AFRICA'S ENERGY DEMAND GROWTH TWICE

IEA - Africa Energy Outlook 2019

Executive Summary

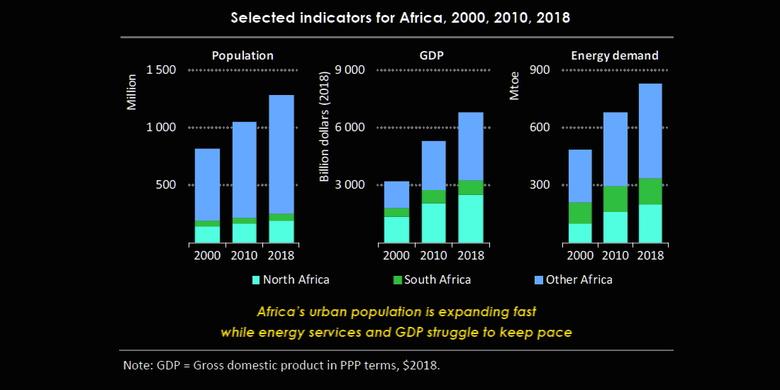

How Africa meets the energy needs of a young, fast growing and increasingly urban population is crucial for the continent’s – and the world’s – economic and energy future. One-in-two people added to the global population between today and 2040 is set to be African, and by 2025, Africa’s population exceeds that of both India and China. The continent’s urban population is set to grow by more than half a billion over that period, much higher than the growth seen in China’s urban population during the country’s twodecade economic and energy boom. These profound demographic changes are set to drive economic growth, infrastructure development and, in turn, energy demand.

Five years since its first special report on Africa, the International Energy Agency (IEA) has updated and upgraded its work in this new World Energy Outlook Special Focus. This reflects not only Africa’s increasing importance in global energy affairs but also the deepening relationships between African energy decision makers and the IEA. This report, the most comprehensive to date, contains a unique richness of data and analysis. The centrepiece is a set of detailed, comprehensive outlooks covering 11 sub-Saharan countries1 that were developed in consultation with our African partners.

Thanks to natural resource endowments and technology improvements, Africa could pursue a much less carbon-intensive development model than many other parts of the world have. The challenges and opportunities differ widely across a diverse continent. But renewables, together with natural gas in many areas, are poised to lead Africa’s energy consumption growth as the continent moves away from the traditional use of biomass that currently accounts for almost half of final energy consumption.

Africa’s energy prospects depend on the way that government policies shape investment flows and the availability and affordability of modern energy sources. Our analysis is based on two scenarios:

- The Stated Policies Scenario reflects our measured assessment of today’s policy frameworks and plans, taking into account the regulatory, institutional, infrastructure and financial circumstances that shape the prospects for their implementation.

- The Africa Case is built on the premise of Agenda 20632, the continent’s inclusive and sustainable vision for accelerated economic and industrial development. Faster economic expansion is accompanied by the full achievement of key Sustainable Development Goals by 2030. These include full access to electricity and clean cooking and a significant reduction in premature deaths related to pollution.

Africa drives global trends, but a lack of access persists

Whichever pathway Africa follows, the continent becomes increasingly influential in shaping global energy trends. Growing urban populations mean rapid growth in energy demand for industrial production, cooling and mobility. Energy demand in Africa grows twice as fast as the global average, and Africa’s vast renewables resources and falling technology costs drive double-digit growth in deployment of utility-scale and distributed solar photovoltaics (PV), and other renewables, across the continent. With the growing appetite for modern and efficient energy sources, Africa emerges as a major force in global oil and gas markets. As the size of the car fleet more than doubles (the bulk of which have low fuel efficiency) and liquefied petroleum gas (LPG) is increasingly used for clean cooking, oil demand grows by 3.1 million barrels per day between today and 2040, higher than the projected growth in China and second only to that of India. Africa’s growing weight is also felt in natural gas markets and the continent becomes the third-largest source of global gas demand growth over the same period.

A critical task for policy makers is to address the persistent lack of access to electricity and clean cooking – and the unreliability of electricity supply. These have acted as brakes on the continent’s development. Nearly half of Africans (600 million people) did not have access to electricity in 2018, while around 80% of sub-Saharan African companies suffered frequent electricity disruptions leading to economic losses. In addition, more than 70% of the population, around 900 million people, lack access to clean cooking. The resulting household air pollution from traditional uses of biomass is causing 500 000 premature deaths a year. It also contributes to forest depletion resulting from unsustainable harvesting of fuelwood, as well as imposing a considerable burden and loss of productive time, mostly on women.

The momentum behind today’s policy and investment plans is not yet enough to meet the energy needs of Africa’s population in full. In the Stated Policies Scenario, 530 million people still lack access to electricity and nearly one billion have no access to clean cooking in 2030. The continent’s ambition to accelerate an industrial expansion continues to be hampered in many countries by unreliable energy supply. Only a handful of countries – including South Africa, Ethiopia, Ghana, Kenya, Rwanda and Senegal – are successful in reaching full access to electricity by 2030. Solid biomass remains a mainstay of the energy mix as a primary fuel for cooking as clean cooking policies lag population growth and premature deaths related to inhaling fumes from cooking end up only 2% below today’s level by 2040.

The Africa Case points the way to a brighter future

The Africa Case outlines a way to lift these constraints, starting with the achievement of full access to modern energy by 2030. In the case of electricity, this would require tripling the average number of people gaining access per year from around 20 million today to over 60 million people. Grid expansion and densification is the least cost option for nearly 45% of the currently deprived, mini-grids for 30% and stand-alone systems for around a quarter.

LPG is used by more than half of those gaining access to clean cooking in urban areas across sub-Saharan Africa, while in the rural areas, home to the majority of those without access, improved cookstoves are by far the preferred solution. Electrification, biogas, ethanol and other solutions also play important roles.

A focus on energy efficiency can support economic growth while curbing the increase in energy demand. In the Africa Case, although the size of the continent’s economy in 2040 is four times larger than today, efficiency improvements help limit the rise in total primary energy demand to just 50%. As a result, even though economic growth in the Africa Case is significantly stronger than in the Stated Policies Scenario, energy use is actually lower. This is linked to an accelerated move away from solid biomass as a fuel and the increased efficiency of charcoal production and use – and to the wide application of electrification and energy efficiency policies. These include fuel economy standards for cars and two/three-wheelers, more efficient industrial processes, building codes and efficiency standards for appliances and cooling systems.

Renewables push ahead to power Africa’s brighter future

Rising electricity needs, especially in sub-Saharan Africa, require a major expansion of the power system. Electricity demand today in Africa is 700 terawatt-hours (TWh), with the North African economies and South Africa accounting for over 70% of the total. Yet it is the other sub-Saharan African countries that see the fastest growth to 2040. Electricity demand more than doubles in the Stated Policies Scenario to over 1 600 TWh, and reaches 2 300 TWh in the Africa Case as electricity supports an increasing range of residential, service and industrial uses. Most of the additional electricity demand stems from productive uses and middle- and higher-income households.

Renewables account for three-quarters of new generation, with a key question being how fast solar will grow. Africa has the richest solar resources in the world, but has installed only 5 gigawatts (GW) of solar PV, less than 1% of the global installed capacity. In the Africa Case, solar PV overtakes hydropower and natural gas to become the largest electricity source in Africa in terms of installed capacity (and the second largest in terms of generation output). With additions across the entire region, solar PV deployment between today and 2040 averages almost 15 GW a year, matching the average annual deployment in the United States over the same period. Wind also expands rapidly in several countries that benefit from high quality wind resources, most notably Ethiopia, Kenya, Senegal and South Africa while Kenya is also at the forefront of geothermal deployment.

The development and reliability of Africa’s electricity sector will be shaped by progress in improving power infrastructure, within and across borders. Supporting a tripling of the electricity demand as envisaged in the Africa Case requires building a more reliable power system and greater focus on transmission and distribution assets. A key priority is targeted investment and maintenance to reduce power outages, a major obstacle to enterprise, and to decrease losses from 16% to a level approaching advanced economies (less than 10% today). In addition, some large power-sector projects – especially for hydropower – require regional integration to go ahead: they would not proceed if assessed only on domestic needs. That means building up the regulation and capacity to support Africa’s power pools and strengthen regional electricity markets.

Africa needs a significant scale-up in electricity sector investment in generation and grids, for which it currently ranks among the lowest in the world. Despite being home to 17% of the world’s population, Africa currently accounts for just 4% of global power supply investment. Achieving reliable electricity supply for all would require an almost fourfold increase, to around $120 billion a year through 2040. Around half of that amount would be needed for networks. Mobilising this level of investment is a significant undertaking, but can be done if policy and regulatory measures are put in place to improve the financial and operational efficiency of utilities and to facilitate a more effective use of public funds to catalyse private capital. Developing the technical and regulatory capacity to support sector reform policies, as well as Africa’s own financial sector, is also critical to ensure a sustained flow of long-term financing to energy projects.

Natural gas can be a good fit for Africa’s industrial growth

Natural gas is facing a potential turning point in Africa. In North Africa, gas already meets around half of the region’s energy needs, but in sub-Saharan Africa, it has thus far been a niche fuel. The share of gas in the energy mix is around 5%, among the lowest in the world. The future could be different. There have been a series of major discoveries in recent years, in East Africa (Mozambique and Tanzania), Egypt, West Africa (Senegal and Mauritania) and South Africa, which collectively accounted for over 40% of global gas discoveries between 2011 and 2018. These developments could fit well with Africa’s push for industrial growth and its need for reliable electricity supply.

Developing gas infrastructure will be a major challenge because of typically small market sizes and concerns about affordability. Nonetheless, the rapid deployment of renewables leaves room for gas to grow as a flexible and dispatchable source of electricity. Outside the power sector, the successful industrialisation foreseen in the Africa Case rests upon the stable provision of energy, including for energy uses that are hard to electrify. Gas could be well suited to these roles and, if it is not available, the alternatives in many cases would be other, more polluting fossil fuels. Much will depend on the price at which gas becomes available, the development of distribution networks (including small-scale liquefied natural gas (LNG) distribution), the financing available for infrastructure and the strength of policy efforts to displace polluting fuels.

In our projections, Africa becomes a major player in natural gas markets as a producer, consumer and exporter. Gas production more than doubles to 2040 in the Stated Policies Scenario. It rises further in the Africa Case, to support higher demand from power and industry. The share of gas in Africa’s energy mix rises to around 24% in 2040 in the Africa Case (close to the global average today). However, the growth in production is considerably higher than the rise in demand, and Africa – led by Mozambique and Egypt – emerges as a major supplier of LNG to global markets.

Energy transitions bring mixed implications for Africa

Development models in Africa that are highly dependent on hydrocarbon revenues are coming under increasing pressure. Africa has abundant natural resources and the associated revenues could be an important motor for development. However, changing global energy dynamics mean that resource-holders cannot assume that their oil resources will translate into reliable future revenues. This year’s outlook incorporates higher shale oil production in the United States, which is providing very strong competition for lighter African crudes. Accelerated energy transitions would result in lower demand and prices for hydrocarbons and cut sharply into future revenues. Our analysis underscores the need for strategic thinking on future investments, transparent resource revenue management and efforts to reform and diversify economies.

Energy transitions are opening up new opportunities for a different set of strategic resources. Africa is home to many of the mineral resources that are critical in driving global energy transitions. The Democratic Republic of the Congo accounts for two-thirds of global cobalt production and South Africa produces 70% of the world’s platinum. Rising demand for the minerals that can support global energy transitions offers an opportunity for minerals-rich countries in Africa, but responsible stewardship of these resources is vital.

These supply chains are coming under increasing scrutiny, and adequate oversight will be needed to ensure that revenues produce visible positive results for local communities and that negative impacts on the environment are minimised.

Climate change matters in Africa, making resilient policy decisions critical

Africa has been a minor contributor to global greenhouse gas emissions, and this remains the case to 2040 in all our scenarios. To date, energy-related carbon dioxide (CO₂) emissions in Africa represented around 2% of cumulative global emissions. Although Africa experiences rapid economic growth, its contribution to global energy-related CO₂ emissions increases to just 4.3% over the period from today to 2040 in the Stated Policies Scenario. In the Africa Case, the continent’s share of cumulative global emissions rises further by just 0.2 percentage points to 2040 despite an economy that grows even more quickly. Looking beyond CO₂, the transition away from the inefficient combustion of biomass for cooking in the Africa Case leads to same levels of greenhouse gas (GHG) emissions as in the Stated Policies Scenario as the increase in CO₂ emissions is offset by reductions in other GHGs (methane and nitrous oxide).

But Africa is in the front line when it comes to the effects of a changing climate on the energy sector. Today, Africa has some of the lowest ownership levels of cooling devices of any region, despite almost 700 million people living in areas where the average daily temperature exceeds 25 degrees. By 2040, this number approaches 1.2 billion as population expands and average temperatures increase with climate change. Without appropriate regulations on the type of equipment used for cooling, this would create a very strong increase in electricity demand. Increased frequency and intensity of extreme weather events such as droughts and floods is set to lead to more variability in generation output, notably hydropower. In Zambia, for example, a severe drought in 2015 led to a drop in output at the largest hydropower plant, resulting in power blackouts. Uncertainty over the impact of climate change on the region’s hydrology underlines the need to build up a diverse power mix and enhance regional connections. Planning and investment decisions for energy infrastructure need to be climate resilient. Outside the energy sector, Africa’s ecosystems already suffer disproportionately from climate change and are exposed to increased risks to food, health and economic security.

Policies will play a crucial role in determining Africa’s energy future Africa’s energy future is not preordained: many pathways are possible, but effective policy choices can guide the continent to a more inclusive and sustainable energy future and accelerate its economic and industrial development. The choices that lead in this direction vary, reflecting the different resource endowments and starting points across a very diverse African energy landscape. Some have full access to modern energy services within their grasp, while others have much further to go, or are struggling with instability or a legacy of conflict. But there are reasons for optimism, both from the dynamism of Africa’s energy sector and from the technologies that offer a cost-effective way to meet rising demand in a sustainable way. Whether and how African countries take advantage of these opportunities will depend in large part on the way that energy policies evolve. With the right institutional and policy foundations, a well-functioning energy sector can be the cornerstone of economic development and make a huge difference in the lives of Africa’s people.

---

1 These are: Angola, Côte d’Ivoire, Democratic Republic of the Congo, Ethiopia, Ghana, Kenya, Mozambique, Nigeria, Senegal, South Africa and Tanzania.

2 Agenda 2063 was adopted in 2015 by the Heads of State and Governments of the African Union; it is the continent’s strategic framework that aims to deliver inclusive and sustainable development.

-----

Earlier: