2040: GLOBAL ENERGY DEMAND WILL UP BY 25%

OPEC - WORLD OIL OUTLOOK 2040

Executive Summary

The World Oil Outlook (WOO) presents the OPEC Secretariat's medium- to long-term analysis and projections for the global economy, oil and energy demand, liquids supply and oil refining, as well as related matters, such as policies and technology. This includes analysis of the energy industry's various linkages and its shifting dynamics. The detailed review in this Outlook includes breakdowns by region, sector and timeframe and is consistent with the July edition of OPEC's Monthly Oil Market Report (MOMR).

Non-OECD countries to drive global population above 9 billion people by 2040

The global population is expected to increase by around 1.6 billion, from an estimated 7.6 billion in 2018 to 9.2 billion in 2040. The majority of this growth is projected to come from developing countries, particularly from the Middle East & Africa. The population of the Organisation for Economic Co-operation and Development (OECD) countries is forecast to increase by 78 million, mostly in OECD Americas. The overall population growth is set to decelerate throughout the forecast period. While the global working-age population (aged 15–64) is projected to grow by just under 900 million over the long-term, its share of the global population is expected to remain relatively constant, dropping slightly from 65% in 2018 to 64% in 2040. Moreover, the global urbanization rate will increase from 56% in 2018 to 64% in 2040.

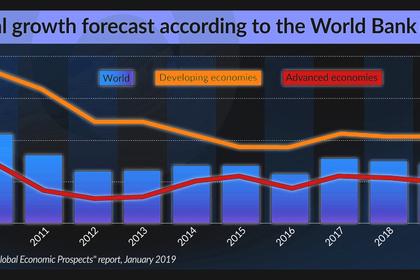

Global GDP growth between 2018 and 2040 is projected to average 3.3% p.a., driven primarily by developing countries

Global Gross Domestic Product (GDP) growth will be mainly driven by developing countries, largely due to improving labour productivity. The GDP of non-OECD countries is expected to grow by 4.5% per annum (p.a.) on average in the medium-term, while projected economic growth for the OECD averages 1.8% p.a. In the long-term, this becomes 4.2% and 1.7%, respectively. Global GDP between 2018 and 2040 is expected to increase at a rate of 3.3% on average, with the pace of GDP growth slowing during the forecast period. The projected figures are lower compared to the WOO 2018 due to a drop in expected economic growth in the near- and medium-term, as well as the longer-term trend of emerging economies such as China and India beginning to reach maturity in the latter years of the forecast period.

Continued high GDP growth in Asian countries will shift the centre of economic gravity further east

Based on 2011 purchasing power parity (2011 PPP), global GDP is projected to rise from $117.4 trillion in 2018 to more than $237 trillion in 2040. Together, China and India are forecast to account for 40% of global GDP in 2040, whereas the OECD is expected to account for only 32%, a striking reversal of the current distribution pattern. Despite large regional shifts in terms of the global economic picture, average income per capita is not envisaged to witness significant changes. OECD Americas is anticipated to remain the region with the highest GDP per capita over the entire forecast period, followed by OECD Asia Oceania and OECD Europe. The Middle East & Africa region is likely to have the lowest GDP per capita, and it is expected to be the only region where the average income remains less than $10,000 per capita in 2040.

Energy policies continue to focus on emission reductions despite some divergent signals from policymakers

The Outlook takes into account existing energy policies, whilst recognizing their transitory nature and potential evolution over time. Recently enacted energy policies focus primarily on measures aimed at emission reductions. The substitution of coal by natural gas and renewables in the power generation sector will continue to be at the centre of policy discussions. Several policies are aimed at limiting oil use, especially in the transportation sector. Examples include tightening standards for Corporate Average Fuel Economy (CAFE), carbon dioxide (CO2) emission performance standards for road transportation vehicles, emissions and efficiency regulations in the maritime and aviation sectors, fuel substitution in the rail sector and taxation policies in many countries.

Technological progress will provide additional options for the global energy system

The rapid evolution of electric mobility technology will lead to a substantial increase in its usage, but internal combustion engines (ICEs) are expected to see further efficiency improvements and remain the main powertrain for the majority of passenger and commercial vehicles during the forecast period. Substantial innovation is expected in the aviation industry, including efficiency leaps for aircraft engines. The increased use of liquefied natural gas (LNG) in maritime transportation will allow for substantially higher fuel efficiency and cleaner emissions. Remarkable progress has been achieved in renewable power generation technology, but photovoltaics (PV) and wind power are likely to continue to suffer low capacity factors. On the supply side, the tight oil boom is making heavy use of rapidly advancing information technology (IT). Moreover, Industry 4.0, combined with highly innovative concepts in data processing and data interpretation via artificial intelligence (AI), will significantly enhance oil industry efficiencies.

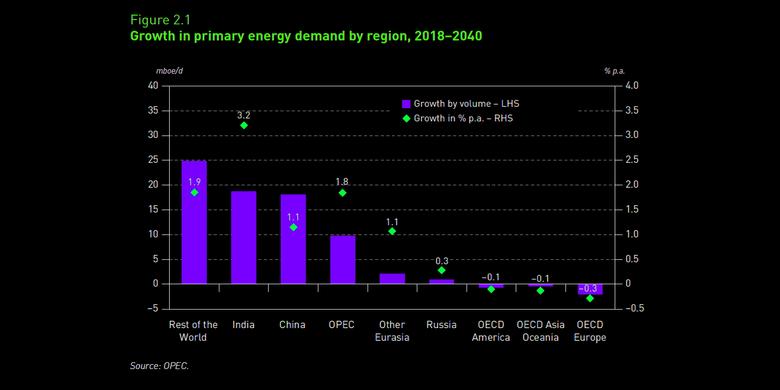

Global primary energy demand is forecast to increase by 72 mboe/d in the period to 2040

Global demand for energy is forecast to increase from nearly 286 million barrels of oil equivalent a day (mboe/d) in 2018 to more than 357 mboe/d in 2040, with average growth of about 1% p.a. In this period, energy demand in non-OECD countries is expected to increase by almost 75 mboe/d, while demand in the OECD is estimated to drop by around 3 mboe/d. These regional demand growth differences relate to variances in demographics, efficiency levels, climate change policies and other factors that shape the energy mix in various countries and regions. Energy demand growth in India and China alone is expected to account for almost 50% of the energy demand growth in the non-OECD region.

Oil will retain the highest share in the energy mix in the period to 2040

In 2018, oil accounted for more than 31% of global energy demand, ahead of coal (27%) and gas (23%). Oil is forecast to remain the largest contributor to the energy mix by 2040, accounting for more than 28%. Between 2018 and 2040, global gas demand is anticipated to rise from 65.5 mboe/d to just above 90 mboe/d. Consequently, natural gas is expected to become the second-largest energy source, reaching a share of 25% in the total primary energy mix in 2040. Demand increases for gas will come primarily from Asia, led by China and India, as well as OPEC Member Countries.

Coal will remain the largest source of global CO2 emissions despite falling demand after 2030

Despite a declining coal demand trend after 2030, coal is still expected to be the largest source of CO2 emissions. It is estimated to account for almost 40%, or 14.9 billion tonnes (bt), of total energy-related emissions in 2040. Energy-related emissions will continue to increase to more than 38 bt by 2040, which is more than 4 bt higher than the observed level in 2018. However, the pace of growth is forecast to decelerate significantly over his period.

'Other renewables' will be the fastest growing source of energy in relative terms, while demand for natural gas rises the most in absolute terms

'Other renewables', which includes solar, wind and geothermal power, is expected to be the fastest growing source of energy, expanding on average by 6.9%. Demand for 'other renewables' is seen rising by nearly 18 mboe/d between 2018 and 2040. Nuclear and biomass are expected to see demand growth of approximately 7 mboe/d each, while additional demand for hydropower will be around 3 mboe/d.

Medium-term global oil demand is expected to reach 104.8 mb/d by 2024

Global oil demand is expected to continue growing at relatively healthy rates in the medium-term reaching 104.8 million barrels a day (mb/d) by 2024. This represents an increase of 6.1 mb/d above the 2018 level. The average growth will be about 1 mb/d over the medium-term period, declining from a projected 1.1 mb/d in 2019 to 0.9 mb/d in 2024. Incremental demand is forecast to come primarily from non-OECD countries (+6.6 mb/d). Annual average oil demand growth from non-OECD countries is projected to remain within a relatively narrow range of 1–1.2 mb/d over this period. Oil demand in the OECD is projected to gradually shift from slight growth during the initial years of the medium-term to declining demand after 2020, partially offsetting growth in the non-OECD region.

Impact of IMO regulations is forecast to be less severe than previously expected

The new International Maritime Organization (IMO) regulation limiting sulphur content in marine fuels (0.5% maximum on a weight basis), effective from 1 January 2020, is expected to be a disruptive event, not only for the shipping sector, but also for the global refining system and related refined product supply. However, evolving market conditions and projections in terms of oil demand, liquids supply and oil refining, as well as developments within the shipping industry, have led to slight adjustments to previous IMO-related projections. Recent assessments indicate that the global refining system will have sufficient flexibility to address the changes in the maritime sector's fuel mix. Nevertheless, the impact on high sulphur fuel oil (HSFO) prices, the gasoil/HSFO spread, as well as HSFO-rich crude oil prices, will still be significant, although less severe than previously expected.

Long-term oil demand to rise to 110.6 mb/d in 2040

Long-term global oil demand is expected to increase by about 12 mb/d, rising from 98.7 mb/d in 2018 to 110.6 mb/d in 2040. From a regional perspective, there is a contrast between declining OECD demand and expanding demand in the non-OECD. Driven by an expanding middle class, high population growth rates and stronger economic growth potential, non-OECD oil demand is expected to increase by 21.4 mb/d between 2018 and 2040. India is projected to be the country with the fastest oil demand growth and the largest additional demand. OECD demand is expected to plateau at around 48 mb/d for the next few years, before declining to around 38 mb/d by 2040. At the global level, growth is forecast to slow from a level of 1.4 mb/d in 2018 to around 0.5 mb/d towards the end of the next decade.

Petrochemical sector will be the leading long-term source of incremental demand

The largest incremental demand growth (+4.1 mb/d) is expected to come from the petrochemical sector, although road transportation will remain the largest demand sector in terms of absolute volumes. For road transportation, despite an overall increase of close to 3 mb/d, its overall share is forecast to drop by 2%. Significant demand growth is also expected in the aviation sector, which is projected to be the fastest growing sector, with oil demand expanding on average by 1.5% p.a. Some growth is also projected in the marine sector, as well as in rail and domestic waterways.

Oil demand in road transportation is set to plateau in the 2030-2040 forecast period

Road transportation is estimated to account for 43% of total demand by 2040. However, this sector is forecast to witness a strong decoupling between oil demand, transport services and the number of vehicles on the road. This will primarily be a result of efficiency improvements driven by technological developments, a tightening of energy policies, and the increasing penetration of alternative fuelled vehicles (electric vehicles (EVs), natural gas and to some extent hydrogen). The total vehicle fleet is estimated to grow by more than 1 billion between 2018 and 2040, reaching 2.4 billion. The large majority of this increase (953 million) comes from non-OECD countries. EVs (including battery electric vehicles (BEVs) and plug-in hybrids) are estimated to reach around 320 million units in 2040, equivalent to a share of 13% of the global fleet. The majority of EVs are expected to be passenger cars (305 million). In relative terms, this represents 15% of all passenger cars in 2040.

Strong medium-term non-OPEC supply growth driven mainly by US tight oil

Non-OPEC total liquids supply is projected to grow by 9.9 mb/d between 2018 and 2024, reaching 72.2 mb/d. This is mainly driven by the return of modest increases in upstream investment and healthy demand. US tight oil is forecast to continue to expand at a strong pace, contributing just over 60% of this medium-term non-OPEC supply growth. In addition, a cyclical recovery elsewhere sees meaningful contributions from Brazil, Norway and Canada, in addition to expected barrels from newcomer Guyana.

Long-term non-OPEC supply prospects are more modest

US tight oil supply will expand sharply by 6.7 mb/d in the medium-term, before slowing thereafter, showing only modest increases. US tight oil supply is expected to peak at 17.4 mb/d in 2029. Tight oil production elsewhere has potential, but it is estimated to remain at relatively modest volumes. US total liquids are forecast to peak at 22.8 mb/d in the mid-2020s. Total non-OPEC supply is forecast to reach 72.6 mb/d in 2026, but gradually decline thereafter to a level of 66.4 mb/d by 2040. Beyond the mid-2020s, only two non-OPEC countries are expected to show meaningful output growth, namely Brazil and Kazakhstan. Virtually all other non-OPEC producers are anticipated to see a decline in long-term liquids production.

Medium-term distillation capacity additions are estimated at almost 8 mb/d, mostly in the Middle East and Asia-Pacific

Almost 70% of distillation capacity additions are projected to occur in the first three years of the forecast period, with an average annual additions estimated at around 1.8 mb/d in the period 2019–2021. However, the rate of capacity additions is expected to level off in the years thereafter, dropping to only 0.4 mb/d. The majority of expansions are seen in the Asia-Pacific and the Middle East (5.7 mb/d or more than 70% of global additions) driven predominantly by oil demand growth, but also efforts to increase refined product exports, mostly in the Middle East. Significant additions (0.8 mb/d) are also expected in Africa with one large project in Nigeria accounting for the largest share.

Medium-term outlook points at significant excess refining capacity

Potential incremental medium-term crude throughput is estimated at a surplus of almost 4 mb/d relative to the incremental refined product demand by 2024. While the gap is still moderate in 2019, it widens gradually from 2020 onwards, illustrating a rising surplus of distillation capacity at the global level. The largest surplus is expected for the Middle East, US & Canada, Europe and China. This may lead to more downstream competition post-2020 and potentially refinery closures. Refinery closures amounting to 2.1 mb/d are expected in the medium-term due to lower demand in several regions, as well as additions of highly competitive new refinery units. Consequently, the majority of closures are expected for the US & Canada and Europe, with limited closures in other regions. The only region with a projected medium-term deficit is Latin America.

Long-term distillation capacity additions projected at around 16.5 mb/d

Total crude distillation capacity additions are projected to reach 16.5 mb/d by 2040, mostly in developing countries (Asia-Pacific, Middle East, Africa and Latin America). Refinery additions required through 2040 are heavily 'front-loaded' with major implications for a slowdown in projects and investment after the medium-term period. Projections for secondary capacity additions indicate the need to add some 8.8 mb/d of conversion units, 18 mb/d for desulphurization and 5 mb/d of octane units in the period to 2040. The majority of these additions are expected to materialize before 2030, in line with demand growth and the implementation of stricter product specifications.

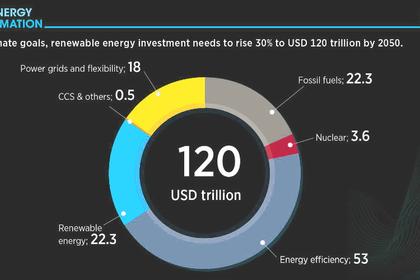

Required long-term investments are estimated at around $10.6 trillion

Projected global upstream investments required to sustain production according to this Outlook are estimated to be $8.1 trillion ($2019) over the period to 2019–2040. Another $1 trillion is seen as required in the midstream sector. Global downstream investments are estimated at around or slightly above $1.4 trillion. Combined, this indicates that nearly $10.6 trillion of investment will be needed globally over the long-term to sustain projected oil supply requirements.

After a medium-term dip, global crude exports are expected to grow in the long-term, driven by additional Middle East exports to the Asia-Pacific

In the medium-term, overall crude trade is seen relatively stable near 38 mb/d. In terms of regional exports, the biggest change is the significant increase in crude exports from the US & Canada, which are expected to climb to a level just under 5 mb/d in 2025, up by around 3 mb/d from 2018. In the long-term, the outlook changes fundamentally, with exports rising by 4.5 mb/d from 2025–2040 to reach almost 42 mb/d. Export flows from the US & Canada are projected to drop to around 3 mb/d by 2040. Total Middle East exports are set to increase by around 7 mb/d between 2025 and 2040 to reach levels of around 23 mb/d.

Energy-exporting developing countries disproportionately affected by the impact of implementation measures taken in response to climate change

For energy-exporting developing countries the imperative to re-orient their economies is due to a stringent regulatory framework on climate change action and the associated adverse impacts of response measures. Achieving diversification is considered vital for their long-term socioeconomic sustainability. A diversified portfolio could help such economies to increase their resilience, while taking into consideration the importance of local and regional contexts in policymaking. Energy-exporting developing countries could use their comparative advantage and diversify even within the energy sector. Policymakers could also pursue actions and measures that extend existing capabilities into industries of higher value added and complexity. Governments could play a vital role in the economic and structural reforms needed to achieve diversification. International cooperation could contribute to the identification and sharing of not only best practices but also ways in which the international community could facilitate increased trade, foreign investment, and support in the form of technology transfer and finance.

-----

Earlier: