SAUDI'S OIL FOR CHINA UP BY 76%

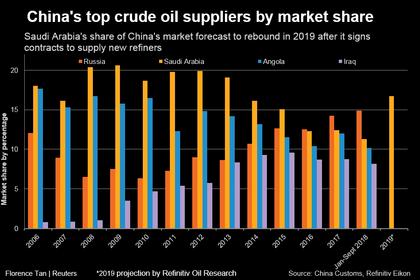

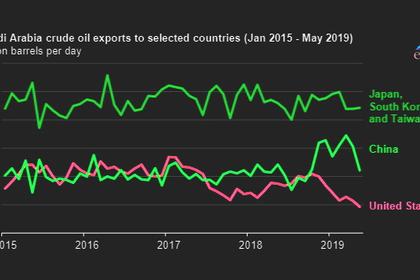

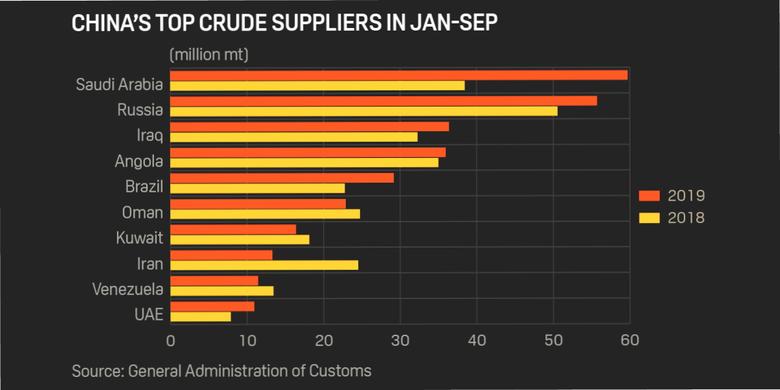

REUTERS - NOVEMBER 25, 2019 - China's crude oil imports from Saudi Arabia rose 76.3% in October, boosted by demand from new refiners, with the kingdom retaining its position as the top supplier to the world's biggest oil importer.

Saudi shipments grew to 8.41 million tonnes, or 1.98 million barrels per day (bpd), compared with 1.74 million bpd in September and 1.12 million bpd in same period last year, data from the General Administration of Customs showed on Monday.

Two new integrated independent refineries, Hengli Petrochemical Co in the north and Zhejiang Petrochemical in the south, have supported crude arrivals from Saudi.

The impact of a drone and missile attack on Saudi oil-processing plants on Sept. 14 did not limit October oil flows, as Saudi Aramco drew on inventories to maintain supplies to customers.

Analysts from the Refinitiv Oil Research team expect the supply disruption in Saudi may start to show in cargo arrivals in November.

Chinese customs did not give a number for Venezuelan crude imports but analysts expect the figure to have fallen to zero last month as buyers stopped taking oil from the South American exporter amid sanctions imposed by the United States.

Imports from Iran remained stable at 532,790 tonnes in October, just below 538,878 tonnes in September, despite persistent tensions between Washington and Tehran.

China's Malaysian crude imports in October doubled from the last year's level, reaching 1.95 million tonnes.

Shipments from Malaysia, such as Mal blend and Singma blend, are typically a mixture of Venezuelan, Iranian and other grades, according to Emma Li, senior oil analyst with Refinitiv.

"Direct imports from Venezuela have been cut to zero but (demand for) Mal blend remains strong, which is reflected in the Malaysia number," said Li.

The Refinitiv research team also expects Malaysian arrivals to reach a record as a result of U.S. sanctions on exports of Iranian and Venezuelan crude.

Imports of U.S. crude in October reached 908,422 tonnes, up from 517,982 tonnes in September.

Arrivals of Russian crude rose to 6.97 million tonnes from 6.31 million tonnes in previous month.

-----

Earlier: