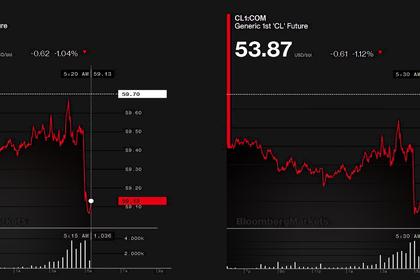

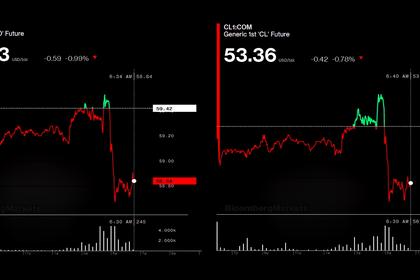

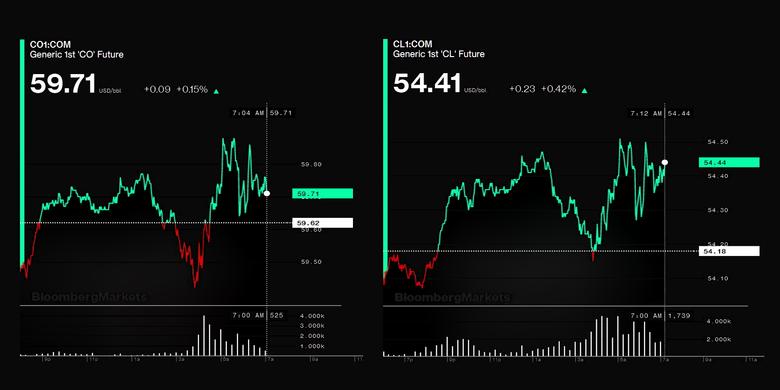

OIL PRICE: NEAR $60 ANEW

REUTERS - Oil prices rose on Friday but remained on track for a weekly loss as a surprise bounce in Chinese manufacturing activity calmed investors' worries about progress in U.S.-China trade talks.

Brent crude was up 27 cents, or 0.4%, at $59.89 a barrel by 0930 GMT, on course for a drop of about 3.4% for the week.

West Texas Intermediate crude rose 32 cents to $54.50 a barrel, which would leave it with a weekly loss of more than 3.8%.

A Reuters survey showed that oil prices are expected to remain under pressure this year and next. The poll of 51 economists and analysts forecast Brent crude would average $64.16 a barrel in 2019 and $62.38 next year.

Another Reuters survey found output from OPEC members recovered in October from an eight-year low, with a rapid recovery in Saudi Arabia's production from September attacks on its oil infrastructure offsetting losses in Ecuador and voluntary curbs under an international supply pact.

Worries about global economic growth, along with oil demand, continue to haunt the market as the United States and China struggle to end a 16-month dispute that has hit trade between the world's top two economies.

"There's renewed doubts about a U.S.-China trade deal ... and at the same time we've had inventory lifts quite a lot more than expected at the crude level out of the U.S. this week," said Lachlan Shaw, head of commodity research at National Australia Bank.

However, China's factory activity unexpectedly expanded at the fastest pace since 2017, raising optimism over the health of the world's second-largest economy.

"The manufacturing data appears to highlight the resilience of the Chinese economy amid global trade tensions," said Han Tan, market analyst at FXTM.

Still, manufacturing activity in North Asia contracted, with Japan's sinking to a more than three-year low in October on shrinking new orders and output. Activity in South Korea and Taiwan also shrank as companies bore the brunt of slumping demand across the globe.

U.S. crude inventories rose by 5.7 million barrels in the week to Oct. 25, dwarfing analyst expectations for an increase of just 494,000 barrels.

U.S. crude production soared nearly 600,000 barrels per day in August to a record of 12.4 million, buoyed by a 30% increase in Gulf of Mexico output, government data released on Thursday showed.

-----

Earlier: