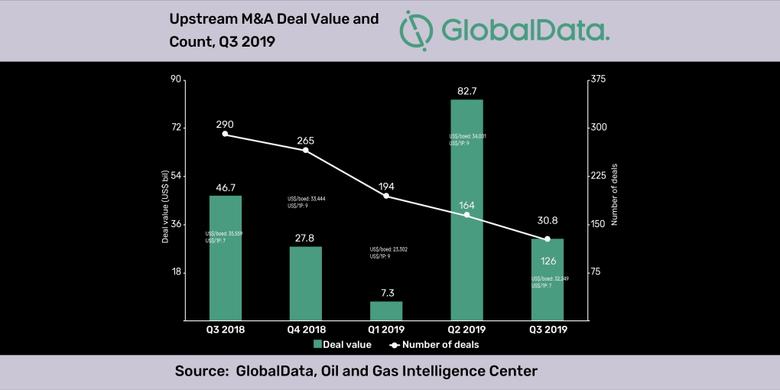

OIL, GAS UPSTREAM M&A: $63.4 BLN

MEOG - Global merger and acquisitions (M&A) and raising activity in the oil and gas upstream sector totaled $63.4bn in Q3 2019, representing a 50% decrease from the $126.8bn in M&A and capital raising deals announced in Q3 2019. By volume, the number of deals decreased by 30% from 338 in Q2 to 269 in Q3, says GlobalData, a leading data and analytics company.

A total of 90 M&A deals, with a combined value of $13.7bn, were recorded in the conventional segment, and 36 deals, with a combined value of $17.1bn, were recorded in the unconventional segment in Q3 2019.

Praveen Kumar Karnati, Oil and Gas Analyst at GlobalData, comments: "Capital raising, through equity offerings witnessed a substantial decrease in deal values, recording $1.2bn in Q3, compared with $14.5bn in Q2. The number of equity offering deals also decreased by 17% from 109 in Q2 to 90 deals in Q3.

"Capital raising, through debt offerings, registered a decrease of 17% in the number of deals and a marginal increase in deal value with 43 deals, of a combined value of $30bn, in Q3, compared with 52 deals, of a combined value of $29.1bn, in the previous quarter."

Ten private equity/venture capital deals, with a combined value of $1.4bn, were recorded in the upstream industry in Q3, compared with 13 deals, with a combined value of $504.2m, in Q2.

The top M&A deal of Q3 was BP's agreement to sell its entire upstream and midstream business in Alaska to Hilcorp Energy for a consideration of $5.6bn. Following the transaction, BP will exit from Alaska oil and gas business.

The upstream assets include interests in Prudhoe Bay (26%), Milne Point (50%), Point Thomson (32%), Liberty project (50%) and non-operating interests in exploration leases in Arctic National Wildlife Refuge.

Karnati adds: "The midstream assets include interests in Trans Alaska Pipeline System (49%), Alyeska Pipeline Service Company (49%), Point Thomson Export Pipeline (32%) and Milne Point Pipeline (50%). The other interests include Prince William Sound Oil Spill Response Corporation (25%).

"BP's net oil production from Alaska in 2019 is expected to average almost 74,000 barrels per day (bd).

Baker Botts is acting as legal advisor to BP and Kirkland & Ellis is acting as legal advisor to Hilcorp in the transaction. The transaction is in line with Hilcorp's historical strategy of acquiring mature fields from major oil companies and slashing costs."

One of the top capital raising deals of Q3 2019 was Petroleos Mexicanos' public offering of notes for gross proceeds of $7.5bn. BofA Securities, Citigroup Global Markets, Credit Agricole Securities (USA), Goldman Sachs & Co, HSBC Securities (USA), J.P. Morgan Securities and Mizuho Securities USA acted as joint book running managers to the company for the offering. The company intends to use the net proceeds from the offering for its general corporate purposes, including the repayment of short-term loans.

-----

Earlier: