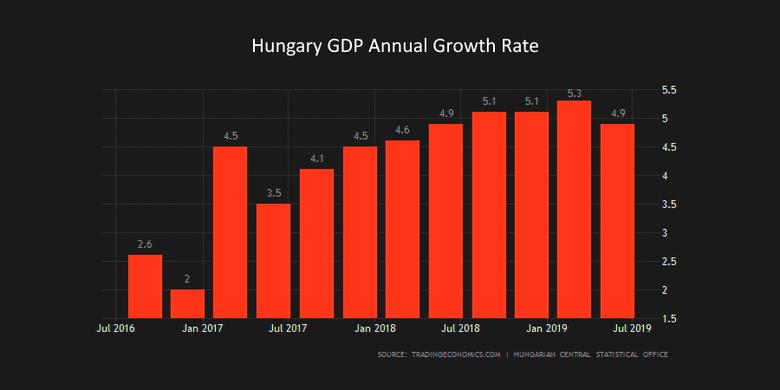

HUNGARY'S GROWTH ABOVE 4%

IMF - October 15, 2019 - In an increasingly difficult global economic environment, Hungary's growth has continued to exceed expectations, registering one of the highest rates in Europe in 2018. The speed of income convergence to advanced economy levels has been impressive. The economy is now running above capacity, wages are growing rapidly, and unemployment is declining to historically low levels. It is thus likely that growth will slow but coordinated structural reforms aimed at improving competitiveness can help sustain the growth momentum. At the same time, it will be important to achieve the government's medium-term fiscal targets so as to rebuild room for fiscal maneuver that can be used in future downturns. Given global headwinds to activity, the accommodative monetary stance is appropriate, but policymakers should be ready to respond to building inflationary pressure.

Outlook and risks

The economy is expected to finish 2019 on a strong footing, growing well above 4 percent. Over the medium-term, the fiscal position is expected to improve, public and external debts would decline further, and domestic credit growth is envisaged to remain buoyant. However, short-term prospects are clouded by wavering global growth, trade tensions, and Brexit. Furthermore, with a positive output gap, Hungary's growth is very likely to decelerate unless structural reform efforts are redoubled to improve productivity and boost potential output.

Need to bolster potential growth and competitiveness

The government's "Program for a More Competitive Hungary" and the Central Bank's extensive agenda to improve competitiveness, especially of small and medium-size enterprises (SMEs), rightly seek to boost potential output. What is needed now is timely implementation of prioritized reform measures that focuses on reducing the identified impediments to doing business. In particular, it is important to further simplify and shorten processes required to obtain building permits and business licenses and continue to speed up the connection to utilities. Additional efforts to enhance governance and public procurement practices would also be necessary.

Supporting the growth and development of SMEs will also require simplifying and streamlining regulations as well as changing them less frequently. The commendable effort to increase participation in the labor market, especially for women, should be complemented with the above reforms, and with improving the efficiency and quality of education, vocational training, and public services. The timely downsizing of the public works schemes, with a view of releasing workers to the very tight primary labor market, is also encouraging and should continue.

Fiscal policy targets are appropriate but specific measures are needed to secure them

The government's target of steady fiscal consolidation to eventually eliminate the deficit over the medium term would help reduce domestic demand pressures and create fiscal space that can be used during future downturns. Such consolidation would reverse the procyclical fiscal stance of the past few years and allow monetary policy to remain accommodative for a longer period, helping preserve Hungary's competitiveness. The authorities' medium-term targets are based on further improving tax collection and moderating investment, which has reached historically high levels. In the absence of specific measures, staff's baseline scenario implies somewhat higher deficits.

Staff therefore recommends a mix of growth-friendly revenue and expenditure measures to help achieve the authorities' fiscal targets. In particular, revenue can be enhanced through reducing exemptions and preferential regimes, as well as broadening the tax base while continuing to phase out sectoral taxes. Streamlining expenditure can be achieved through reducing spending on goods and services, which is above the peers' average, and the public wage bill, building on the progress made at the central government administrative level. A small reduction in the public wage bill should focus on rationalizing public employment based on a diagnostic analysis that identifies possible inefficiencies. This should go hand-in-hand with increasing digitalization and improving processes. Such a reduction would release much-needed labor to the private sector while allowing for a protection of the competitiveness of the salaries of the remaining public sector employees. Public transport and energy subsidies could also be rationalized. Should these measures produce more savings than what is needed to reach the targeted fiscal balance, they can be used to finance infrastructural investment in the medium term to compensate for the eventual decline in EU funds. It is also important to implement the government's plan to enhance the monitoring of state-owned enterprises to improve efficiency and reduce the risk of contingent liabilities.

While reducing currency risks is a prudent objective of the debt management strategy, there is also merit in avoiding a large increase in domestic interest payments and in considering a lengthening of maturities.

Monetary policy navigating challenges

Given the recent moderation of inflation, uncertain global growth conditions, and the resumption of monetary easing by the ECB, it is appropriate for the monetary stance to remain accommodative. Attention should be given to any emerging price pressures, including from second-round effects of the recent oil shock. In addition, clear and timely communication will remain essential for effective forward guidance. Close monitoring of the unconventional arrangements is warranted to continually assessed their success in achieving their objectives, while reducing the risk of market distortions

The Hungarian real estate market is booming, particularly in Budapest. Macroprudential policies are helping to preserve financial stability and limiting the risk of a credit-fueled housing boom. However, the share of purchases financed by private savings is high and household debt is relatively low. Therefore, moderating the price increase would also be helped by reviewing the various fiscal incentives for house purchases, basing them on means-testing and targeting, reducing impediments to doing business in the construction sector, improving the transportation network and commuting options, and proactively facilitating an increase in housing supply over time via effective urban planning.

The banking system is strong, but efficiency should be buttressed

The banking system is, on average, well capitalized, profitable, and liquid. The loan quality of banks has continued to further improve. Macroprudential policies are in place to contain excessive risk-taking. Consolidation of the banking system should continue to be market-based. In addition to digitalization, optimization of the branch network, and financial deepening to improve cost efficiency, and predictable contract enforcement will also help lower the relatively high bank intermediation costs.

A staff team led by Khaled Sakr visited Budapest during September 24 - October 3, 2019. The mission met with Ministry of Finance State Secretaries Banai, Gion, and Rákossy, Magyar Nemzeti Bank Deputy Governors Nagy and Patai, other senior officials, and representatives of the private sector and employers' associations. Staff is grateful to the authorities and other interlocutors for their excellent collaboration, kind hospitality, and candid discussions.

-----