NIGERIA WANTS $62 BLN

BLOOMBERG - Nigeria is seeking to recover as much as $62 billion from international oil companies, using a 2018 Supreme Court ruling the state says enables it to increase its share of income from production-sharing contracts.

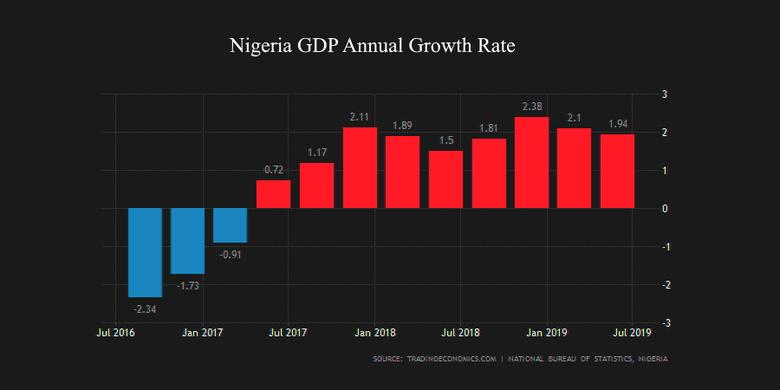

The proposal comes as President Muhammadu Buhari tries to bolster revenue after a drop in the output and price of oil, Nigeria's main export. It's previously targeted foreign companies, fining mobile operator MTN Group Ltd. almost $1 billion for failing to disconnect undocumented SIM-card users, and suing firms including JPMorgan Chase & Co. in a corruption scandal.

In the latest plan, the government says energy companies failed to comply with a 1993 contract-law requirement that the state receive a greater share of revenue when the oil price exceeds $20 per barrel, according to a document prepared by the attorney-general's office and the Justice Ministry. The document, seen by Bloomberg, was verified by the ministry.

While the government hasn't said how it will recover the money, it has said it wants to negotiate with the companies. In its battle with MTN, the fine imposed on the company was negotiated down from an initial penalty of $5.2 billion.

Nigerian presidency spokesman Garba Shehu didn't answer three phone calls or respond to a text message requesting comment.

Under the production-sharing contract law, companies including Royal Dutch Shell Plc, ExxonMobil Corp., Chevron Corp., Total SA and Eni SpA agreed to fund the exploration and production of deep-offshore oil fields on the basis that they would share profit with the government after recovering their costs.

When the law came into effect 26 years ago, crude was selling for $9.50 per barrel. The oil companies currently take 80% of the profit from these deep-offshore fields, while the government receives 20%, according to the document. Oil traded at $58.29 a barrel on the London-based ICE Futures Europe Exchange.

Most of Nigeria's crude is pumped by the five oil companies, which operate joint ventures and partnerships with the state-owned Nigerian National Petroleum Corp.

Representatives of the oil companies met Justice Minister Abubakar Malami Oct. 3 in the capital, Abuja, according to two people familiar with the discussions who asked not to be identified because the meeting wasn't public. Malami told them that while no hostility is intended toward investors, the government will ensure all the country's laws are respected, the people said.

Ruling Challenged

Oil companies including Shell have gone to the Federal High Court to challenge the government's claim that they owe the state any money, arguing that the Supreme Court ruling doesn't allow the government to collect arrears. They also contend that because the companies weren't party to the 2018 case, they shouldn't be subject to the ruling.

"We do not agree with the legal basis for the claim that we owe outstanding revenues," Shell's Nigerian unit said in an emailed response to questions.

Chevron spokesman Ray Fohr said the company doesn't comment on matters before the court. Its units in Nigeria "comply with all applicable laws and regulations," he said by email.

Exxon and Total declined to comment, while Eni officials didn't immediately respond to requests for comment.

The Supreme Court ruling followed a lawsuit by states in Nigeria's oil-producing region seeking interpretation of the nation's production-sharing law. The states argued that they weren't receiving their full due. The court ruled in their favor and asked the attorney general and justice minister to take steps to recover the outstanding revenue.

The 1993 law required that its provisions be reviewed after 15 years and subsequently every five years. The attorney-general's office insists that the provision for a higher share of revenue doesn't require legislative action to take effect, according to the document.

"Instead it imposes a duty on the oil companies and contracting parties, being NNPC, to by themselves review the sharing formula," the ministry said.

-----

Earlier:

2019, September, 2, 12:35:00

DANGEROUS NIGERIA'S OIL

Nigeria lost about 22 million barrels of its crude oil production to theft in the first half of this year, Nigerian National Petroleum Corp. said

|

2019, August, 26, 15:25:00

NIGERIA'S OIL PRODUCTION UP TO 2.2 MBD

Nigeria's oil production hovered around 2.2 million b/d in the first week of August, compared with around 1.92 million b/d a year ago.

|

2019, April, 5, 09:50:00

EXXON SALES NIGERIA FOR $3 BLN

Exxon Mobil recently held talks on the sale of a suite of oil and gas fields in Nigeria as the company focuses on new developments in U.S. shale and Guyana, industry and banking sources told Reuters.

|