РУССКИЙ ГАЗ ДЛЯ ЕВРОПЫ: 37%

МИНЭНЕРГО РОССИИ - 2 октября. - Министр энергетики Российской Федерации Александр Новак принял участие в работе панельной сессии «К лидерству в мировом энергобалансе: приоритетные задачи газовой отрасли», прошедшей в рамках «Российской энергетической недели».

По словам Александра Новака, доля газа в мировом энергетическом балансе продолжит расти, при этом потребление газа в сжиженном состоянии будет увеличиваться наиболее высокими темпами.

«Есть несколько причин этому - от доступности газа до его высокой экологичности и мобильности», - отметил Министр.

Он подчеркнул, что Россия продолжит оставаться крупнейшим поставщиком трубопроводного газа в мире и будет наращивать долю рынка сжиженного газа.

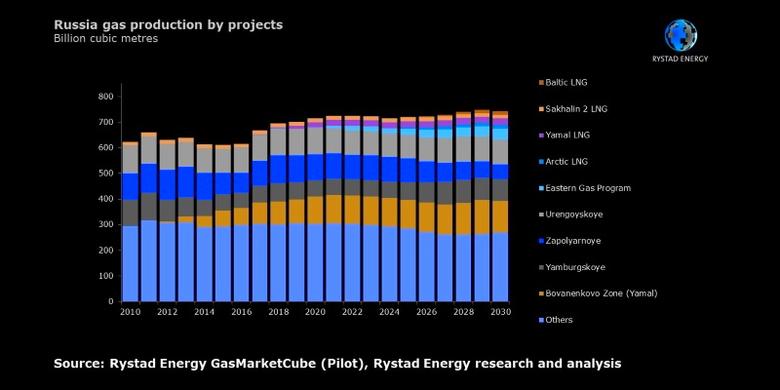

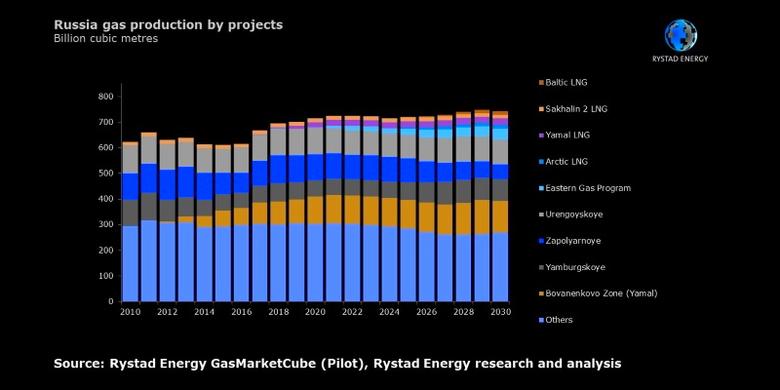

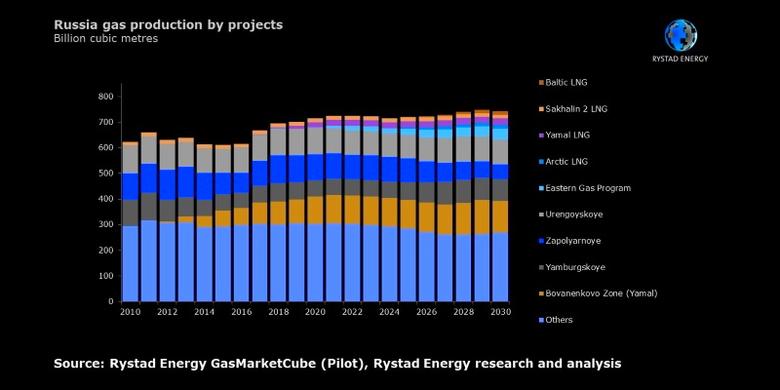

«Сейчас реализуется ряд СПГ-проектов, одновременно мы достраиваем крупнейшие инфраструктурные проекты, такие как «Сила Сибири», «Турецкий поток», "Северный поток-2", последний из которых стоит порядка 10 млрд евро. Этот проект на многие десятилетия станет основой для стабильных поставок газа в Европе, где собственная добыча падает. Мы видим востребованность российского газа в Европе. В экспорте газа в Европу мы занимаем уже 37%. Кроме того, за последние 10 лет мы значительно увеличили добычу газа - на 100 млрд, в этом году ожидаем добычу 740 млрд куб м газа», - отметил Александр Новак.

Несмотря на сохраняющееся давление на российский ТЭК со стороны отдельных стран, в частности, США, глава Минэнерго России выразил уверенность, что отечественные проекты найдут своего потребителя и «сохранят свою высокую конкуренцию по сравнению с «молекулами свободы» из США».

-----

РУССКИЙ ГАЗ ДЛЯ ЕВРОПЫ: 37%

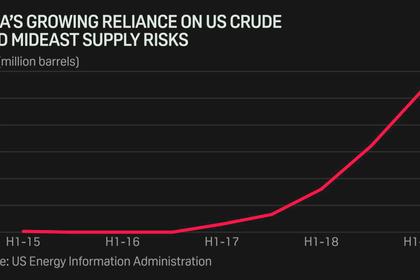

U.S. EIA - In the first half of 2019, U.S. exports of crude oil increased to average 2.9 million barrels per day (b/d), an increase of 966,000 b/d from the first half of 2018. Also in the first half of 2019, U.S. crude oil exports set a new record-high monthly average of 3.2 million b/d in June 2019 (Figure 1). The number of U.S. crude oil export destinations also continued to grow, and now exceeds the number of U.S. crude oil import sources.

Asia was the largest regional destination for U.S. crude oil exports—1.3 million b/d in the first half of 2019—followed by destinations in Western Europe, which received 824,000 b/d. U.S. crude oil exports to North America, which almost exclusively go to Canada (the largest single destination for U.S. crude oil exports globally) did not change much from the first half of 2018 to the first half of 2019, averaging 458,000 b/d.

U.S. crude oil exports to Asia grew significantly in the first half of 2019, up 472,000 b/d (58%) compared with the same period in 2018, despite a large decrease in exports to China. U.S. crude oil exports to China in the first half of 2019 averaged 248,000 b/d (64%) less than the same period last year. This decrease largely reflects continuing trends from the second half of 2018 when U.S. crude oil exports to China decreased significantly.

Increased U.S. crude oil exports to other destinations in Asia offset the drop in volumes to China. U.S. crude oil exports to South Korea increased 278,000 b/d (246%), exports to India increased 154,000 b/d (114%), and exports to Taiwan increased 109,000 b/d (133%) in the first half of 2019 compared with the first half of 2018.

U.S. crude oil exports to Western Europe also increased 327,000 b/d (66%) during this time. First-half 2019 exports to the Netherlands increased 173,000 b/d (192%) and exports to the United Kingdom increased 74,000 b/d (53%) compared with first half 2018 (Figure 2).

As U.S. crude oil export volumes have increased, so have the number of export destinations. During first half of 2019, the number of U.S. crude oil export destinations surpassed the number of U.S. crude oil import sources. In 2009, the United States imported crude oil from an average of 35 sources each month. A decade later, in the first half of 2019, the average number of sources fell to 26. After the restrictions on exporting domestic crude oil were lifted at the end of 2015, the number of U.S. crude oil export destinations has increased to more than 30 as of the end of the first half of 2019 (Figure 3). Between January 2016 (the first full month of unrestricted U.S. crude oil exports) and June 2019, U.S. crude oil production has increased by 2.9 million b/d. During that same period, U.S. crude oil exports increased 2.7 million b/d, the equivalent of 98% of the absolute crude oil production increase.

Increasing U.S. crude oil production has both reduced crude oil imports and increased crude oil exports, but the reasons for changes in each are complex.

Fewer crude oil import sources is the result of increased U.S. production of light-sweet crude oils whereas most U.S. refineries are configured to process medium- to heavy- sour crude oils. The U.S. Energy Information Administration's (EIA) report Technical Options for Processing Additional Light Tight Oil Volumes Within the United States, explains how U.S. refineries have accommodated much of the growth in U.S. crude oil production since 2010 with two limited- or no-investment-cost options: displacing imports of crude oil (primarily light crude oil, but also medium crude oil) from countries other than Canada and increasing refinery utilization rates. Displacing light crude oil imports has both reduced the volume of crude oil the United States imports and the number of sources.

The increase in the number of U.S. crude oil export destinations is the result of

- Growing demand from refineries abroad for light-sweet crude oil

- Interconnected infrastructure to export greater volumes of U.S. crude oil

- Developing infrastructure to enable larger cargo sizes

National and international regulations increasingly limit the amount of sulfur present in transportation fuels. As global demand for heavy residual oils declines, many less complex refineries outside the United States, which can't process and remove sulfur from heavy-sour crude oils, are processing more of the lighter and sweeter crude oils. To supply this increasing demand, U.S. port infrastructure along the U.S. Gulf Coast is expanding to accommodate increased crude oil tanker traffic and larger crude oil tankers loading for export. In addition, new and expanded pipelines are being built to transport crude oil from areas such as the Permian and Eagle Ford to the U.S. Gulf Coast.

-----

Earlier:

2019, October, 2, 12:05:00

U.S. RUSSIA, CHINA SANCTIONS

Treasury imposed sanctions on Moscow-based Maritime Assistance LLC, which it called a front company for Russian shipping company, Sovfracht, which has been subject to US sanctions since September 2016 for operating in Crimea. Russia annexed Crimea from Ukraine in March 2014, a move which is not recognized by most of the international community.

2019, October, 2, 11:50:00

U.S. OIL, GAS FOR INDIA

India's annual trade surplus with the US has averaged about $20 billion in the past four years. The US this year has withdrawn preferential treatment on some Indian exports to the US, stepping up the pressure on New Delhi, while arguing that India has not provided equitable and reasonable access to its markets.

2019, October, 2, 11:20:00

YAMAL LNG CAPACITIES

The Yamal LNG project has all the necessary capacities to ensure supplies of LNG produced to customers in accordance with contractual obligations within the agreed timelines.

2019, September, 20, 15:35:00

ТУРЕЦКИЙ ПОТОК ДЛЯ БОЛГАРИИ

Строительство "Турецкого потока" начинается, во время честной и открытой процедуры государственная компания из Саудовской Аравии стала исполнителем проекта. Пока некоторые нас спрашивали об отношениях с соседями, с Россией, с Саудовской Аравией, сегодня был подписан договор. 90% труб для "Турецкого потока" уже доставлено в Болгарию из России, и уже завтра мы начнем развозить их по трассе, финансирование обеспечено, 308 км газопровода будет построено до конца января 2020 года

All Publications »

Tags:

РОССИЯ,

ГАЗ,

ЕВРОПА,

СПГ