VENEZUELA'S OIL PRODUCTION: BELOW 1 MBD

PLATTS - The US issued new Venezuela sanctions Tuesday ahead of President Nicolas Maduro's inauguration, but analysts said additional actions, which could impact crude flows, are still being considered as the South American country's oil output is forecast to dip below 1 million b/d later this year.

The sanctions, which the US Treasury Department announced Tuesday, target seven individuals and two dozen entities, including the television news network Globovision and its owner, Raul Gorrin.

The Trump administration has resisted sanctions targeting Venezuela's oil sector, both due to opposition from US refiners and the fact that the country's oil output has been in steady decline without sanctions. But Maduro's inauguration could trigger new sanctions, analysts said.

Maduro, who will be inaugurated for a second term Thursday following an internationally disputed election in May, said Monday that Venezuela plans to produce 2.5 million b/d in 2019, but analysts claim output will be a fraction of that.

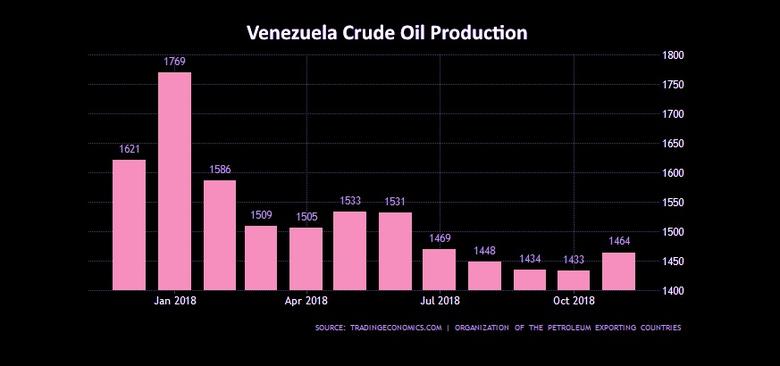

Venezuelan oil production averaged 1.17 million b/d in December, unchanged from November, but down 470,000 b/d from a year ago, according to the latest S&P Global Platts OPEC survey. Venezuelan production has fallen 1.23 million b/d over three years.

The US Energy Information Administration forecasts that Venezuelan oil production will fall below 1 million b/d in the second half of 2019, according to Erik Kreil, an international energy analysis team leader with the EIA.

EIA forecasts that Venezuelan oil production will drop to about 700,000 b/d in 2020, Kreil said.

Venezuelan oil production has been "surprisingly stable" since September after sequential declines of more than 150,000 b/d in each of the first three quarters of 2018, according to Paul Sheldon, chief geopolitical adviser with Platts Analytics.

"But it is difficult to foresee declines reversing, which would likely require political compromise and economic reforms," Sheldon said in a note.

Platts Analytics forecasts Venezuelan crude output to decline by 230,000 b/d from Q4 2018 to Q4 2019.

During a December 28 briefing, a senior State Department official said the US was considering "options" in response to Maduro's inauguration.

"We view [the inauguration] as an important date, and we view with great concern the situation in Venezuela," the official said.

The US has already sanctioned PDVSA, severely restricting its access to new debt financing, and could strengthen existing sanctions.

In August, Treasury prohibited US persons from providing financing or dealing in new debt with PDVSA if the debt has a term to maturity of greater than 90 days. But Treasury could shorten this 90-day period, an action which may effectively block commercial terms for crude oil trade, according to Kevin Book, a managing director with ClearView Energy Partners.

"Changing 90 days to 60 or 30 would require faster settlement, imposing new cash burdens, which could deter US purchases of crude," Book said. "PDVSA could be hard-pressed to cope with 30-day or 60-day terms on diluent and light crude, as well."

The US is also considering listing Venezuela as a state sponsor of terrorism, a designation which could result in a de facto ban of US imports of Venezuelan crude oil.

According to the EIA, the US imported nearly 505,900 b/d of Venezuelan crude in October, down from about 650,500 b/d in September, but above the February average 409,500 b/d, the lowest point since EIA began tracking these imports.

-----

Earlier:

2019, January, 7, 09:40:00

VENEZUELA'S OIL EXPORTS DOWN AGAINBLOOMBERG - Home to the world’s biggest crude reserves, Venezuela exported 1.245 million barrels a day last year, the lowest since 1990, as production tumbles amid an economic and humanitarian crisis. Financial sanctions imposed by the U.S. have further tightened the screws on Venezuela’s ailing economy, while creditors have sought seize its assets including oil cargoes and its prized Citgo refineries in the U.S. |

2018, December, 12, 08:40:00

VENEZUELA - RUSSIA OIL: $17 BLNPLATTS - Russia will invest $5 billion to raise Venezuela's oil production by 1 million b/d under a new economic agreement, Venezuelan President Nicolas Maduro said Thursday.

|

2018, December, 7, 07:50:00

RUSSIA'S INVESTMENT TO VENEZUELA: $5 BLNREUTERS - Venezuela has signed deals securing investment from Russia in the South American country’s oil and gold sectors, President Nicolas Maduro said on Thursday at the end of a three-day trip to Moscow.

|

2018, November, 26, 13:25:00

VENEZUELA'S OIL DOWN TO 1.17 MBDREUTERS - The country’s oil production has fallen to just 1.17 million barrels-per-day, a 37 percent drop in the last year, according to reports from secondary sources to OPEC, leaving itstruggling to ship Russian entities the roughly 380,000 bpd it has agreed to send, according to PDVSA

|

2018, November, 23, 12:05:00

VENEZUELA'S ECONOMY DOWN 17%REUTERS - Preliminary data compiled by Venezuela’s central bank shows the economy shrank by 16.6 percent in 2017 compared with the year before, two sources familiar with the matter said on Thursday, the country’s sharpest decline on record.

|

2018, September, 17, 15:00:00

VENEZUELA - CHINA COOPERATIONREUTERS - Venezuela gave China another stake in the OPEC nation’s oil industry and signed several other deals in the energy sector, but Beijing made no mention of new funds for Caracas during President Nicolas Maduro’s visit to his key financier on Friday.

|

2018, September, 13, 14:10:00

U.S. SANCTIONS AGAINST THE WORLDCNBC - "We can see that the pricing situation today depends not just on the supply/demand balance or the general economic situation but also on the uncertainty that we observe today in the global markets: the trade wars, the sanctions that the U.S. pursue," Novak said, speaking to CNBC's Geoff Cutmore at the Eastern Economic Forum (EEF) in Vladivostok, Russia. |