GECF: GLOBAL RECESSION

GECF - 13 October 2019 - Global Economic Outlook: Is Recession Around the Corner?

Dr. Alexander Apokin - Energy Economics Analyst - EEFD

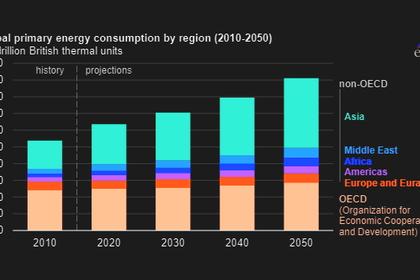

The global economy has started to slow down in 2019, reflecting an impact from USChina trade tensions, as well as the economic cycle in the US. The proper countercyclical policy response so far remains in the prospects, and growth uncertainties in major economies are tilted to the downside. All in all, chances are high for a period of a broad-based slowdown of global GDP. While energy markets are among the first to be affected, the "shale revolution" has eased the adjustment of oil and gas markets to the demand shocks.

The ongoing momentum in the global trade is prone to U.S. – China tension and the impact from recent tariff hikes dents the global value chains. According to the WTO, global trade turnover is bound to increase by just 1.2% in 2019, which is the slowest since 2009, and 2.7% in 2020, while the IMF projects trade growth to 2025 remains sluggish. This trade deceleration is broad-based both geographically and in terms of the markets, but is likely driven by Asian import weakness, as the fallout from Chinese deceleration spreads across the region. While it is too early to assess if the present trade tensions will do any long-term damage to global economic prospects, there a solid medium-term impact is certainly expected. In 2020-2025 we assume that the trade tensions and policy decisions will lead to cyclical deceleration of the global economy to 3.0-3.2% band, and financial shocks accompanying growth deceleration are highly likely.

Compared to 10 years ago during the Great Recession, financial shocks will have much bigger leverage today, as there are larger accumulated non-financial debt burdens. The total non-financial sector debt to GDP ratio of G20 countries increased from 79.9% GDP in 2008 to 93% GDP in 2018, as emerging economies ramped up their debt from 58.1% GDP to 98.2% GDP in a structural transformation. Most of it was corporate leverage, which has largely been originated by Chinese companies. As of now, total debt-to-GDP ratio of China at 259% GDP is almost the same as that of the US at 249% GDP, and as Chinese economy is braking, it keeps growing despite more restrictive financial regulation.

There is already a growing concern among policymakers as to which way is the best to address cyclical slowdowns in the aftermath of quantitative easing policy, in the global economy that has grown accustomed to the low-rate environment.

There is less government fiscal space available to stimulate the economy, with government debt levels now being on average 20% GDP higher than ten years ago, and many countries still struggling with the aftermath of debt crises (Italy and Spain), or entering the new crises already (such as Argentina). Several governments that have the fiscal space available are clearly reluctant to use it out of institutional (Germany and India) or geopolitical (Russia) reasons.

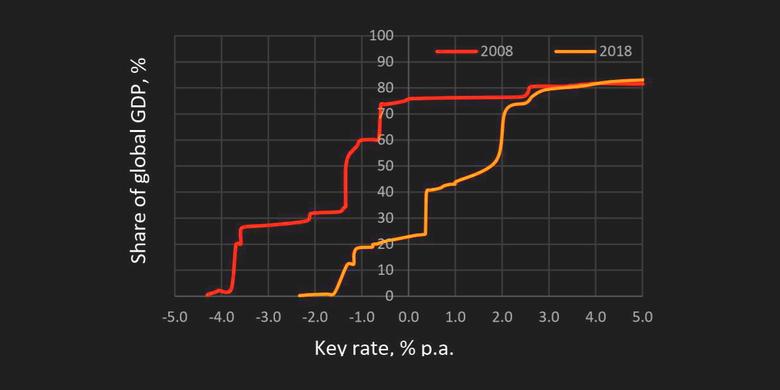

This places the responsibility to react to macroeconomic shocks squarely on the shoulders of central banks. However, is there an ample monetary policy space? In the economies producing more than 40% of the global GDP, the real rate is already below 0.5%, and out of that for the economies producing more than 25% global GDP (including euro area economies, Japan and the UK) the real rate remains negative.

Inasmuch possible, the central bankers are already managing the risks. The ECB went further into negative rate territory as well as relaunched asset purchase program from November at 20 bn EUR per month pace. Japan is continuing with its QE program, and the Fed is reducing the rates again.

Many emerging country central banks follow suit, including China that has already unleashed monetary stimulus earlier this year. However, those actions aim mainly to mitigate systemic bank risks and deal with the increased global uncertainty in financial markets rather than prevent an economic slowdown. Without sound fiscal policy support, monetary easing on this scale is unlikely to prop up growth.

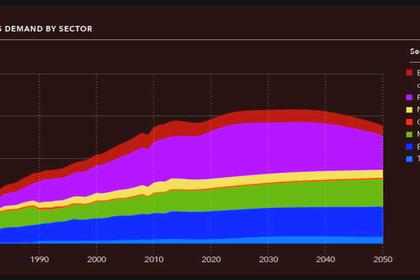

Global energy markets: more resilience built after 10 years?

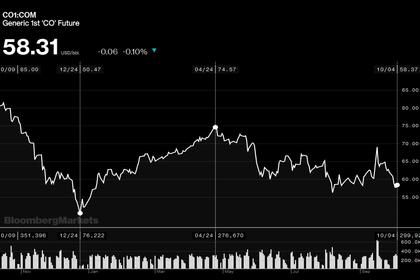

The slowdown of the global economy strongly affected energy markets in the past, as inelastic oil and gas supply and low storage capacity was combined with demand drops to create significant price swings. In 2008, WTI oil price plunged from a peak of almost $150/bbl to less than $30/bbl, the strongest decline ever. Can this scenario repeat today? Some influence is very apparent: the demand worries that made the recent energy price spikes short-lived despite unabated geopolitical tension. So, as the market signal goes, the risks of demand slowdown at the moment outweigh supply disruption risks.

However, for the last five years oil and natural gas prices have proven resilient to the shocks from economic activity. That is the one side effect of the "shale revolution" that became apparent as more flexible production from tight oil and gas shale deposits has increased price elasticity of supply. The tight oil and gas investment in North American shale that provides for larger part of this supply, is more price-sensitive, as it is done by quite a number of private oil producers. Furthermore, this flexibility is stronger for downside rather than upside adjustments, as sharp decline in supply from tight oil and gas deposits occurs naturally while the time and additional investment are required for completion of new wells.

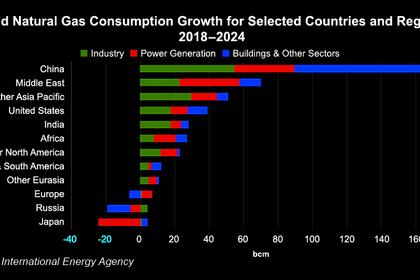

The size of those cushions provided by tight oil and gas is sufficient to offset most medium-term demand shocks. Concerning oil, flexible unconventional (mostly tight oil) production makes for 5-6% of global supply now, as compared to virtually zero in 2008. For the natural gas market, the relationship between economic activity and market balance is even more complicated. Firstly, the share of unconventional gas relates as 15% today vs less than 2% in 2008, and secondly, natural gas markets are more influenced by the interfuel competition as compared to oil. Thus, despite stronger seasonal price swings in the gas market, over time as the timely volume adjustment to oil and gas demand shocks becomes more feasible, we are less likely to see fast and dramatic changes in the prices.

-----

Earlier: