U.S. ENERGY OUTLOOK 2019

EIA - Annual Energy Outlook 2019 with projections to 2050

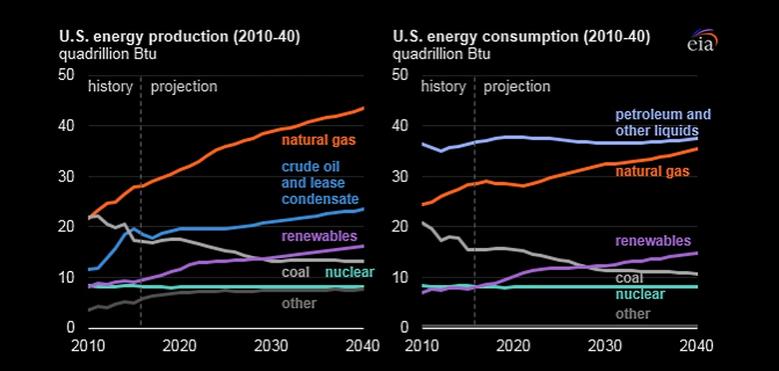

In the Reference case, U.S. crude oil production continues to set annual records through the mid-2020s and remains greater than 14.0 million barrels per day (b/d) through 2040. The continued development of tight oil and shale gas resources, particularly those in the East and Southwest regions, supports growth in NGPL production—which reaches 6.0 million b/d by 2030—and dry natural gas production. Dry natural gas production reaches 43.4 trillion cubic feet by 2050.

Growth in drilling in the Southwest region also drives natural gas production from tight oil formations in the Reference case. Because drilling activity in oil formations primarily depends on crude oil prices rather than natural gas prices, the increase in natural gas production from oil-directed drilling puts downward pressure on natural gas prices. Sustained low natural gas prices and declining costs of renewable power enable the shares of electricity generated by natural gas and renewables to increase. The natural gas share increases from 34% in 2018 to 39% in 2050, and the renewables share increases from 18% in 2018 to 31% in 2050.

Other significant findings in AEO2019 include:

The United States becomes a net energy exporter by 2020. In the Reference case, the United States becomes a net exporter of petroleum liquids in 2020 as U.S. crude oil production increases and domestic consumption of petroleum products decreases. The United States continues to be a net exporter of natural gas and coal (including coal coke) through 2050.

U.S. net exports of natural gas continue to grow as liquefied natural gas becomes an increasingly significant export. In the Reference case, U.S. liquefied natural gas (LNG) exports and pipeline exports to Canada and to Mexico increase until 2030 and then flatten through 2050 as relatively low, stable natural gas prices make U.S. natural gas competitive in North American and global markets.

Natural gas and renewable energy shares grow in U.S. electric generation. EIA's Reference case highlights the impact of sustained low natural gas prices and declining costs of renewables on the electricity generation fuel mix. The natural gas share maintains its lead and continues to grow, increasing from 34% in 2018 to 39% in 2050. The renewables share, including hydroelectric generation, also increases from 18% in 2018 to 31% in 2050, driven largely by growth in wind and solar generation. Renewables grow to become a larger share of U.S. electric generation than nuclear and coal in less than a decade.

Increasing energy efficiency across end-use sectors keeps U.S. energy consumption relatively flat, even as the U.S. economy continues to expand. Delivered U.S. energy consumption grows across all major end-use sectors, with electricity and natural gas consumption growing fastest.

More information is here.

-----

Earlier:

2019, January, 23, 11:20:00

U.S. PRODUCTION: OIL + 62 TBD, GAS + 849 MCFDU.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 62,000 b/d month-over-month in February from 8,117 to 8,179 thousand barrels/day , gas production to increase 849 million cubic feet/day from 76,708 to 77,557 million cubic feet/day .

|

2019, January, 23, 10:50:00

SMALL U.S. NUCLEAR FUELWNN - The mobile nuclear reactor is required to produce a threshold power of 1-10 MWe of generation, which it must be able to produce for at least three years without refuelling. It must weigh less than 40 tonnes and be sized for transportability by truck, ship, and C-17 aircraft. Designs must be "inherently safe", ensuring that a meltdown is "physically impossible" in various complete failure scenarios such as loss of power or cooling, and must use ambient air as their ultimate heat sink, as well as being capable of capable of passive cooling.

|

2019, January, 21, 11:35:00

FLAT US E&P CAPEXPLATTS - US onshore E&P capital investments in 2019 are likely to be flat to slightly down from last year, with international activity outside North America picking up slowly over the next several months, Schlumberger's top executive said.

|

2019, January, 21, 11:20:00

FASTEST RENEWABLE GROWINGU.S. EIA - EIA expects non-hydroelectric renewable energy resources such as solar and wind will be the fastest growing source of U.S. electricity generation for at least the next two years.

|

2018, December, 24, 12:00:00

U.S. PRIMARY ENERGY PRODUCTION 8.0 QUADRILLION BTUU.S. EIA - U.S. primary energy production totaled 8.0 quadrillion British thermal units (Btu), a 10% increase compared with September 2017.

|

2018, December, 24, 11:55:00

U.S. OIL CAPEX DOWNPLATTS - Three aggressive independent Permian Basin upstream operators released capital budgets for 2019 in the last few days that are lower than either prior expectations or actual 2018 spending by at least 12% to 15%, as corporate executives attributed reduced activity to the recent plunge in oil prices.

|

2018, December, 21, 14:25:00

U.S. OIL PRODUCTION 11.6 MBDAPI - The U.S. produced a record 11.6 million barrels of oil per day (mb/d) and a record 4.8 mb/d of NGLs in November. Crude exports also hit a record high at 2.4 million barrels per day last month, and U.S. petroleum net imports fell at their lowest monthly level in more than 50 years at 2.2 million barrels per day. |