2019-10-04 10:00:00

U.S. COAL PRODUCTION DOWN 2.4%

U.S. EIA - Annual Coal Report

The Annual Coal Report (ACR) provides annual data on U.S. coal production, number of mines, productive capacity, recoverable reserves, employment, productivity, consumption, stocks, and prices. All data for 2018 and previous years are final.

Highlights for 2018

- U.S. coal production decreased 2.4% year over year to 756.2 million short tons (MMst).

- The total productive capacity of U.S. coal mines was 1,020.5 MMst, a decrease of 3.6% from the 2017 level.

- The average number of employees at U.S. coal mines increased by 532 from the 2017 level to 53,583 employees.

- U.S. coal mining productivity, as measured by average production per employee hour, decreased 4.8% from the 2017 level to 6.23 short tons per employee hour.

- U.S. coal consumption decreased 4.0% from the 2017 level to 688.1 MMst. The electric power sector accounted for about 92.6% of the total U.S. coal consumed in 2018.

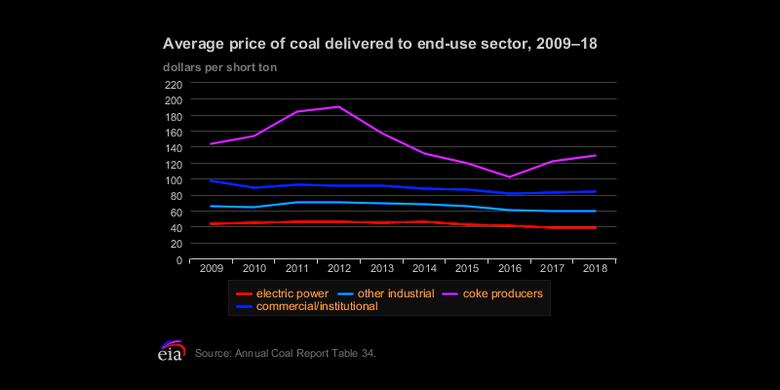

- The average sales price of bituminous coal was $59.43 per short ton, a 6.9% increase from the 2017 level. The average sales price of subbituminous coal was $13.64 per short ton, a 4.5% decrease from the 2017 level. The average sales price of thermal coal increased by 1.8% from the 2017 level to $27.02 per short ton. The average sales price of metallurgical coal increased 8.4% from the 2017 level to $144.00 per short ton.

- Total U.S. coal stocks in 2018 ended at 130.5 MMst, 21.9% lower than at the same time in 2017. Electric power coal stocks decrease by 34.3 MMst to 103.5 MMst at the end of 2018.

-----

Earlier:

2019, September, 26, 13:30:00

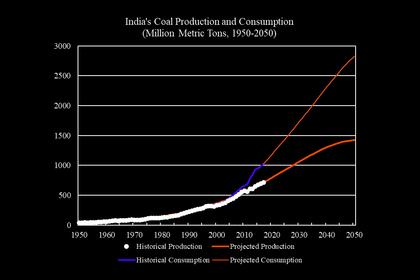

COAL FOR INDIA UP 28%

Indian power utilities imported 28.70 million mt of thermal coal over April-August, up 28% from the same period a year ago