reforms, at 5.3 percent of GDP, the fuel and utility subsidy bill remains large. Not only are these subsidies costly, they also encourage excessive consumption and inefficient investment and, being untargeted, disproportionately benefit the wealthiest. Raising public awareness about their budgetary costs, distortions, and distributional impact would help build consensus for reforms. The mission also sees scope for rationalizing transfers, by consolidating various programs, improving targeting, and better enforcing eligibility criteria.

- Broadening the coverage of the profit tax and introducing an excise on luxury goods. Applying the profit tax to all companies operating in Kuwait would raise non-oil revenue while leveling the playing field. An excise tax on luxury goods would contribute to a more socially-balanced adjustment mix. A personal income tax on high-income individuals could be an alternative.

- Rebalancing spending toward capital with improved implementation. Increasing the level and efficiency of capital outlays is essential for closing infrastructure gaps with GCC peers and raising the long-term growth potential. This should be complemented by public investment management reforms to improve project planning, selection, and implementation. The mission encourages the government to undertake a public investment management assessment that would provide a comprehensive diagnostic of Kuwait’s public investment management system.

12. The authorities agree on the need to further strengthen fiscal governance.Addressing shortcomings in public procurement, spending efficiency, and fiscal transparency would help cut waste, strengthen accountability, and reduce Kuwait’s vulnerabilities to corruption. To this end, the mission welcomes the newly released anti-corruption strategy and efforts to strengthen the operational independence and capacity of the Anti-Corruption Agency (ACA). The mission encourages prompt implementation of the new procurement law (passed in 2016), which aims to put in place a modern procurement system that would reduce opportunities for corruption and deliver value for money by promoting competition, equal treatment of bids, and introducing life-cycle-costing and other non-price criteria. Given the potential for large efficiency gains, the government could consider a focused Public Expenditure Review of education and healthcare spending. The mission welcomes the planned adoption of the GFSM2014 methodology and encourages improving the timeliness of intra-year budgetary execution data to enable more effective monitoring. Further steps should focus on expanding coverage to off-budget entities, debt, and contingent liabilities; increasing transparency to the public over the management of oil revenues; and conducting a Fiscal Transparency Evaluation to develop a comprehensive roadmap.

13. A robust medium-term fiscal framework would bolster fiscal policy credibility and ensure durable gains from fiscal adjustment. The introduction in 2017 of the 3-year expenditure ceilings stretched the planning horizon beyond annual budgets and helped contain spending. The mission urges the government to reintroduce such ceilings, anchoring them to a long-term fiscal policy objective (e.g., based on intergenerational equity considerations). Setting a time-consistent path for an intermediary target, such as non-oil primary balance, would help delink spending from oil revenues. To further improve the fiscal framework, the mission recommends strengthening top-down budgeting and expenditure control mechanisms. Medium-term budget planning should also consider fiscal risks, including those stemming from public pensions, state-owned enterprises, and public-private partnerships. In this regard, it is important to develop a contingent liabilities framework.

14. The mission supports the government’s steps to strengthen the institutional and legal framework for debt management and capital market development.The approval of the new debt law would allow the government to resume domestic borrowing, helping absorb structural excess liquidity. Gradually increasing the tenor of bonds would help build a long-term yield curve in dinars, while issuing sovereign Sukuk would widen the investor base. The mission welcomes the establishment of an asset-liability management committee, between the Ministry of Finance, the Central Bank, Kuwait Investment Authority, and the Kuwait Petroleum Corporation. Along with improved coordination, this will help in forming a more systematic view of asset-liability management, weighing costs and benefits of borrowing and investment, including the implications on GRF liquid buffers, central bank reserves, domestic liquidity, and debt market development. In this regard, publishing a regular issuance calendar and, in due time, moving to a market-based auctions to allow for price discovery would help deepen government debt markets. This in turn would facilitate corporate bond market development and help diversify private sector financing.

15. The peg to an undisclosed basket remains appropriate. It has provided an effective nominal anchor. The authorities are fully committed to the peg as demonstrated by CBK’s use of various monetary policy instruments to maintain the dinar’s attractiveness. Staff’s external sector assessment suggests a moderate current account gap, most of which would be closed by increasing fiscal savings as recommended over the medium term. The mission notes that, as the economy diversifies over the longer term, the benefits of greater exchange rate flexibility may increase.

16. Enhancing the coverage, quality, and timeliness of statistics is essential for informed policy making. To this end, the mission encourages increasing support to the Central Statistical Bureau, including for building technical capacity, and strengthening data provision arrangements.

B. Safeguarding Financial Stability

17. Prudent regulation and supervision by the CBK have helped keep the banking sector resilient. Banks are under Basel III regulations for capital, liquidity, and leverage, and transitioned to IFRS9 in January 2019 with little impact thanks to precautionary loan-loss provisioning. The current FSAP found banks to be resilient to various stress test scenarios, including protracted credit, liquidity and market shocks. The main vulnerabilities stem from high concentration of loans to single borrowers, large depositors, common exposures (particularly in the real estate sector), and interconnectedness of the financial system. The mission welcomes the CBK’s continuous calibration of macroprudential tools to carefully balance financial stability and credit growth, and its plans to upgrade stress-testing techniques and early warning indicators. As banks enhance their assessment of credit risk to wider segments of the economy, a gradual relaxation of interest rate ceilings would allow them to better price these risks and expand lending to new market segments.

18. The already strong supervisory regime could be further improved in certain areas. The CBK updates its supervisory framework on an ongoing basis to incorporate international best practices, and the supervisory approach is appropriate. Further refinements could include better integrating on- and off-site supervision, enhancing the consolidated supervision framework, and strengthening cross-border supervision. To reduce the risk of inconsistent interpretation of Shariah compliance, the authorities have proposed draft amendments to the CBK law establishing a centralized Shariah Board at the CBK. They are strengthening the AML/CFT framework, including through improved coordination between the Financial Intelligence Unit (FIU), ACA and CBK.

19. The CBK is developing options to strengthen its systemic risk oversight and crisis management frameworks. In line with FSAP recommendations, it has prepared a draft law assigning the CBK an explicit financial stability mandate and creating a Financial Stability Committee to establish a formal coordination mechanism between the CBK, Capital Markets Authority, Ministry of Finance, and Ministry of Commerce and Industry. Reforms should also focus on enhancing the existing corrective action framework, establishing a special resolution regime for banks, mandating bank recovery planning, and reforming the current blanket guarantee of deposits. Progress in these areas would promote market discipline, allow for orderly resolution in case of bank failure, and help safeguard fiscal resources.

20. The comfortable liquidity environment offers an opportunity to enhance the liquidity management framework. To better anticipate system-wide pressures, the CBK is currently reviewing its forecasting framework with a view to improving its accuracy and extending the forecast period beyond the short run. Information-sharing arrangements between the CBK and the relevant agencies would be essential in that regard. Gradually reducing the current ample liquidity in the system will be needed to incentivize banks to manage their balance sheets effectively and provide an impetus for an interbank market to develop, contributing to a more efficient allocation of liquidity. This would reduce the reliance of banks on the CBK as the first port of call in the event of non-emergency liquidity needs, a role normally assigned to money or bond markets.

C. Boosting Private Sector-led Growth and Economic Diversification

21. A vibrant private sector is the only sustainable solution to creating enough jobs for the large number of Kuwaiti youth entering the labor market. With the budgetary environment constrained, structural reforms that create incentives for entrepreneurship, foster productivity and competitiveness, and encourage private initiative will be paramount to private sector development.

22. An enabling business environment is a pre-condition for a dynamic private sector. The mission is encouraged by the recent streamlining of registration and licensing, including digitalizing administrative procedures, and relaxing restrictions on foreign direct investment. Eliminating excessive regulations, easing the burden and cost of trading across borders, enhancing market competition, and further reducing restrictions on foreign ownership will be key to Kuwait’s efforts to attract domestic and foreign investment. Improving access to land would remove a key constraint to private businesses.

23. Encouraging the private sector to play a bigger role in the economy would improve efficiency, competitiveness, and diversification. While progress was made in building stronger legal and institutional frameworks in recent years, privatizations and PPPs have yet to gather momentum, though several projects are in the pipeline. Given their significant potential in raising productivity and enhancing private sector development, the authorities should accelerate the execution of the planned privatizations and PPPs. It will be important to ensure transparent and competitive implementation and to limit hidden costs and contingent liabilities for the government.

24. Education and labor market reforms would boost Kuwaitis’ employment in the private sector. Comprehensive education reform, including enhanced vocational training, would help produce a better-skilled and more productive workforce. The authorities should revamp public wage subsidies for nationals working in the private sector to make the subsidies time-bound and targeted toward younger Kuwaitis.

25. The mission encourages increased focus on SMEs given their job creation potential. The mission welcomes the revised definition of SMEs. With the recent changes in its mandate, the National Fund for SME Development, in addition to lending, will be able to provide equity finance, train entrepreneurs, and encourage better integration of SMEs into supply chains.

26. Steadfast implementation of these reforms would yield large growth dividends. The mission estimates that rebalancing government spending towards growth-enhancing investment, strengthening governance, and increasing the role of the private sector in the economy could raise Kuwait’s non-oil growth potential to 5 percent, from 4 percent currently.

Kuwait: Selected Economic Indicators, 2014–24 |

||||||||||||||

|

Est. |

Projections |

|||||||||||||

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

||||

|

Oil and gas sector |

||||||||||||||

|

Total oil and gas exports (billions of U.S. dollars) |

97.6 |

48.5 |

41.5 |

49.6 |

65.7 |

53.4 |

55.8 |

58. 0 |

59.8 |

61.8 |

63.7 |

|||

|

Average oil export price (U.S. dollars/barrel) |

96.5 |

49.0 |

41.0 |

53.4 |

70.6 |

56.4 |

57.5 |

58.3 |

59.1 |

60.0 |

60.8 |

|||

|

Crude oil production (millions of barrels/day) |

2.87 |

2.86 |

2.95 |

2.70 |

2.74 |

2.79 |

2.86 |

2.93 |

2.99 |

3.05 |

3.11 |

|||

|

National accounts and prices |

(Annual percentage change, unless otherwise indicated) |

|||||||||||||

|

Nominal GDP (market prices, in billions of Kuwaiti dinar) |

46 |

34 |

33 |

36 |

43 |

40 |

42 |

45 |

47 |

50 |

52 |

|||

|

Nominal GDP (market prices, in billions of U.S. dollars) |

163 |

115 |

109 |

120 |

141 |

132 |

139 |

147 |

155 |

164 |

173 |

|||

|

Real GDP 1 |

0.5 |

0.6 |

2.9 |

-3.5 |

1.7 |

2.5 |

2.9 |

2.9 |

2.5 |

2.7 |

2.9 |

|||

|

Real oil GDP |

-2.1 |

-1.7 |

3.9 |

-7.2 |

1.2 |

2.0 |

2.5 |

2.5 |

2.0 |

2.0 |

2.0 |

|||

|

Real non-oil GDP |

4.9 |

4.2 |

1.4 |

2.1 |

2.5 |

3.0 |

3.5 |

3.4 |

3.2 |

3.7 |

4.0 |

|||

|

CPI inflation (average) |

3.1 |

3.7 |

3.5 |

1.5 |

0.7 |

2.5 |

2.7 |

4.7 |

3.9 |

3.5 |

3.0 |

|||

|

Unemployment rate (Kuwaiti nationals) |

5.0 |

4.7 |

3.3 |

... |

... |

... |

... |

... |

... |

... |

... |

|||

|

Budgetary operations 2 |

(Percent of GDP) |

|||||||||||||

|

Revenue |

67.4 |

52.3 |

52.8 |

58.9 |

60.4 |

56.8 |

57.4 |

57.7 |

56.4 |

55.2 |

54.0 |

|||

|

Oil |

51.9 |

35.4 |

34.5 |

38.0 |

43.2 |

37.9 |

37.6 |

36.9 |

36.2 |

35.6 |

35.0 |

|||

|

Non-oil, of which: |

15.4 |

16.9 |

18.3 |

20.9 |

17.3 |

18.9 |

19.8 |

20.8 |

20.2 |

19.6 |

19.0 |

|||

|

Investment income |

10.6 |

13.3 |

14.6 |

16.4 |

13.0 |

14.3 |

15.1 |

14.6 |

13.7 |

13.2 |

12.7 |

|||

|

Expenditures 3 |

48.8 |

52.7 |

52.3 |

50.8 |

48.6 |

52.0 |

52.0 |

52.4 |

52.0 |

51.4 |

50.4 |

|||

|

Expense |

43.3 |

45.0 |

44.2 |

42.6 |

40.9 |

43.4 |

43.4 |

43.7 |

43.3 |

42.9 |

42.0 |

|||

|

Capital |

5.4 |

7.7 |

8.1 |

8.2 |

7.8 |

8.5 |

8.6 |

8.7 |

8.7 |

8.6 |

8.5 |

|||

|

Balance |

18.6 |

-0.3 |

0.5 |

8.1 |

11.8 |

4.9 |

5.4 |

5.3 |

4.5 |

3.8 |

3.5 |

|||

|

Balance (after transfers to FGF and excl. investment income) |

2.3 |

-17.5 |

-17.9 |

-12.6 |

-6.0 |

-13.7 |

-14.0 |

-13.6 |

-13.5 |

-13.6 |

-13.3 |

|||

|

Non-oil balance excl. investment income (percent of non-oil GDP) 4 |

-102.5 |

-88.3 |

-83.8 |

-86.4 |

-87.4 |

-84.8 |

-84.0 |

-80.8 |

-78.4 |

-76.5 |

-74.1 |

|||

|

Excluding oil-related subsidies and benefits (percent of non-oil GDP) |

-81.2 |

-77.5 |

-74.8 |

-77.3 |

-77.1 |

-76.3 |

-75.6 |

-72.6 |

-70.4 |

-68.8 |

-66.5 |

|||

|

Total gross debt (calendar year) 5 |

3.4 |

4.7 |

10.0 |

20.7 |

14.8 |

18.4 |

21.5 |

26.6 |

31.2 |

34.5 |

38.1 |

|||

|

Money and credit |

(Percent change; unless otherwise indicated) |

|||||||||||||

|

Net foreign assets 6 |

3.6 |

-2.1 |

8.7 |

-3.1 |

4.2 |

4.0 |

5.5 |

7.3 |

5.9 |

6.6 |

6.7 |

|||

|

Claims on nongovernment sector |

5.2 |

7.6 |

2.9 |

2.8 |

3.0 |

6.0 |

6.8 |

8.2 |

7.4 |

7.6 |

7.5 |

|||

|

Kuwaiti dinar 3-month deposit rate (year average; in percent) 7 |

0.8 |

0.8 |

1.1 |

2.4 |

1.7 |

... |

... |

... |

... |

... |

... |

|||

|

External sector |

(Billions of U.S. dollars, unless otherwise indicated) |

|||||||||||||

|

Exports of goods |

104.5 |

54.5 |

46.5 |

55.1 |

71.6 |

59.7 |

62.5 |

65.1 |

67.4 |

69.9 |

72.4 |

|||

|

Of which: non-oil exports |

7.0 |

6.0 |

5.0 |

5.6 |

5.9 |

6.3 |

6.7 |

7.1 |

7.5 |

8.1 |

8.7 |

|||

|

Annual percentage change |

-2.8 |

-14.1 |

-15.7 |

10.6 |

6.6 |

6.2 |

6.1 |

6.1 |

6.1 |

7.1 |

8.1 |

|||

|

Imports of goods |

-27.0 |

-26.5 |

-27.0 |

-29.5 |

-30.6 |

-31.5 |

-32.6 |

-33.7 |

-34.8 |

-36.1 |

-37.5 |

|||

|

Terms of Trade (ratio, annual percent change) |

-12.2 |

-42.5 |

-12.5 |

21.9 |

21.7 |

-17.1 |

1.5 |

0.9 |

1.0 |

1.0 |

1.0 |

|||

|

Current account |

54.4 |

4.0 |

-5.1 |

7.1 |

18.6 |

6.4 |

9.9 |

10.9 |

10.8 |

11.4 |

11.7 |

|||

|

Percent of GDP |

33.4 |

3.5 |

-4.6 |

5.9 |

13.2 |

4.9 |

7.1 |

7.4 |

7.0 |

6.9 |

6.7 |

|||

|

International reserve assets 8 |

32.3 |

28.3 |

31.2 |

33.0 |

35.6 |

36.5 |

38.1 |

40.3 |

42.0 |

44.2 |

46.5 |

|||

|

In months of next year's imports of goods and services |

7.4 |

6.5 |

6.5 |

6.6 |

6.9 |

6.8 |

6.9 |

7.0 |

7.0 |

7.1 |

7.2 |

|||

|

Memorandum items 7: |

||||||||||||||

|

Exchange rate (U.S. dollar per KD, period average) |

3.52 |

3.32 |

3.31 |

3.31 |

3.31 |

... |

... |

... |

... |

... |

... |

|||

|

Nominal effective exchange rate (Percentage change) |

1.5 |

3.1 |

0.8 |

2.6 |

0.2 |

... |

... |

... |

... |

... |

... |

|||

|

Real effective exchange rate (Percentage change) |

2.0 |

5.0 |

2.8 |

0.4 |

-0.7 |

... |

... |

... |

... |

... |

... |

|||

|

Sources: Data provided by the authorities; and IMF staff estimates and projections. |

||||||||||||||

|

1 Calculated on the basis of real oil and non-oil GDP at factor cost. |

||||||||||||||

|

2 Based on fiscal year cycle, which starts on April 1 and ends on March 31. |

||||||||||||||

|

3 Starting FY 2016/17, there has been a reclassification of expenditure items. |

||||||||||||||

|

4 Excludes investment income and pension fund recapitalization. |

||||||||||||||

|

5 Excludes debt of Kuwait's SWF related to asset management operations. |

||||||||||||||

|

6 Excludes SDRs and IMF reserve position. |

||||||||||||||

|

7 For 2018, based on latest available data. |

||||||||||||||

|

8 Does not include external assets held by Kuwait Investment Authority. |

||||||||||||||

-----

Earlier:

2018, August, 3, 09:45:00

KUWAIT OIL PRODUCTION 2.8 MBDPLATTS - Kuwait's crude oil production currently stands at 2.8 million b/d, the country's oil minister Bakheet al-Rashidi said Wednesday, up about 90,000 b/d from June levels.

|

2018, July, 2, 12:15:00

KUWAIT'S OIL UPREUTERS - Kuwait will raise oil output by 85,000 barrels per day (bpd)starting on Sunday, part of an agreement between OPEC and non-OPEC producers to increase production by one million bpd, Energy Minister Bakhit al-Rashidi told a local newspaper on Saturday.

|

2018, April, 18, 13:02:00

KUWAIT'S INVESTMENT $113 BLNAOG - Kuwait plans to invest $113bn over the next five years to enhance oil exploration and production activities both inside and outside the country

|

2017, December, 25, 20:10:00

SHELL - KUWAIT LNGBLOOMBERG - Kuwait Petroleum Corp. signed a 15-year liquefied natural gas import deal with Royal Dutch Shell Plc to help the oil exporting nation meet growing domestic energy demand.

|

2016, July, 6, 18:05:00

KUWAIT'S DEFICIT: $18.2 BLNKuwait's budget deficit reflects the impact lower oil prices have had on crude exporters, particularly Gulf Arab monarchies that rely on oil revenues to support generous subsidies, welfare benefits and public sector wages.

|

2016, April, 3, 16:10:00

KUWAIT & SAUDI AGREEProduction at Khafji was halted in October 2014 because of environmental concerns. The 300,000-b/d field lies in the Saudi-Kuwaiti neutral zone. Kuwait Gulf Oil Co. and Saudi Aramco Gulf Operations Co. jointly operate it. Neither company commented on restart reports.

|

2015, November, 12, 20:00:00

RUSSIA & KUWAIT COOPERATIONRussia’s President Vladimir Putin met with Emir of Kuwait Sabah Al-Ahmad Al-Jaber Al-Sabah this week to discuss opportunities for cooperation in the fields of energy and diplomacy. The two countries also signed a memorandum for military technical cooperation. |