OIL PRICE: ABOVE $56

REUTERS - Oil prices rose on Friday, shaking off early losses after China said it would hold talks with the U.S. government on Jan. 7-8 to look for solutions to a trade dispute between the world's two biggest economies.

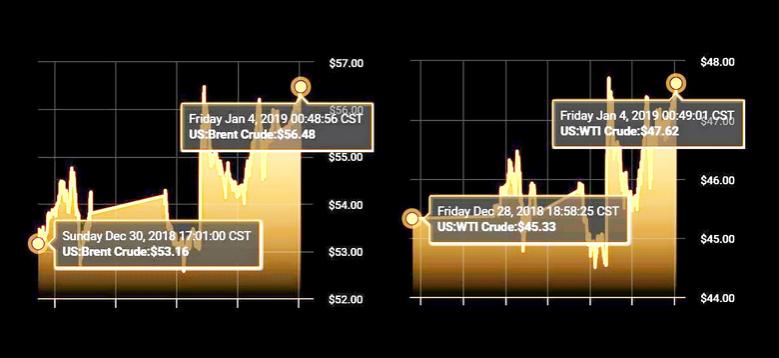

Brent crude futures LCOc1 were at $56.33 per barrel at 0638 GMT, up 38 cents, or 0.7 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude oil futures CLc1 were at $47.73 per barrel, up 64 cents, or 1.4 percent.

Both benchmarks are on track for solid gains in the first week of 2019 trading despite rising concerns that the Sino-American trade war will lead to a global economic slowdown.

The firmer prices came after China's commerce ministry said it would hold vice-ministerial level trade talks with U.S. counterparts in Beijing on Jan. 7-8.

The two nations have been locked in a trade war for much of the past year, disrupting the flow of hundreds of billions of dollars worth of goods and stoking fears of a global economic slowdown.

Data for December from the Institute for Supply Management (ISM) on Thursday showed the broadest U.S. slowdown in growth in a decade.

Leading economies in Asia and Europe have already reported a fall in manufacturing activity.

"Led by a sharp fall in the U.S. ISM and China's PMI... the global manufacturing PMI fell to 51.5 in December..., a 27-month low," Morgan Stanley said in a note following the release of the ISM data.

The U.S. bank said the data "increased the downside risks to an already moderating global growth outlook."

OPEC CUTS

Despite the market turmoil, traders said oil prices are expected to receive some support as supply cuts announced late last year by the Organization of the Petroleum Exporting Countries (OPEC) kick in.

OPEC oil supply fell by 460,000 barrels per day (bpd) between November and December, to 32.68 million bpd, a Reuters survey found on Thursday, as top exporter Saudi Arabia made an early start to a supply-limiting accord. Iran and Libya, which are exempt from cuts, posted involuntary supply declines.

"Isolating the participating countries indicates their output would need to fall a further 940,000 bpd to be in adherence with their targets," U.S. investment bank Jefferies said on Friday.

OPEC, Russia and other non-members - an alliance known as OPEC+ - agreed last December to reduce supply by 1.2 million bpd in 2019 versus October 2018 levels to rein in an emerging fuel glut. The fuel surplus was in part depicted by light distillate fuel stocks at Asia's refining hub in Singapore climbing to a record 16.1 million barrels in early January.

"If OPEC is faithful to its agreed output cut together with non-OPEC partners, it would take 3-4 months to mop up the excess inventories," energy consultancy FGE said.

Considering the planned cuts versus ongoing increases in U.S. crude production, which hit a record 11.7 million bpd by late 2018, FGE said it expected Brent prices to range between $55-$60 per barrel in the first months of 2019.

-----

Earlier:

2018, December, 27, 17:45:00

OIL PRICE: NEAR $54 AGAINREUTERS - Brent crude oil LCOc1 dropped $1.67 a barrel, or 3.1 percent, to a low of $52.80 before recovering to around $53.45 by 1205 GMT. U.S. light crude oil CLc1 slipped $1.30 to $44.92 and was last 80 cents lower at $45.42.

|

2018, December, 26, 07:45:00

OIL PRICE: NEAR $50REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1, were up 29 cents, or 0.68 percent, at $42.82 per barrel, at 0355 GMT, having at one point risen as high as 2 percent from the last close. They had slumped 6.7 percent in the previous session to $42.53 a barrel - the lowest since June 2017. Meanwhile Brent crude oil futures LCOc1 were down 11 cents or 0.22 percent at $50.36 a barrel, having skidded 6.2 percent in the previous session to $50.47 a barrel, the weakest since August 2017.

|

2018, December, 26, 07:40:00

ОПЕК + РОССИЯ: МИНУС 2.5%МИНЭНЕРГО РОССИИ - Принято консолидированное решение о совместных действиях с коллегами из ОПЕК и не ОПЕК по сокращению добычи на 2,5% для стран ОПЕК и 2% для стран не ОПЕК.

|

2018, December, 26, 07:35:00

MARKET WILL BE BALANCEDREUTERS - “I think that during the first half, due to joint efforts, which were confirmed by the OPEC and non-OPEC countries this December, the situation will be more stable, more balanced,” Novak said in an interview on Rossiya-24 TV. |

2018, December, 26, 07:25:00

OPEC: 26 MBBL SURPLUSAN - “Based on available figures, we have around 26 million barrels of surplus ... compared to 340 million barrels in early 2017,” Al-Mazrouei told a press conference in Kuwait City.

|

2018, December, 24, 12:10:00

OIL PRICE: NEAR $54 YETREUTERS - International benchmark Brent crude LCOc1 futures rose 60 cents, or 1.1 percent, to $54.42 a barrel at 0408 GMT. Prices climbed to as high as $54.66. U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 37 cents, or 0.8 percent, to $45.96 a barrel after earlier climbing to as high as $46.24.

|

2018, December, 24, 11:55:00

U.S. OIL CAPEX DOWNPLATTS - Three aggressive independent Permian Basin upstream operators released capital budgets for 2019 in the last few days that are lower than either prior expectations or actual 2018 spending by at least 12% to 15%, as corporate executives attributed reduced activity to the recent plunge in oil prices. |