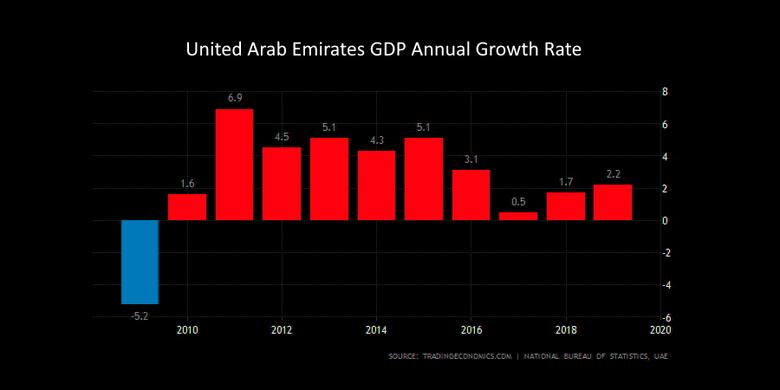

UAE GDP GROWTH 2.5%

IMF - November 6, 2019 - An IMF team led by Mr. Koshy Mathai visited the UAE from October 22 to November 5, 2019, to conduct discussions for the 2019 Article IV Consultation. Upon conclusion of the visit, Mr. Mathai issued the following statement:

"Following a challenging period, the economy is recovering. Non-oil growth could exceed 1 percent in 2019 and pick up to around 3 percent next year, the fastest since 2016, on the back of Expo 2020 and fiscal stimulus. Overall GDP growth would register 2.5 percent in 2020.

"Sustaining robust non-oil growth after Expo 2020 remains a key priority, made all the more pressing over the longer term by the likelihood that global oil demand will slow in the face of technological advances as well as policy responses to climate change. Against this context, the IMF team discussed two key policy priorities with the authorities: (i) promoting the growth of the non-oil private sector, including small and medium enterprises (SMEs); and (ii) strengthening fiscal frameworks to ensure both sufficient saving of oil wealth for future generations and smoothing of short-term fluctuations.

"In the first area, the authorities have already taken a number of important steps, including adopting a foreign direct investment (FDI) law allowing 100-percent foreign ownership in selected sectors, and reducing or eliminating fees and penalties.

"The mission welcomes the authorities' steps to implement a comprehensive national SME development strategy. Particularly important steps in this area would include: (i) lowering startup costs; (ii) operationalizing the new insolvency framework; and (iii) promoting greater financial inclusion. The mission recommends establishing a single agency responsible for SME promotion, with any possible costs to the budget recorded transparently.

"Further strengthening and developing the financial sector should support private-sector development while mitigating risk. Real-estate and construction exposures should continue to be under prudential control, noncompliant large exposures brought down to below prudential limits, a track record of enforcement under the new anti-money laundering/combating the financing of terrorism (AML/CFT) framework established, fintech harnessed—subject to stability considerations—to improve intermediation and financial inclusion, and a benchmark yield curve developed. The mission welcomes the authorities' request for a Financial Sector Assessment Program (FSAP) once the new banking law has been fully implemented.

"All these measures should be complemented by broader reform efforts. In particular, reducing the footprint of government-related entities (GREs) in nonstrategic sectors will promote competition and enhance private-sector growth. In addition, in line with the authorities' Emiratization agenda, incentives for private employment should be strengthened and public-sector compensation and benefits addressed.

"Turning to fiscal policy, a fiscal framework is needed that enshrines a commitment to savings, which are currently below the level required to preserve wealth for future generations. A balance between short- and long-term objectives, however, is critical, and given current economic conditions, the authorities' existing stimulus is appropriate. Developing transparent, rules-based fiscal frameworks can help ensure a balancing of objectives, and the mission welcomes the steps taken to enhance monetary and fiscal coordination. These frameworks should be centered around long-term fiscal anchors, while allowing the flexibility to smooth short-run oil price fluctuations as well as the non-oil business cycle. The mission recommends that fiscal frameworks be complemented with better monitoring and analysis of GRE-related contingent liabilities, and that supportive institutions like independent and technocratic fiscal councils be established to provide impartial advice on economic conditions and ensure proper implementation of the frameworks.

"The IMF team would like to express its appreciation to the authorities and other stakeholders for their hospitality and thoughtful discussions."

-----

Earlier: