CHINA NEED COAL

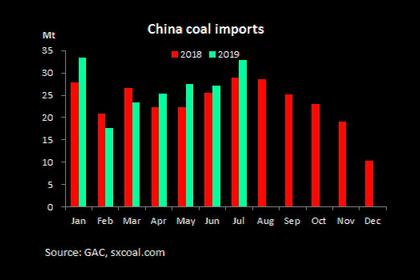

PLATTS- China's voracious appetite for coal may be nearing its peak consumption level, but the country's love affair with one of the cheapest fuels is unlikely to end anytime soon, despite Beijing's efforts to turn the skies of Asia's biggest energy consumer blue.

Although China's energy mix will continue to evolve, with coal's share expected to fall gradually over the coming years, the relatively slow rate of decline in coal consumption will likely mean that China's influence on world coal prices will remain for many years to come.

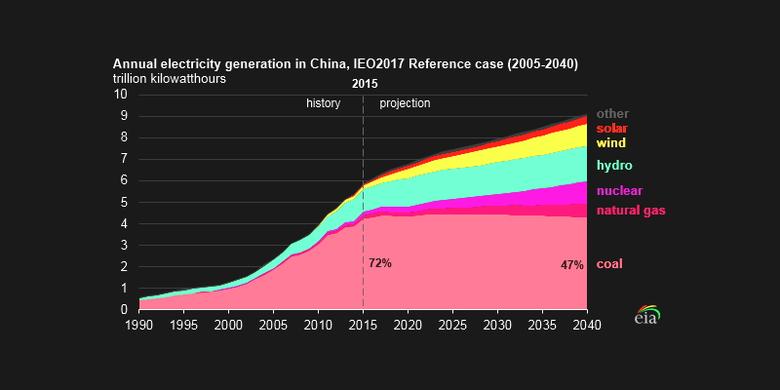

"Chinese coal-fired power plants are also relatively young, so it is likely these will be in operation for quite some time. Even if renewables grow quickly, there's very little gas capacity in the mix. It will be hard to replace the entire coal volume with nuclear or gas," said Matthew Boyle, lead coal analyst at S&P Global Platts Analytics.

BP's Energy Outlook estimates coal's share of China's energy mix to fall to 35% in 2040 from 60% in 2017, but for the country to remain the world's largest consumer of coal and account for 39% of global coal demand in 2040.

"For the past couple of years, China has been the thermal coal import destination of last resort in the seaborne market, pulling in growing spot supply from Indonesian and Australian miners," Boyle said.

China relies heavily on coal in the power sector and many of its plants are highly efficient in terms of coal consumption and emission of pollutants. The coal sector is also an important source of government tax revenue, as well as a large employment generator.

"China's share of coal in the energy mix is set to fall further but the question is whether it will fall to one-third or one-tenth of the energy mix by 2035. The former is very possible." said Michal Meidan, director for the China Energy Program at the Oxford Institute for Energy Studies.

RENEWABLE BOTTLENECKS

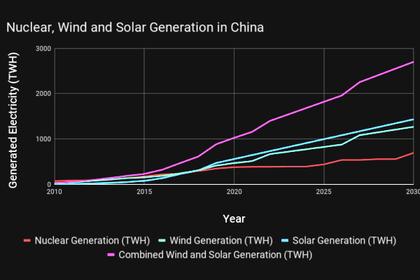

A more fundamental issue affecting renewables consumption in China has been the poor coordination of wind and solar installations with grid construction.

Most of the country's wind and solar potential is located in western areas such as Xinjiang, Inner Mongolia, and Gansu province, far away from the main consumers in the country's eastern regions, Meidan said.

"While installed renewable capacity is rising rapidly, there are still challenges connecting them to the grid and concerns about intermittency. So coal will still remain a pillar of power generation in the coming years," she said.

In addition, Chinese power producers have asked the government to allow for the development of between 300 and 500 new coal power plants by 2030, suggesting that coal-power capacity should expand to 1,300 GW by 2030 -- 290 GW higher than the current capacity.

"While coal's share of primary energy consumption is in free fall, declining from 70% in 2011 to 59% last year, it will still remain the single largest supply source through to 2050," she added.

With the escalation in China's trade tensions, energy security has become a key concern, to the extent that China is using more efficient coal in both power plants and industrial applications, she added.

ROBUST PRODUCTION OUTLOOK

China will continue to be the largest coal producer for the next several years, despite restructuring that has seen closure of small, less efficient mines, the International Energy Agency said in a recent report, adding that expansion of capacity in the country's western regions has more than offset those closures.

Final investment decisions for new coal-fired plants fell from 60 GW in 2015 to less than 6 GW in 2018 when, for the first time, more gas-fired power was approved than coal, the IEA said. "However, China has a stock of more than 1 000 GW of coal-fired capacity, much of it recently commissioned and highly efficient," the report added.

DBS Group Research said in a note that China's regulatory loopholes allow the entry of sizable new coal-fired power plants, which are currently under construction, despite the government's plans to curb capacity to reduce air pollution.

"We do not expect coal-fired power plants' capacity to diminish because capacity development for renewable energy still has a long way to go before replacing coal-fired power plants as the dominant energy source," the bank added.

China consumes 3 billion mt/year of thermal coal, out of which seaborne import requirements comprise only around 6%.

"Chinese domestic coal flows have also improved on increased railway and waterway capacity, which makes the flow of coal from the north to the main demand centers in the south easier," Boyle said.

"China's rising domestic coal output means coal demand growth is more likely to be met by inland domestic supply rather than imports," he added.

Platts Analytics forecast China's coal consumption and imports to peak by 2024 as, from 2025, additional capacity additions in other electricity-generating fuels will slowly erode coal's share of electricity generation in the market.

-----

Earlier: