IMF FOR MEXICO: $61 BLN

IMF - November 25, 2019 - On November 22, 2019, the Executive Board of the International Monetary Fund (IMF) approved a successor two-year arrrangement for Mexico under the Flexible Credit Line (FCL) in an amount equivalent to SDR 44.5635 billion (about US$61 billion [1] ) and canceled the previous arrangement. The Mexican authorities stated their intention to treat the arrangement as precautionary.

The previous two-year FCL arrangement for Mexico was approved by the IMF’s Executive Board on November 29, 2017 for an original access amount equivalent to SDR 62.3889 billion (about US$86 billion) (see Press Release No. 17/459 ), which, at the request of the Mexican authorities, was reduced to SDR 53.4762 billion (about US$74 billion) on November 26, 2018 (see Press Release No. 18/440 ). Mexico’s first FCL arrangement was approved on April 17, 2009 (see Press Release No. 09/130 ), and was renewed on March 25, 2010 (see Press Release No. 10/114 ), January 10, 2011 (see Press Release No. 11/4 ), November 30, 2012 (see Press Release No. 12/465 ), November 26, 2014 (see Press Release No. 14/543 ), and May 27, 2016 (see Press Release No. 16/250 ).

Following the Executive Board’s discussion on Mexico, Mr. David Lipton, First Deputy Managing Director and Acting Chair, made the following statement:

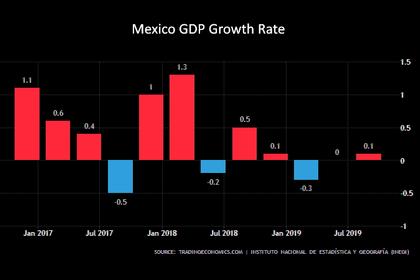

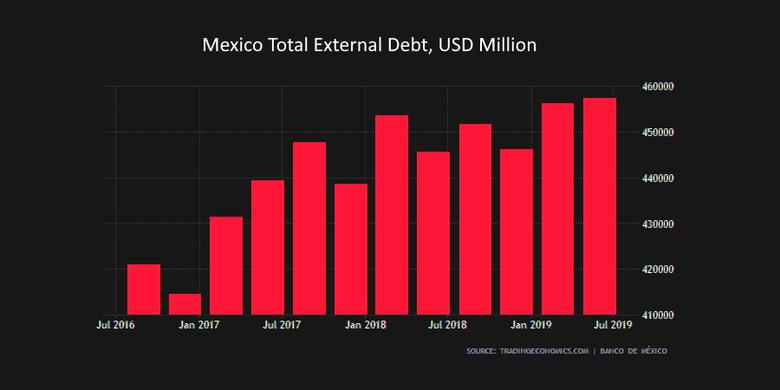

“Very strong policies and policy frameworks have helped Mexico navigate a complex external environment. Fiscal policy has stemmed the rise in the public debt ratio in the past two years; a very tight monetary policy stance has helped reduce headline inflation to the central bank’s target; and financial supervision and regulation are strong. The flexible exchange rate is playing a key role in the economy’s adjustment to external shocks.

“The Mexican economy, nonetheless, remains exposed to external risks, including renewed volatility in global financial markets, increased risk premia, and a sharp pull-back of capital from emerging markets, as well as continued uncertainty about Mexico’s trade relations with the United States. The new arrangement under the Flexible Credit Line (FCL) will continue to play an important role in supporting the authorities’ macroeconomic strategy by providing insurance against tail risks and bolstering market confidence.

“The authorities have a successful record of sound policy management and are firmly committed to maintaining prudent policies going forward. They intend to continue to treat the arrangement as precautionary. The lower level of access is appropriate and consistent with the authorities’ strategy to gradually phase out Mexico’s use of the facility. As external risks facing Mexico recede, they intend to request a further reduction in access under the FCL in the future.”

[1] Amount based on the Special Drawing Right (SDR) quote of November 21, 2019 of 1 USD=SDR0.72635.

-----

Earlier: