OPEC'S SHARE WILL DOWN

REUTERS - OPEC will supply a diminishing amount of oil in the next five years as output of U.S. shale and other rival sources expands, the exporter group said, despite a growing appetite for energy fed by global economic expansion.

OPEC's production of crude oil and other liquids is expected to decline to 32.8 million barrels per day (bpd) by 2024, the group said in its 2019 World Oil Outlook published on Tuesday. That compares with 35 million bpd in 2019.

Rising climate activism in the West and widening use of alternative fuels are putting the strength of long-term oil demand under more scrutiny. The Organization of the Petroleum Exporting Countries cut its medium- and long-term oil demand forecasts in the report.

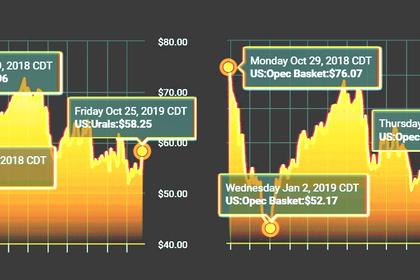

OPEC supply has been falling in the last few years under a pact with Russia and other non-members to support the market. The resulting higher oil prices have bolstered non-OPEC output and OPEC is expected to restrain output in 2020.

"Non-OPEC supply prospects have been revised up sharply, as U.S. tight oil, in particular, has again outperformed expectations," OPEC Secretary-General Mohammad Barkindo wrote in the foreword of the report, using another term for shale.

The United States has pushed its oil output to record highs due to a shale revolution that allowed new technology to tap reserves previously deemed uneconomic. OPEC supply has declined as a result of voluntary curbs and U.S. sanctions on OPEC members Venezuela and Iran.

Vienna-based OPEC expects supply of U.S. tight oil to reach 16.9 million bpd in 2024 from 12.0 million bpd in 2019, although the expansion will slow and peak at 17.4 million bpd in 2029.

LOWER DEMAND FORECAST

OPEC, a 14-country, Middle East-dominated producer group that counts world No. 1 oil exporter Saudi Arabia, Iraq and Iran among its members, cut its forecast for global oil demand over the medium term.

The organization, which pumps almost a third of global oil supply, now sees oil consumption in 2023 reaching 103.9 million bpd, down from 104.5 million bpd in last year's report.

Longer-term, oil demand is expected to increase by 12 million bpd to reach 110.6 million bpd by 2040, also lower than last year's forecast.

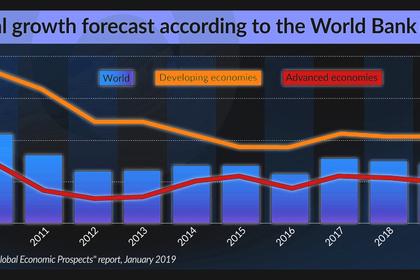

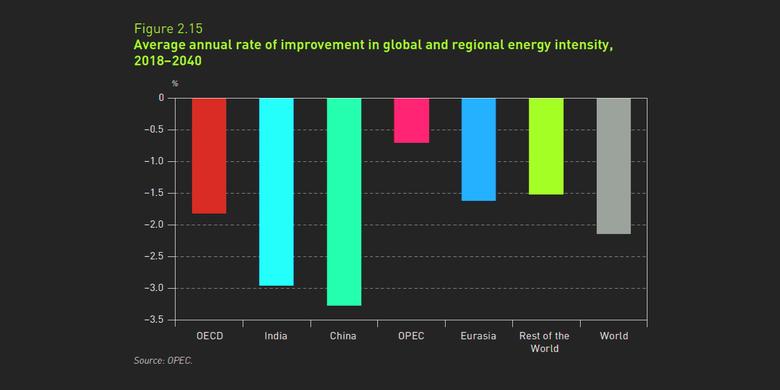

OPEC cited a recent lowering of economic growth forecasts plus efficiency gains and use of other fuels for the lower demand outlook. It said it expected oil use in industrialized countries, or those in the Organisation for Economic Cooperation and Development, to decline after 2020.

Electric cars, while still a very small share of the global fleet, are "gaining momentum", OPEC said. They will account for nearly half of all new passenger cars in OECD countries by 2040, almost a quarter of those in China and more than 26% globally.

OPEC still hopes to boost production in coming decades thanks to its abundant and cheap-to-extract reserves. It expects supply from non-OPEC producers to hit a high of 72.6 million bpd in 2026 and fall to 66.4 million bpd by 2040.

"In the long term," Barkindo wrote, "it is OPEC that will be expected to meet the majority of oil demand requirements."

-----

Earlier: