ENEL STRATEGIC PLAN: €6.1 BLN INCOME

ENEL - Milan, November 26th, 2019 - The Enel Group (hereinafter the "Group") is presenting its 2020-2022 Strategic Plan today to the financial markets and media.

ENEL 2020–2022 STRATEGIC PLAN: MAXIMISING VALUE THROUGH SUSTAINABILITY

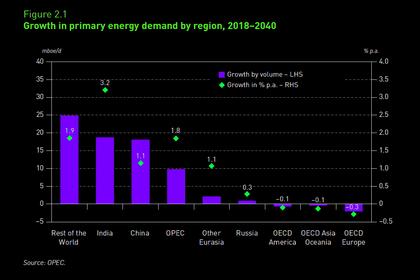

Enel’s integrated business model and the full incorporation of sustainability into its strategy has allowed the Group to become the world’s leading private operator of renewables and networks, boasting the largest retail customer base. The strategic choice, made in 2015, to switch to a sustainable, integrated business model positioned the Group as an early leader of the energy transition, now allowing Enel to benefit from the opportunities offered by the expanding value pool associated with the acceleration of this transition. As a result, the Group is well positioned to increase value creation for shareholders over the plan period, with ample upside potential beyond 2022.

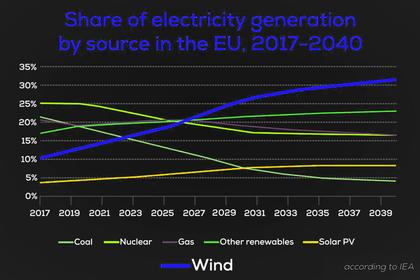

- Decarbonisation of the global generation fleet will account for 50% of total planned investments, with 14.4 billion euros devoted to the accelerated deployment of new renewable capacity and the progressive substitution of coal generation. By 2022, the Group is expected to develop 14.1 GW of new renewable capacity (+22% vs. previous plan) and reduce coal capacity and production by 61% and 74%, respectively, vs. 2018. The share of renewables on total capacity is due to reach 60% in three years, driving upwards the generation fleet’s profitability as well as increasing CO2– free production to 68% in 2022. Enel’s investments in decarbonisation are expected to contribute 1.4 billion euros to Group’s EBITDA growth

- Around 1.2 billion euros of capex will address the Electrification of consumption, leveraging on Enel’s expanded and diversified retail customer base, as well as on efficiencies associated with the platformisation of Group activities. Investments are expected to yield 0.4 billion euros in EBITDA growth and position Enel for the future uptake of electrification-driven consumption

- A total of around 13 billion euros will be invested in the drivers of the energy transition, based on the two main trends of decarbonisation and electrification, and which offer several value creation opportunities:

- Enabling Infrastructures: 11.8 billion euros will be invested in the continued digitalisation and automation of grids, fostering resiliency and quality of service, ultimately aimed at contributing 0.7 billion euros to the growth of Group EBITDA

- Ecosystems and Platforms: 1.1 billion euros will be dedicated to Enel X for the ongoing deployment of services and infrastructure to support decarbonisation and electrification, leveraging on its platform-based model and aimed at contributing 0.4 billion euros to the growth of Group EBITDA

- Total organic capex: 28.7 billion euros, up 11% vs. previous plan, leading to an expected EBITDA of 20.1 billion euros in 2022 (+13% vs. 17.8 billion euros expected in 2019). Capex allocation directly targets three main SDGs, which account for around 95% of the Group’s overall investments: SDG 7 (Affordable and Clean Energy), 9 (Industry, Innovation and Infrastructure) and 11 (Sustainable Cities and Communities), all contributing to the achievement of SDG 13 (Climate Action). Enel contributes to all other SDGs by promoting a sustainable business model and employing sustainable behaviours

- Net ordinary income planned at 6.1 billion euros in 2022 (+27% vs. 4.8 billion euros expected in 2019), with the 2021 target up by around 200 million euros vs. previous plan

- The share of sustainable finance sources, such as SDG-linked bonds, on Enel’s gross debt is expected to increase to approx. 43% in 2022 and to around 77% in 2030 from approx. 22% currently, supporting a sharp reduction in cost of debt

- Shareholder remuneration: Enel will continue to pay, over the whole plan period, the highest amount between 70% of Group net ordinary income and a minimum guaranteed Dividend Per Share (DPS), with a compounded annual growth rate of 8.4% for the implicit DPS and 7.7% for the minimum DPS. Minimum DPS up by 1 eurocent/share in 2020 and 2021 vs. the previous plan, with a new target of 0.40 euros/share in 2022

Francesco Starace, CEO and General Manager of Enel said: “The plan that we are presenting today underscores the success of the sustainable and integrated business model that we have deployed since 2015, targeting the opportunities in the power sector connected with the global decarbonisation and electrification trends. Thanks to this approach, Enel is now a more sustainable, efficient and profitable organisation, with a substantially lower risk profile and a greater capability to rapidly adapt to change.

Enel’s 2020-2022 Plan is also based on the inherent sustainable business model that we have built, while working along the two global trends that are shaping the energy sector: decarbonisation and electrification. The digital transformation of our large network business and the platformisation of all our customer-related activities are key enablers of this plan, boosting efficiencies and introducing additional services.

Our new plan envisages higher overall investments compared to our previous plan and directly addresses the pursuit of UN Sustainable Development Goals (SDGs).

2019 has marked a turning point for the dynamics of transformation within the world’s energy systems and we expect an acceleration of the trends of decarbonisation and electrification in the years to come.

Enel will accelerate the decarbonisation of its generation mix through significant investments in renewable growth while progressively reducing thermal generation. On the path towards full decarbonisation by 2050, our substantial renewable pipeline provides visibility well beyond the plan period.

We are future-proofing our networks and customer processes through investments in grid digitalisation as well as the progressive transformation of Enel into a platform-based group. With this approach, we are ensuring uniformity of our customer management processes as well as those relating to resource allocation, asset operation and maintenance. These actions are key to embracing the electrification of consumption, boosting the action against climate change as well as ensuring the supply of affordable, clean energy.

Sustainability in Enel’s vision is also becoming a key enabling factor in our financial strategy. Enel, during the plan period and beyond, will increasingly leverage on Sustainable Finance instruments such as SDGlinked bonds, whose cost advantages over traditional tools will further support the improvement of our already strong credit metrics.

The robustness of this Strategic Plan and the associated significant earnings visibility, allow us to confirm the Group’s net ordinary income target for 2020 and to increase the 2021 target on the previous plan, as well as set new upwards EBITDA and net ordinary income targets for 2022. Likewise, we can confirm our three-year minimum DPS policy, revising upwards our minimum DPS targets for both 2020 and 2021 on last year’s plan and setting a rising new minimum DPS at 40 eurocents in 2022.”

-----

Earlier: