OIL PRICES 2019-20: $60-$58

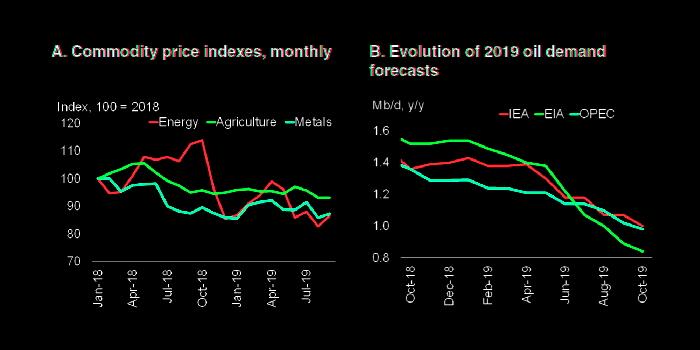

WBG - October 29, 2019 – Energy and metal commodity prices are expected to continue to fall in 2020 following sharp declines in 2019 on a weaker outlook for global growth and consequent softer demand, the World Bank said in its October Commodity Markets Outlook.

"Slowing demand for commodities presents a challenge for exporters and an opportunity for importers," said Ceyla Pazarbasioglu, World Bank Group Vice President for Equitable Growth, Finance & Institutions. "As both of them switch from using one commodity to another due to price fluctuation and technological advance, it will be important that these resources be produced and consumed in an environmentally sustainable way."

Download the October Commodity Markets Outlook

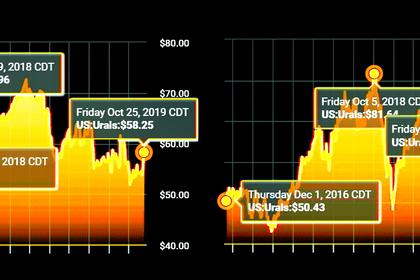

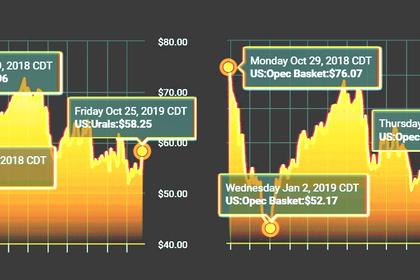

Crude oil prices are projected to average US$60 per barrel in 2019 and weaken to US$58 per barrel in 2020. These forecasts are US$6 per barrel and US$7 per barrel lower than anticipated in the April Commodity Markets Outlook. In line with the slowdown in global growth, oil consumption is now expected to rise at a much slower pace than earlier forecasts and increase only modestly next year. A sharper-than expected economic downturn poses the greatest risk to the oil price forecast. More broadly, energy prices, which also include natural gas and coal, are expected to average almost 15 percent lower in 2019 than in 2018, and to continue to decline in 2020.

Metal prices are also projected to fall 5 percent in 2019 and continue to slide next year as slowing global demand weighs heavily on the market. Precious metals, which have risen sharply this year, are anticipated to make further gains in 2020 in response to heightened global uncertainty and accommodative monetary policies. Agriculture prices are anticipated to decline this year but stabilize in 2020.

A resolution of trade tensions could push up the prices of some agricultural commodities, such as soybeans and corn, while lower energy prices could lower fuel costs and fertilizer prices, reducing prices of energy-intensive crops such as oilseeds.

A special section in the report looks at what drives consumers to substitute one commodity for another, such as natural gas for coal, or paper instead of plastic. These substitutions are driven by technological innovation and changes in commodity prices. This phenomenon highlights the risks to the long-term growth prospects of countries that rely heavily on a narrow group of commodity exports.

"Depending on export revenues from a small set of commodities makes commodity-exporting developing economies vulnerable because demand surges and higher prices could induce innovation and facilitate substitution among commodities," said Ayhan Kose, Director of the World Bank's Prospects Group.

Another special section looks at the impact of the September 14 attacks on oil production facilities in Saudi Arabia. The market response was short-lived by historical standards because of the swift restoration of production, increasingly diversified sources of oil supplies, including shale oil, and weakening demand. However, it was a reminder that the global oil market remains dependent on several critical infrastructure and transport bottlenecks that may be vulnerable to disruption.

-----

Earlier: