SAUDI ARAMCO IPO: $100 BLN

MEOG - Saudi Aramco, the world's most profitable company and biggest oil producer, is set to go public sometime in 2020 or 2021 in what is billed as the world's largest initial public offering. Despite delays and devastating attacks on two of its key oil sites on September 14, the IPO remains the centerpiece of Saudi Arabia's economic transformation and could raise some $100bn to help usher in a new economy less dependent on oil.

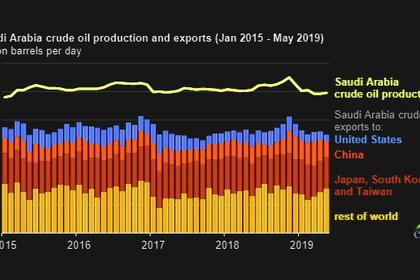

With an oil production capacity of about 12mn b/d and posting a profit of $46.9bn in the first half of 2019, Aramco is betting institutional investors will rush to buy the 5% stake set to be sold by the Saudi government.

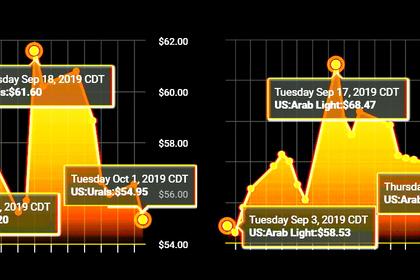

Postponed last year for Aramco to absorb petrochemical group SABIC, the timing of the giant IPO remains unclear and hinges on market conditions, the oil price, and return to full production after the attacks, analysts believe. Aramco has vowed to restore its 12mn b/d of production capacity by the end of November but, at the time of writing, market watchers were mixed on whether the IPO will be pushed back again to let the dust settle on the Abqaiq and Khurais plant attacks.

"2020 is possible, but because of the projected size of this IPO the banks would need advance notice that it is coming down the pipeline so they can set aside resources," said Ellen Wald, president of Transversal Consulting and author of "Saudi, Inc." a history of the Saudi oil industry. "Of course, the price of oil and the general strength of the equities market also play into timing," she said.

More recently, signs are that Riyadh is moving move aggressively to bring the IPO to fruition.

Aramco's chairman and energy minister, Khalid al-Falih, was removed from his two posts in September. Yasir al-Rumayyan, the head of Saudi Arabia's $320bn sovereign wealth fund, was appointed Aramco chairman, while Prince Abdulaziz bin Salman, the king's son and an oil veteran with over 30 years' experience in the industry, was named energy minister. With Rumayyan dropped into Aramco's board in 2016 when the IPO was announced and the wealth fund tasked with investing the expected bounty from the listing, most observers see the separation of duties as designed to accelerate progress on the Aramco IPO.

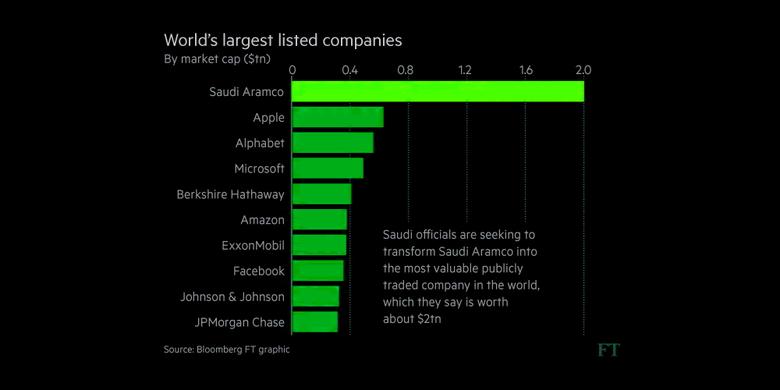

Crown Prince Mohammed bin Salman has valued Aramco at up to $2trn, making the IPO value around $100bn. But most analysts see a valuation of up to $1.5trn as more realistic and are keen for more information to assess its market value. "Greater disclosure will always help," Bernstein Research senior analyst Neil Beveridge said. "A clear and stable dividend policy will be important to attract investors."

Key buyers are expected to be sovereign wealth funds and institutional investors both of which need to meet public or internal disclosure demands.

Regional model

Proceeds of Aramco's IPO will be injected back into the economy, particularly the country's sovereign wealth fund, to help spur non-oil growth as part of the Vision 2030, which seeks to wean the kingdom off oil income. The kingdom is seeking both a domestic and international listing but the jury is still out on whether it will secure a coveted listing in London or New York.

For that reason, Aramco's IPO is being closely watched by other NOCs as the region's first national oil company to open itself to greater market scrutiny. While the UAE's Abu Dhabi National Oil Company was the first NOC to list a unit in 2017, the company's CEO Sultan al-Jaber has ruled out an IPO for the parent company. ADNOC Distribution was listed on the Abu Dhabi Securities Exchange and ADNOC has indicated it may list more units in the future.

"There is going to be huge interest in an Aramco IPO even if it is only because of the size and the novelty," said Wald. Indeed, in addition to the integration of SABIC's major petrochemical reach, Aramco is looking to grow its downstream and trading operations at a breakneck pace.

Market grooming

Aramco has already taken a series of steps to groom itself for the IPO. In March, it published earnings figures for the first time. The figures showed it to be the world's most profitable company, with a net income of $111bn in 2018, eclipsing giants such as Google, ExxonMobil, and Amazon. It issued a bond prospectus in April this year for its debut $12bn international bond sale, including nuggets of data about its various operations from refineries to pipelines.

This year, Aramco also published the first independent audit of its huge oil and gas reserves. The audit showed Aramco's proved oil reserves at the end of 2017 were 263.1bn barrels, or 2.2bn barrels higher than previous estimates. Gas reserves stood at 319.5trn standard cubic feet, up from 302.3trn standard cubic feet in previous estimates.

But the biggest revelation was in August, when the company held its first ever earnings call with analysts and published its first-half earnings, which showed an 11.5% drop in net profit from the year-ago period to $46.9bn. Despite the fall, Aramco held on to its rank as the world's most profitable company.

Aramco may still need to do more in terms of disclosure to justify a $2trn valuation, but its giant near-term earnings potential, deep asset base and the integration of SABIC could be enough to win over most skeptics.

-----

Earlier: