ARAMCO'S IPO $25.6 BLN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

ARAMCO'S IPO $25.6 BLN

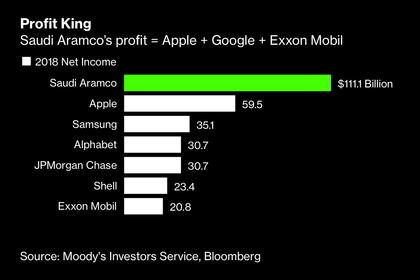

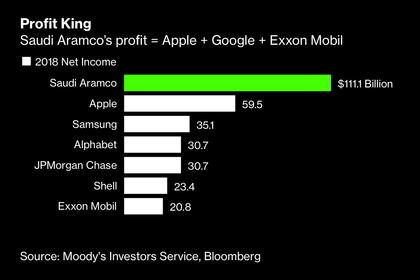

MEOG - Saudi Aramco announced that in its initial public offering (IPO) on the Saudi exchange (Tadawul), it would price its shares at $8.53 (SAR 32) per share, with 3bn shares to be listed, comprising 1.5% of the company's share capital.

This would make Aramco's listing the world's largest, beating Alibaba's $25bn IPO at $25.6bn. The company initially said it would price shares between $8 (SAR 30) and $8.53 (SAR 32), eventually settling on the higher end of the range.

This means the company is valued at $1.7trn, shy of Crown Prince Mohammed bin Salman's $2trn valuation. Still, it will be the world's most valuable publicly traded company once official listed.

Goldman Sachs Group is the share stabilising manager, and can therefore put in action a greenshoe option of 450mn shares up to 30 days after trading begins. That means the IPO could net up to $29.4bn.

Proceeds will go to the Public Investment Fund, the crown prince's primary investment vehicle and driver of economic diversification.

-----

Earlier:

2019, December, 4, 11:50:00

SAUDI ARAMCO IPO $44.3 BLN

In total, the Saudi government plans to sell 0.5% of Aramco to individual investors and the remainder to domestic institutions and international firms registered in the kingdom, known as qualified foreign investors.

2019, November, 18, 13:15:00

SAUDI ARAMCO VALUATION $1.7 TLN

Crown Prince Mohammed bin Salman had been seeking a valuation for the world's biggest oil and gas company of $2 trillion. Saudi Arabia's government currently owns all of Saudi Aramco's 200 billion shares outstanding.

All Publications »

Tags:

SAUDI,

ARAMCO,

IPO