OIL, GAS INVESTMENT DOWN

BLOOMBERG - Three years ago, influential figures in the oil industry were sounding a clear warning: prices were too low, investment was collapsing and by the end of the decade the world would face a shortage.

In reality, the market today is looking at several more years of plenty, so much so that OPEC is beginning its third year of production cuts just to prevent a surplus.

"We're in an age of abundance," said Ed Morse, head of commodities research at Citigroup Inc. in New York. "A supply crunch is not likely at all."

So what happened?

Oil's biggest slump in a generation earlier this decade forced companies to slash spending, leading to a flurry of warnings that there wouldn't be enough growth in oil supplies to meet rising demand and also offset production lost from aging fields.

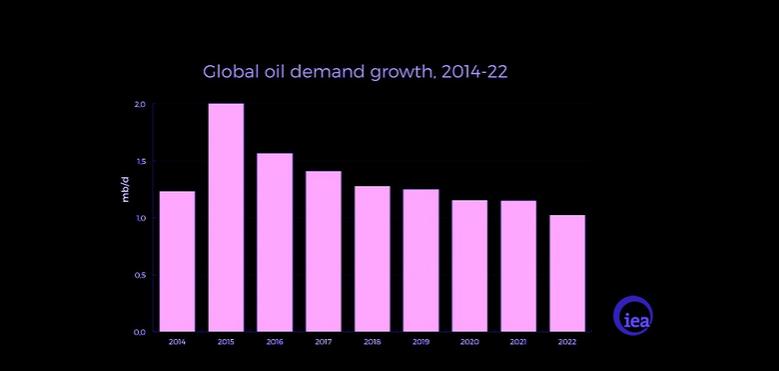

Investment in oil and gas production collapsed by about $350 billion, or more than 40 percent, from 2014 to 2016 -- the sharpest contraction since the 1980s -- after crude fell from over $120 a barrel to less than $30, according to the International Energy Agency. The number of new projects approved in 2017 dwindled to the lowest in 70 years, the Paris-based agency said.

'Alarm Bells'

In November 2015, the IEA cautioned that supply growth outside OPEC would grind to a halt by 2020. Three months later it was ringing "alarm bells" for a coming crisis. Total SA Chief Executive Officer Patrick Pouyanne foresaw a shortfall of as much as 10 million barrels a day, about the volume Saudi Arabia was pumping at the time. The concerns were echoed across the industry, from Royal Dutch Shell Plc executives to hedge fund veteran Andy Hall.

Instead, supply has turned out to be plentiful. The U.S. is estimated to produce about 12 million barrels a day of crude this year, a level it was earlier forecast to reach only in 2042. Russia has raised output to a record and Iraq's is near unprecedented levels. Brazil is set to pump at the fastest pace in at least 15 years in 2019, according to the IEA.

Bank of America Corp. estimates three-quarters of non-shale projects over the next five years will be profitable at just $40 oil, bringing new crude from the North Sea to Guyana even if prices stay low.

These have kept benchmark Brent near $60 a barrel, despite a brief surge to a four-year high above $86 in October as American President Donald Trump's sanctions against Iranian exports threatened to disrupt the market.

Pushed Back

Forecasts of a supply gap persist, but they're being pushed further out into the future.

The world still needs to add another 10 million barrels a day of production capacity -- effectively another Saudi Arabia -- by the first part of the next decade, and investment in the industry outside shale isn't sufficient to ensure this, IEA Executive Director Fatih Birol said in Davos, Switzerland, on Jan. 22. OPEC officials regularly say their current policy is aimed at encouraging enough investment to prevent a supply crunch.

Risks such as the U.S. sanctions on Venezuela and Iran still remain. But as America's shale surge continues, and oil majors squeeze costs and deploy new technologies, the dangers of a prolonged shortfall are abating.

Though the shale boom has recently shown signs of slowing, the U.S. government forecasts that crude production will continue to hit new records into the next decade, turning a country once reliant on imports into an exporter to rival many OPEC members. Consultant Rystad Energy AS projects that the U.S. will be producing more oil than Saudi Arabia and Russia combined by 2025.

"The shale story is a story of the triumph of technology, and all the signs are that that process will continue," said Paul Stevens, a fellow at the Chatham House think tank in London. "History suggests you don't turn that back. It may continue at a slower rate than before, but you don't tend to reverse it.''

Reset Costs

The expansion isn't limited to shale. Oil's crash forced companies to trim excesses, become more efficient and reset industry costs. So, while they were cutting expenditure, most were also learning how to keep the production taps open at far lower prices.

That's resulted in costs in the deepwater Gulf of Mexico and Brazil falling by 50 percent as they make use of previously built infrastructure and deploy new technology like robotics, according to Citigroup's Morse.

Norway's Equinor ASA has reduced the break-even price of its portfolio of new projects to $21 a barrel, a figure that was closer to $70 in 2013. BP Plc last year started output from a Gulf of Mexico project after spending 15 percent below its budget, and is working on a $9 billion expansion of its Mad Dog project, having more than halved the original cost.

Cost Deflation

"The view that there's been inadequate spending is based on an assumption about cost structures," said Morse. "Costs continue to deflate, not increase, and they deflate everywhere."

There are even signs of a revival in spending, which would only boost production further. Capital expenditure in shale is set to increase by 20 percent this year, the IEA's Birol said.

"There is no sign of a shortage so far," said Amy Mayers Jaffe, a senior fellow at the Council on Foreign Relations in New York. "People who believe there have to be higher oil prices in the future, like OPEC or Saudi Arabia, still suggest that the supply gap is still three years away. It is continuously three years in the future."

-----

Earlier:

2019, January, 28, 10:25:00

OIL UNDER SIEGEREUTERS - “There is no doubt - and there is a consensus coming here in various meetings in Davos - that our industry is literally under siege and the future of oil is at stake,” said Mohammed Barkindo, secretary-general of oil producer group OPEC.

|

2019, January, 21, 11:35:00

FLAT US E&P CAPEXPLATTS - US onshore E&P capital investments in 2019 are likely to be flat to slightly down from last year, with international activity outside North America picking up slowly over the next several months, Schlumberger's top executive said.

|

2019, January, 14, 11:45:00

OIL NEED INVESTMENTPLATTS - Oil prices averaging $70/b in 2018 underscore the need for more investment in new supply, UAE energy minister Suhail al-Mazrouei told delegates at the Atlantic Council's Global Energy Forum in Abu Dhabi on Saturday.

|

2019, January, 11, 11:30:00

NORWAY'S PETROLEUM PRODUCTION WILL UPNPD - The Norwegian Petroleum Directorate’s forecasts show that, after a minor decline in 2019, oil and gas production will increase from 2020 and up to 2023. Overall production will then approach the record year of 2004.

|

2019, January, 4, 11:40:00

OFFSHORE OILFIELD SERVICES - 2019: $210 BLNMEOG - An expected $210bn will be spent on offshore oilfield services globally next year, according to Rystad Energy’s latest project sanctioning report. Offshore contractors have experienced four consecutive years of declining revenues, but those still standing can expect revenues to start growing again next year.

|

2018, December, 24, 11:55:00

U.S. OIL CAPEX DOWNPLATTS - Three aggressive independent Permian Basin upstream operators released capital budgets for 2019 in the last few days that are lower than either prior expectations or actual 2018 spending by at least 12% to 15%, as corporate executives attributed reduced activity to the recent plunge in oil prices.

|

2018, December, 7, 08:10:00

WBG GREEN INVESTMENT $200 BLNWBG - “There are literally trillions of dollars of opportunities for the private sector to invest in projects that will help save the planet,” said IFC CEO Philippe Le Houérou. “Our job is to go out and proactively find those opportunities, use our de-risking tools, and crowd in private sector investment. We will do much more in helping finance renewable energy, green buildings, climate-smart agribusiness, urban transportation, water, and urban waste management.” |