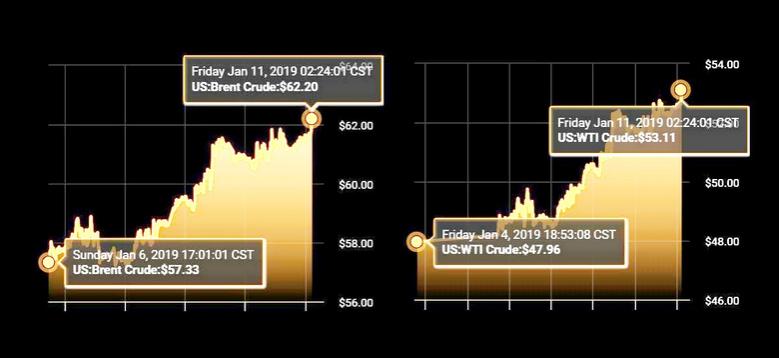

OIL PRICE: NEAR $62

REUTERS - Oil prices were on track for solid weekly gains on Friday after financial markets were lifted by hopes the United States and China may soon resolve their trade disputes, and as OPEC-led crude output cuts tightened supply.

Despite this, markets were held in check by expectations of an economic slowdown in 2019.

International Brent crude futures LCOc1 were at $61.62 per barrel at 0749 GMT, down 6 cents, or 0.1 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were 4 cents above their last settlement, at $52.63 per barrel.

Brent and WTI are set for their second week of gains, rising nearly 8 percent and 10 percent respectively.

Markets were being supported by hopes that the trade war between Washington and Beijing may be resolved soon after officials said three-day talks this week concluded constructively and that further negotiations would likely follow this month.

"Sentiment is greatly improved, and trade talk optimism has helped boost risk-appetite across the week," said Jasper Lawler, head of research at London Capital Group in a note on Friday, although he added that at this stage "there is a lack of anything concrete between the U.S. and China".

Lower oil exports from Iran since last November, when U.S. sanctions against it resumed, have also supported crude.

Despite this, concerns over the health of the global economy lingered on, with signs mounting that China's growth in 2018 and 2019 would be the lowest since 1990.

"If we experience an economic slowdown, crude will underperform due to its correlation to growth," said Hue Frame, portfolio manager at Frame Funds in Sydney.

Most analysts have downgraded their global economic growth forecasts below 3 percent for 2019, with some even fearing a looming recession amid trade disputes and spiraling debt.

OPEC CUTS MAKE WAY FOR SHALE

On the supply side, oil markets are receiving support from supply cuts led by the Organization of the Petroleum Exporting Countries (OPEC) aimed at reining in a glut that emerged in the second-half of 2018.

A key reason for the emerging glut was the United States where crude oil production C-OUT-T-EIA soared by more than 2 million barrels per day (bpd) in 2018 to a record 11.7 million bpd.

Consultancy JBC Energy this week said it was likely that U.S. crude oil production was already "significantly above 12 million bpd" by January 2019.

Given the overall supply and demand balance, Swiss bank Julius Baer said it was "price neutral" in its oil forecast.

"We see the oil market as well balanced into the foreseeable future, as the petro-nations make space for further U.S. shale production growth," said Norbert Ruecker, head of commodity research at the bank.

-----

Earlier:

2019, January, 9, 11:20:00

OIL PRICE: ABOVE $59REUTERS - U.S. West Texas Intermediate (WTI) crude oil futures CLc1 were at $50.42 per barrel at 0752 GMT, up 64 cents, or 1.3 percent, from their last settlement. That marked the first time this year that WTI has topped $50 a barrel. International Brent crude futures LCOc1 were up 69 cents, or 1.2 percent, at $59.41 per barrel.

|

2019, January, 9, 11:15:00

OPEC OIL PRODUCTION DOWN 630 TBDPLATTS - OPEC crude production in December tumbled 630,000 b/d month on month, an S&P Global Platts survey of industry officials, analysts and shipping data showed Tuesday, but the organization still has much more cutting to do to reach its new quotas for 2019.

|

2019, January, 9, 11:10:00

SAUDI'S OIL PRODUCTION DOWN 400 TBDMEOG - Saudi Arabia reportedly cut its crude production by more than 400,000 barrels per day (bpd) in December 2018. Saudi crude production sat at 10.65 million bpd (mbpd) that month, down from 11.07 mbpd in November.

|

2019, January, 9, 10:45:00

VENEZUELA'S OIL PRODUCTION: BELOW 1 MBDPLATTS - The US Energy Information Administration forecasts that Venezuelan oil production will fall below 1 million b/d in the second half of 2019, according to Erik Kreil, an international energy analysis team leader with the EIA.

|

2019, January, 7, 10:00:00

OIL PRICE: NEAR $58REUTERS - Brent crude futures LCOc1 were at $57.86 per barrel at 0538 GMT, up 80 cents, or 1.4 percent, from their last close. U.S. West Texas Intermediate (WTI) crude oil futures CLc1 were at $48.77 per barrel, up 81 cents, or 1.7 percent.

|

2019, January, 7, 09:50:00

IRAQ'S OIL PRODUCTION: 4.513 MBDREUTERS - Iraq said on Friday it was committed to the OPEC+ output-cutting deal and would keep its oil production at 4.513 million barrels per day for the first half of 2019.

|

2019, January, 7, 09:45:00

LIBYA'S OIL REVENUE UP 78%REUTERS - Libya’s oil revenue rose to $24.4 billion in 2018, up 78 pct from 2017, Libya’s National Oil Corporation (NOC) said in statement on Sunday. |