2020: U.S. LNG DIFFICULTIES

PLATTS - On the cusp of 2020, a handful of proposed US liquefaction projects have commercial momentum toward final investment decisions, while others languish.

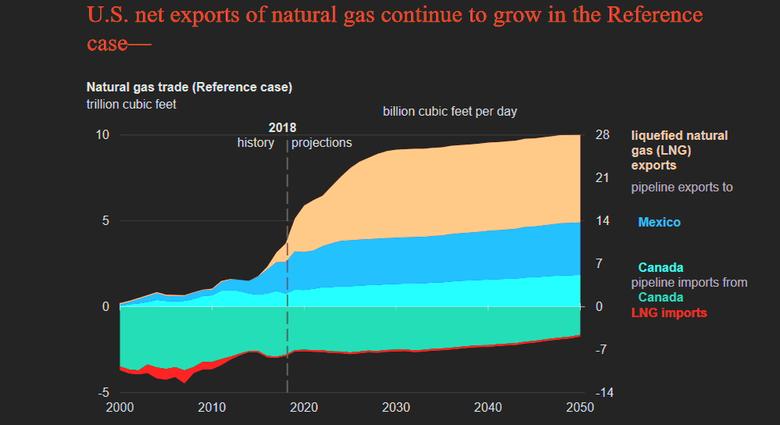

This was supposed to be a breakout year for US LNG export projects getting commercially sanctioned. But with 2019 wrapping up, just two new export terminals and an additional train at an existing facility made it over the line to construction. That means 2020 could be a shakeout year for the dozen or so projects actively being developed on the Gulf, Atlantic and Pacific coasts, amid a growing consensus among market observers that the window for independent projects to be advanced to construction is rapidly closing.

"It's getting late. It's getting dark. It's much tougher," said Michael Webber, an independent LNG analyst and managing partner of Webber Research & Advisory. "Liquidity issues are going to have real teeth to them next year. The rubber will meet the road for a lot of these projects."

NextDecade's Rio Grande LNG in Texas, Tellurian's Driftwood LNG in Louisiana and Sempra Energy's Port Arthur LNG in Texas all have firm equity or offtake deals supporting their projects. But the commercial activity, at least so far, has been insufficient for the three projects to advance to positive final investment decisions.

The picture is bleaker for several other projects - Shell- and Energy Transfer-backed Lake Charles LNG in Louisiana, Exelon-backed Annova LNG in Texas, LNG Limited's Magnolia LNG in Louisiana, Pembina's Jordan Cove LNG in Oregon, Kinder Morgan's Gulf LNG in Mississippi and Texas LNG in Brownsville have not announced any firm long-term contracts tied to their proposed supplies.

| North American second-wave LNG project outlook | ||||

| Facility | Train | Nameplate (mtpa) | Nameplate (Bcf/d) | Start date |

| Calcasieu Pass LNG | 1-9 | 10 | 1.3 | 1/1/2023 |

| Sabine Pass | 6 | 4.5 | 0.6 | 7/1/2023 |

| Woodfibre LNG | 1 | 2.1 | 0.3 | 1/1/2024 |

| Golden Pass | 1 | 5.2 | 0.7 | 7/1/2024 |

| LNG Canada | 1 | 6 | 0.8 | 10/1/2024 |

| Golden Pass | 2 | 5.2 | 0.7 | 3/1/2025 |

| LNG Canada | 2 | 6 | 0.8 | 6/1/2025 |

| Golden Pass | 3 | 5.2 | 0.7 | 1/1/2026 |

| * List includes projects that have FIDs or are expected by year's end | ||||

| Source: S&P Global Platts Analytics | ||||

As 2020 looms, developers face significant headwinds, including depressed global gas prices, oversupply concerns and the still unresolved US-China trade war. A recent initial agreement between the two countries to hold off on additional tariffs and roll back some existing tariffs did not bring any immediate relief to the LNG market.

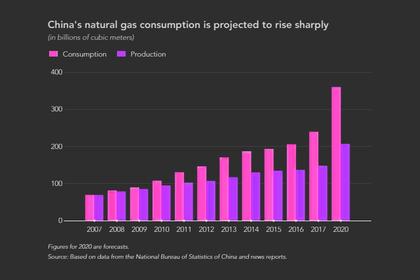

China's 25% tariff on imports of US LNG remains. Amid that backdrop, no US LNG has been delivered to China since March, and long-term contracting between US developers and Chinese counterparties is effectively stalled, though some executives are confident in future prospects.

"I think China will be buying LNG from the US," said Tellurian CEO Meg Gentle. "I don't view them as reacting against the 25% tariffs. I see them as holding their LNG commitments until there is agreement on a lot of things. Part of the Chinese side of the preliminarily announced Phase 1 deal is buying additional goods from the US. I view movement forward on US-China trade a positive for energy markets."

In the meantime, the overall commercial crunch has caused a number of US developers to push their targets for sanctioning their projects until 2020 or 2021, even as regulators have been signing off on certificate approvals with increasing speed. Some developers have stopped talking about FID altogether.

US LNG project developers tout various advantages in their effort to stand out in a crowded field, from low costs to innovative pricing models and equity investment partnerships. But complications in short-term contracting as a result of market volatility and trade uncertainty can deter buyers from entering supply agreements with US projects, favoring projects that are backed by majors and capitalized.

GLOBAL TRENDS

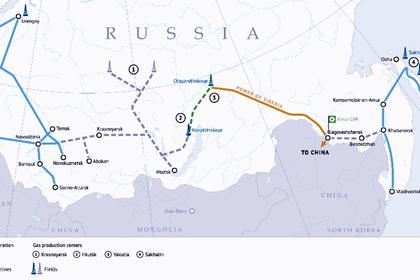

Globally, a series of major LNG projects took a different approach in recent years that saw deep-pocketed project sponsors take FID without firm offtake agreements. That has given projects in Canada, Russia and elsewhere a speed-to-market advantage The only US project to take that route, so far, has been Golden Pass LNG in Texas, which is backed by ExxonMobil and Qatar Petroleum.

Amid the contracting challenges in the US, some established players are moving forward with additional liquefaction trains with less offtake sold upfront than for earlier trains. That was the case when Cheniere Energy greenlighted a sixth train at its Sabine Pass facility in Louisiana in June.

The trend could make it more difficult for the market to forecast which new US projects make it to the finish line and which ones do not.

"If there is going to be a bright spot next year, it's going to be a bow getting tied on projects that were getting close to the goal line this year," Webber said. "It will be projects that get done not because the market wants that gas today, but because it has nowhere else to go."

-----

Earlier: