LNG MARKET TIGHTENING: SHELL

PE - Global LNG is "clearly a well-supplied market", but Shell believes that the market dynamics could shift again over the next few years. "We do not use the term oversupply—as all of the LNG being produced is being absorbed," a spokesman for the firm tells Petroleum Economist.

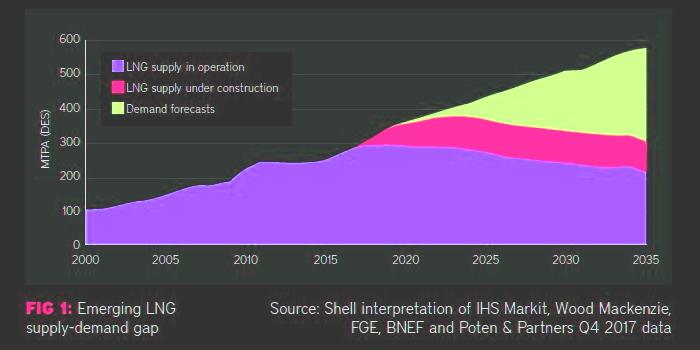

But Shell's supply-demand analysis suggest that the LNG market is "more than three-quarters through the rapid supply growth" coming from liquefaction projects that were sanctioned between 2011 and 2015. "After this we expect to see little new supply coming in and inevitable tightening of the market."

Shell analysts see a similar difference between the short and medium-term outlooks for demand. During 2017 and 2018 Asian LNG demand grew faster than overall LNG supply, resulting in a reduction in LNG deliveries to Europe. This year, despite continued demand growth in China, Shell is "seeing LNG supply grow much faster than Asian demand, and therefore an increase in LNG deliveries to Europe". These LNG volumes are being accommodated by reduced pipeline gas deliveries to Europe, fuller storage and increased coal to gas switching in the power sector.

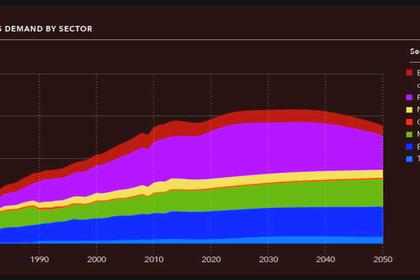

But, longer-term, "due to the role of gas in transitioning to a lower carbon energy system and improving air quality, particularly for fast growing Asian economies, we expect to see continued strong growth in LNG demand for some time," says the spokesman.

Shell sees the LNG market's move towards commoditisation as having a number of positive implications—it can result in volume growth that benefits all participants, while increased liquidity can create more open markets and reduce the cost of trading and delivering LNG, according to the Anglo-Dutch major. But the spokesman cautions that "there are several factors unique to LNG that may impact complete commoditisation".

Shell is the world's largest LNG portfolio player, and it contends that "the model we deploy is playing a big role in the development of a more flexible and inclusive global LNG market that provides natural gas to a broader number of people at an affordable cost". The model "is based on integration along the LNG value chain, which is not only a competitive advantage but also makes us more resilient and reliable, as we are able to optimise the portfolio while addressing our customer's changing needs".

Shell's scale and portfolio "enables [it] to bridge the gap between and buyers and suppliers needs, which is good for growth of the industry". The needs and profile of buyers are "changing and with growing competition in downstream gas markets, buyers are looking at shorter, smaller and more flexible contracts with varying structures that enable them to be competitive in their own downstream markets".

"All of this is not closely aligned with what the producers need to secure financing," says the Shell spokesman. "Hence, it is becoming increasingly difficult to get projects over the line. We can step in here, and without necessarily taking equity interest—enable projects to proceed by agreeing substantial long-term offtake contracts, or we can also raise debt finance on our balance sheets and take FID without long-term offtake contracts."

-----

Earlier: