RUSSIAN LNG FOR ASIA

BLOOMBERG - Russia's Novatek PJSC is looking at storing liquefied natural gas produced in the Arctic on Japan's southern island of Kyushu so it can better meet spot demand from China and cut shipping costs.

Saibu Gas Co., which last month signed a preliminary deal to allow Russia's biggest LNG producer to use its storage facilities, said Wednesday it may build two additional LNG tanks and upgrade its re-exporting capability. That infrastructure would offer Novatek greater flexibility to meet Chinese and South Korean demand and cut freight costs, according to Wood Mackenzie Ltd.

Arctic LNG Shipments

"Given its LNG sources are very far from Asia, storage and re-loading will enable it to capture shorter-term arbitrage opportunities," said Nicholas Browne, an analyst with the energy consultant in Singapore. "Keeping gas in storage could ultimately reduce its costs in supplying Asian markets" because shipping is more expensive from the Arctic when ice cover increases.

The ability to meet spot LNG demand in China may grow in importance as the Asian nation ramps up efforts to use gas in place of coal to clean up polluted urban skies. The country's LNG deliveries may achieve 22 percent compounded annual growth from 2017 to 2020, according to Bloomberg Intelligence analyst Lu Wang.

Prompt LNG cargoes would also help offset disruptions of supply from other sources, such as pipelines. After shipments from Central Asia slipped during peak winter demand last year, LNG imports from Qatar jumped to the highest since 2014. China suffered a similar, though short-lived, Turkmenistan pipeline outage earlier this month.

Shorter Path

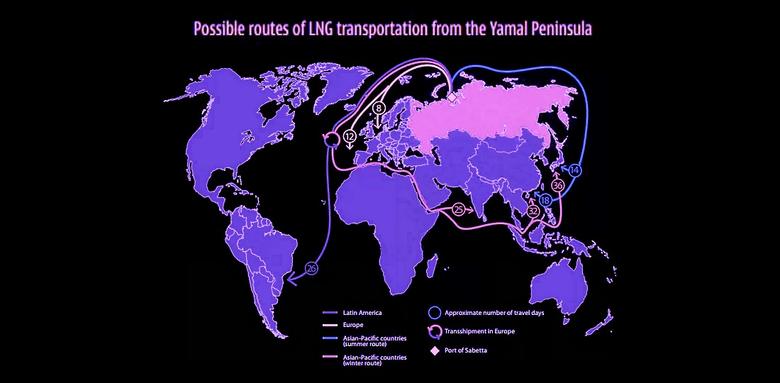

Novatek's agreement with Saibu shows it's prioritizing the Asia Pacific region as it optimizes its LNG portfolio, Rystad Energy analyst Xi Nan said in an email. It takes about 15 days to ship LNG from the company's Yamal project in the Arctic to Asian markets via the Northern Sea route compared to about 30 days by a southern path that travels through the Suez Canal, she said.

Novatek, which is Russia's largest producer of LNG, declined to comment.

The company plans to make the final investment decision on its Arctic LNG 2 venture, which could cost up to $25.5 billion, this year. It has an agreement to sell up to 15 percent of the project to Total SA, and Saudi Aramco has expressed interest in buying up to 30 percent in the plant, projected to have a capacity of about 20 million metric tons a year.

Novatek said in August it planned to complete a feasibility study by Oct. 1 for a 20 million ton per year trans-shipment terminal on the Kamchatka Peninsula that would allow special ice-class tankers carrying LNG from Arctic LNG 2 to transfer the fuel to more conventional vessels.

"The long-term success of Arctic LNG projects depends on routine, commercial navigation of the Northern Sea Route to reach key Asian markets," said James Taverner, a London-based analyst at the industry consultant IHS Markit Ltd. "A key strategy for Arctic LNG projects is access to reloading and storage facilities close to end-user markets. This allows supply to be quickly and flexibly delivered to Asian buyers."

-----

Earlier:

2019, January, 9, 11:00:00

GLOBAL LNG MARKET UPPLATTS - The global LNG shipping spot market is expected to remain strong in 2019 on the back of higher spot LNG demand and trading volume growth outpacing LNG vessel supply, according to analysts and ship brokers.

|

2019, January, 7, 09:35:00

RUSSIAN LNG: COMPETITIVE ADVANTAGEPE - A steadily growing fleet of liquefied natural gas (LNG) carriers purpose-designed to combat the ice floes of the Northern Sea route is giving the giant Yamal plant in the Arctic Circle a long-term competitive advantage, as the vessels deliver gas into Asia and Western Europe in conditions that were until recently considered too hostile.

|

2019, January, 4, 11:45:00

WORLD LNG INVESTMENT UPREUTERS - A final investment decision (FID) could be taken on more than 60 million tonnes per annum of LNG capacity this year, well above the previous record of about 45 million tonnes in 2005 and triple last year’s 21 million tonnes, Wood Mackenzie’s research director for global gas and LNG, Giles Farrer, said.

|

2018, December, 12, 08:45:00

U.S. LNG WILL UPU.S. EIA - EIA projects that U.S. liquefied natural gas (LNG) export capacity will reach 8.9 billion cubic feet per day (Bcf/d) by the end of 2019, making it the third largest in the world behind Australia and Qatar. Currently, U.S. LNG export capacity stands at 3.6 Bcf/d, and it is expected to end the year at 4.9 Bcf/d as two new liquefaction units (called trains) become operational.

|

2018, December, 10, 08:35:00

AUSTRALIA: THE BIGGEST LNGREUTERS - Australia overtook Qatar as the world’s largest exporter of liquefied natural gas (LNG) for the first time in November, data from Refinitiv Eikon showed on Monday.

|

2018, November, 30, 11:55:00

RUSSIAN LNG IS BETTERREUTERS - The United States has been pressing Europe to cut its reliance on cheap Russian gas and buy much more expensive U.S. LNG instead, which many European countries, including industrial heavyweight Germany, have so far resisted.

|

2018, November, 23, 12:10:00

START OF YAMAL LNG - 3NOVATEK - PAO NOVATEK (“NOVATEK” and/or the “Company) announced that its joint venture Yamal LNG has commenced initial production of LNG at the plant’s third LNG train. The total nameplate capacity of all three LNG trains is 16.5 mmtpa, or 5.5 mmtpa per LNG train. |