U.S. SHALE DOWN

REUTERS - Investors are bracing for weaker results from U.S. shale players in coming days as lower oil and natural gas prices and cost-cutting measures have weighed on third-quarter operations.

Major shale producers ConocoPhillips (COP.N) and Concho Resources (CXO.N) this week kick off quarterly earnings reports for a group whipsawed this year by volatile pricing and investor demands for improved returns. Oil and gas producers have cut drilling and slashed jobs amid worries over pricing outlooks.

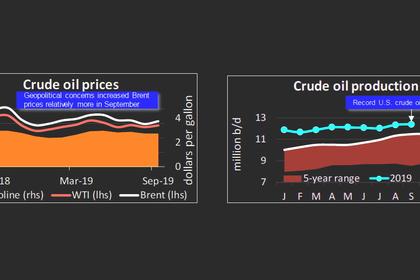

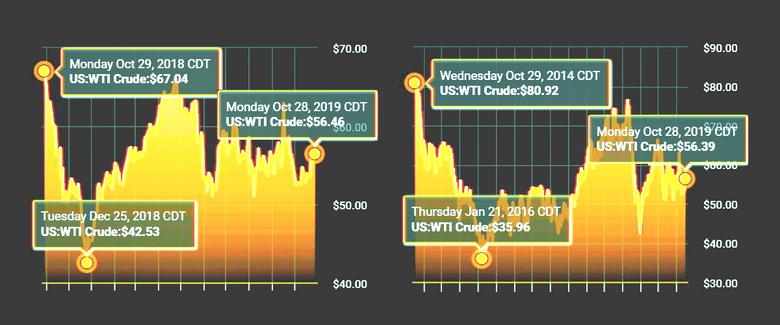

U.S. oil prices are down 17% and natural gas is down about 31% from a year ago, undercutting production increases. Costs of job cuts and retiring debt also will pressure profit at some companies, analysts said ahead of reports.

“I think we are moving from a growth to a value phase,” said Brad Holly, chief executive at Whiting Petroleum Corp (WLL.N) at a Denver oil conference earlier this month.

Whiting, Devon Energy (DVN.N), and PDC Energy (PDCE.O) each pared staff in recent months as prices swooned. Cutbacks have spread across the sector, with Halliburton (HAL.N), Schlumberger (SLB.N), and Patterson-UTI Energy (PTEN.O) idling equipment.

Investors will be watching for shale productivity updates. Last quarter, Concho Resources’ (CXO.N) stock plunged 22% in a day after cutting its production outlook, blaming well designs that hurt output.

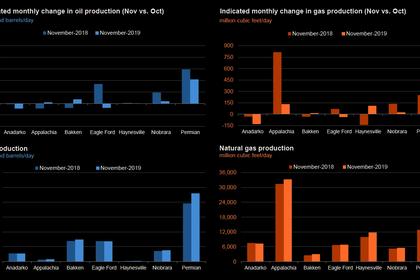

OUTPUT GAINS ‘DECELERATING’

Concho is expected to report earnings of 69 cents per share for the quarter, down from $1.42 a year ago. Top U.S. independent Conoco is expected to post earnings per share of 75 cents, compared with $1.36 a year ago, according to IBES data from Refinitiv.

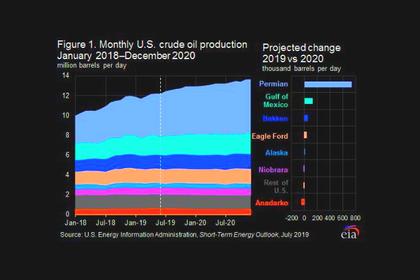

U.S. oil companies have flooded the market with crude this year, capping prices at about the mid-$50 a barrel range. Oil production averaged 11.8 million barrels per day (bpd) in July, the latest monthly figure, up 915,000 bpd from the same period last year, according to U.S. government figures.

“We will continue to see growth, but it will be decelerated, and meaningfully decelerated from where it has been for the last three years,” said Bobby Tudor, chairman of Tudor, Pickering, Holt & Co, in an interview this month on the sidelines of a conference. He based the forecast on U.S. oil at about $50 a barrel.

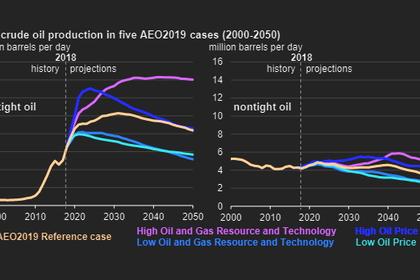

U.S. oil output is projected to rise by 900,000 bpd next year to 13.2 million bpd, down from a gain of 1.3 million bpd day this year, according to a U.S. Energy Information Administration forecast.

With prices in the mid-50s, top shale-service provider Halliburton last week warned U.S. customer activity would continue to decline this year, and outlined plans for a new round of cost cuts.

RESTRAINT CAME ‘TOO LATE’

Halliburton and other hydraulic fracturing providers have taken 100 U.S. fracking fleets that complete oil and gas wells off the market, “with a portion of that to never return,” consultancy Primary Vision wrote last week.

“We expect 2020 (spending) plans to be focused around maintenance capital,” or spending that supports existing output, said Bernadette Johnson, vice president of market intelligence at consultancy Enverus.

Among major shale producers, EOG Resources (EOG.N) is forecast to report per share earnings of $1.13, down from $1.75 a year earlier. Pioneer Natural Resources Co (PXD.N) could post earnings of $1.98 per share, down 9 cents, according to Refinitiv IBES.

Continental Resources (CLR.N) is projected to earn 47 cents per share, down from 90 cents a year earlier. Its shares have fallen to about $29.16 from roughly $54.15 a year ago.

“People are ignoring shale names now and they’re sort of disgusted with them almost,” said Rohan Murphy, an analyst with Allianz Global Investors in London, adding that their push for capital discipline came “almost a bit too late.”

-----

Earlier: