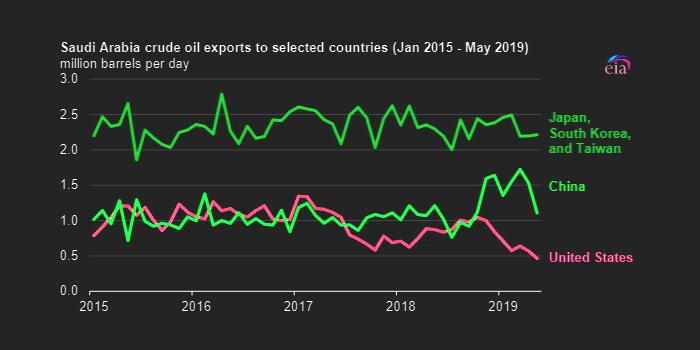

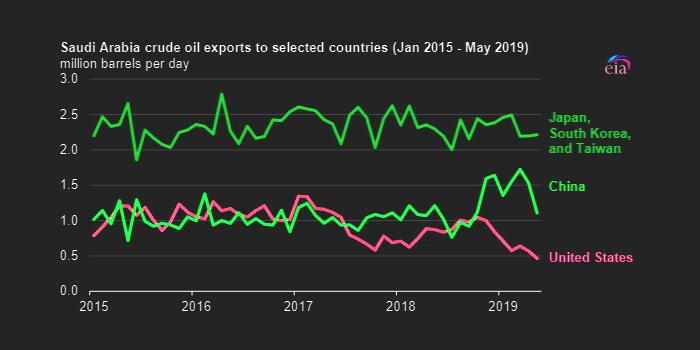

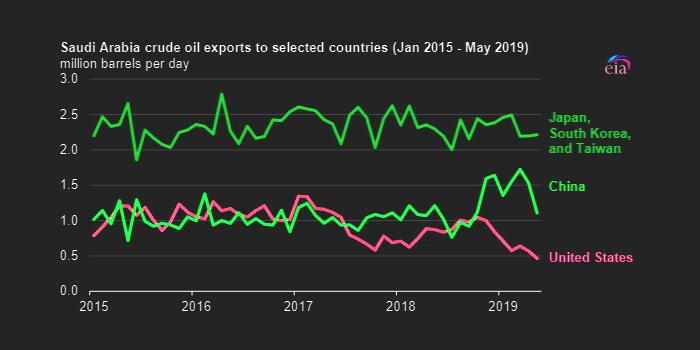

SAUDI ARAMCO'S OIL FOR CHINA: +151 TBD

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

SAUDI ARAMCO'S OIL FOR CHINA: +151 TBD

SAUDI ARAMCO - SHANGHAI, CHINA, November 07, 2019 - Saudi Aramco signed crude oil sales agreements for 2020 with five Chinese customers, increasing total volume by 151,000 barrels per day compared to their 2019 supply contracts. These new sales agreements further solidify the Company's position as China's top crude supplier.

These five new agreements were signed separately on the sideline of the second China International Import Expo (CIIE), the largest trade fair held under the patronage of Chinese President Xi Jinping.

Commenting on the newly signed agreements, Ahmed Al-Subaey, Vice President of Marketing, Sales and Supply Planning, said, "The new agreements signed at CIIE reflect Chinese customers' continued faith in Saudi Aramco's supply stability and operational excellence. Likewise, the new agreements demonstrate our continued commitment to the world's fastest-growing oil market."

This is the second consecutive year that Saudi Aramco has attended CIIE. Last year, the Company signed a number of crude oil sales agreements with Chinese customers that helped to propel Chinese crude oil sales in 2019 to new levels. These agreements reflect Saudi Aramco's efforts to strengthen its position in China and support the country's growth in refining and petrochemicals, as well as overall energy security.

-----

Earlier:

2019, November, 7, 13:41:48

SAUDI ARAMCO IPO

Saudi Aramco’s vision is to be the world’s pre-eminent integrated energy and chemicals company.

2019, November, 5, 14:25:00

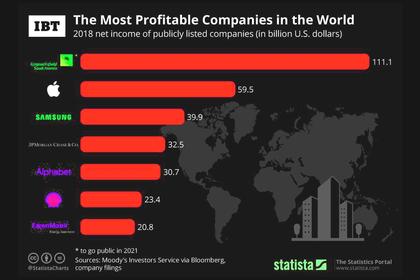

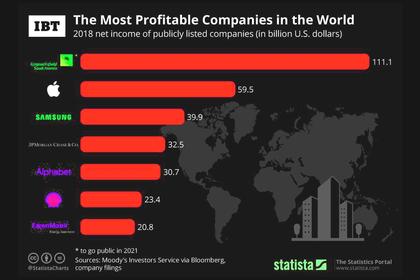

SAUDI ARAMCO'S PROFIT $68.2 BLN

Saudi Aramco earned net income of $68.2 billion compared with $83.1 billion for the same period a year ago, it said in a statement posted on its website. The state company’s revenue slipped to $217 billion from $233 billion.

2019, November, 5, 14:20:00

SAUDI ARAMCO'S VALUE $1.5 TLN

Bankers have told the Saudi government that investors will likely value the company at around $1.5 trillion, somewhat below the $2 trillion valuation by Saudi Crown Prince Mohammad Bin Salman when he first floated the idea of an IPO nearly four years ago.

All Publications »

Tags:

SAUDI,

ARAMCO,

CHINA