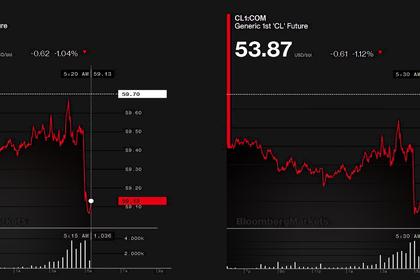

OIL PRICE: NOT ABOVE $62

REUTERS - Crude oil futures fell on Friday amid lingering uncertainty on whether, and when, the United States and China will agree a long-awaited deal to end their bitter trade dispute, the gloom compounded by rising crude inventories in the United States.

Brent crude, the global benchmark, was down 44 cents, or 0.7%, at $61.85 a barrel by 0739 GMT, after gaining 0.9% in the previous session. Brent is set to rise 0.4% for the week.

U.S. West Texas Intermediate (WTI) crude was down 50 cents, or 0.9%, at $56.65 a barrel. The contract rose 1.4% on Thursday and is set to rise 0.8% for the week.

The trade war between the world's two biggest economies has slowed economic growth around the world and prompted analysts to lower forecasts for oil demand, raising concerns that a supply glut could develop in 2020.

On Thursday, the Chinese commerce ministry said the two countries have agreed in the past two weeks to cancel trade tariffs in different phases, without giving a timeline.

But that comment was shrouded in doubt soon after when Reuters reported that the plan faces stiff internal opposition in the U.S. administration.

"Oil is in pause mode as traders await more details on the trade talks," said Stephen Innes, Asia Pacific market strategist at AxiTrader.

Also concentrating minds among sector watchers were remarks by OPEC Secretary-General Mohammad Barkindo this week that he was more optimistic about the outlook for 2020 because of potentially positive developments on trade disputes, appearing to downplay any need to cut output more deeply.

A deal between the Organization of the Petroleum Exporting Countries (OPEC) and allies, such as Russia, is limiting supplies until March next year. The producers will meet on Dec. 5-6 in Vienna to review that policy.

Barkindo's comments are "spooking the market, especially in the face of the seemingly never-ending run of U.S. inventory builds," said AxiTrader's Innes.

U.S. crude oil stockpiles rose sharply last week as refineries cut output and exports dropped, while refined products extended a multi-week drawdown, the Energy Information Administration said on Wednesday.

Stocks at the Cushing, Oklahoma, delivery hub for WTI rose by 1.7 million barrels, the EIA said.

-----

Earlier: