DEAD ENDS IN THE ENERGY TRANSITION

ENERGYCENTRAL - How Not-to-Succeed in the Next Decade of Energy Transition

This post was first published at http://benoit.marcoux.ca/blog/how-not-to-succeed-in-the-next-decade-of-energy-transition/.

The 2020s promise to be a momentous time for the electricity industry, and I wanted to take some time to reflect on what businesses might need to succeed through the energy industry transition. I might have a privileged perspective on this, having worked with utilities, vendors and investors, first in the IT and telecom industries as they went through their transitions, and then mostly in the electricity industry for the last 20 years. This does not mean that I can’t be wrong (I know – I’ve been wrong many times), but perhaps my views will help others be right.

I’ve structured this post as a series of “don’ts”, based in part on actual IT and telecom examples that I’ve lived through – I’ve put these examples in italic, but I left the names out to protect the innocents. I found that many businesses have short-term views that lead them down dead-end paths, and I might be more useful in showing known pitfalls than trying to predict the future.

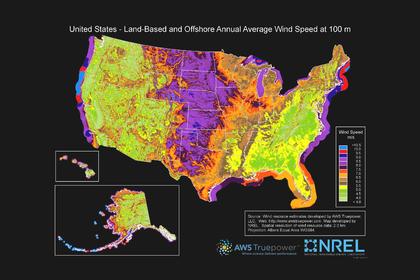

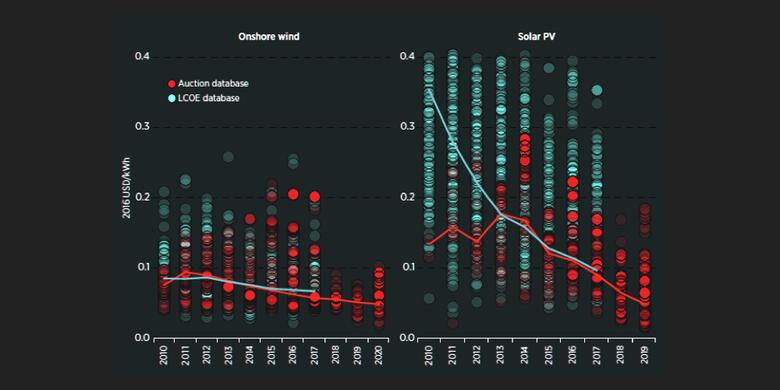

Don’t Fight a Declining Cost Curve

The IT, telecom and, now, electricity industries are all seeing declining cost curves. The best known one is Moore’s Law, the observation that the density of integrated circuits (and hence the cost of computing) halves every 2 years. Moore’s Law is nearly 60 years old and still strong. It gave us iPhones more powerful now than supercomputers of a generation ago, even though my iPhone ends up in my pocket most of the time, doing nothing. These days, the electricity industry sees the cost of wind and solar energy as well as that of electricity storage dropping at a rate of 10% to 20% per year, with no end in sight.[1]

In IT, telecom and, now, electricity, this also leads toward zero marginal cost, the situation where producing an additional unit (a Google search, a FaceTime call or a kWh) costs nothing (or almost nothing).

During the IT and telecom transitions, many startups proposed solutions to optimize the use of (still) expensive information processing assets. Some sought to extend the life of previous generations of equipment (like a PBX) by adding some intelligence to it (a virtual attendant), while others were dependent on a price point (like dollars per minutes for overseas calls) that simply collapsed (calls are essentially free now).

If your business case depends on the cost of energy or the cost of storage remaining where they are, ask yourself, what if the cost goes down 50%? That’s only 3 years of decline at 20%/year. After 10 years, costs will be only 10% of what they are now. Can you survive with near-zero marginal costs? If your solution aims to optimize capital costs, will it matter in a few years? Or, will people just do as they do now, with a do-nothing iPhone supercomputer in their pocket?

Don’t Think That Transition Will Go 2% a Year Over 50 Years

Phone companies were depreciating their copper wires and switches over decades. Phone utilities were highly regarded companies, imbued with a duty for public service and providing lifelong employment to their loyal employees. Service was considered inflexible, but everyone could afford a local line, which was cross subsidized by expensive long-distance calls and business lines. Things were simple and predictable.

In 1980, McKinsey & Company was commissioned by AT&T (whose Bell Labs had invented cellular telephony) to forecast cell phone penetration in the U.S. by 2000. The consultant predicted 900,000 cell phone subscribers in 2000 – the actual figure is 109,000,000. Based on this legendary mistake, AT&T decided there was not much future to these toys. A decade later, AT&T had to acquire McCaw Cellular for $12.6 Billion.[2]

In 1998, I was operating the largest international IP telephony network in the world, although it was bleeding edge and tiny in comparison to AT&T and other large traditional carriers. Traditional carriers were waiting for IP telephony to fail, as the sound quality was poor, it was not efficiently using the available bandwidth, it was illegal in many countries, etc. The history did not play out as expected. In 2003, Skype was launched, the iPhone, in 2006. Today, you can’t make a phone call anymore that is not IP somewhere along its path.

I’m seeing the same lack of vision in energy industry. For example, the International Energy Agency (IEA) is famous for being wrong, year after year, in lowballing the rise of solar and wind energy in its scenarios.[3]

Another example is the rise of electric vehicles. There are about 77 million light-duty vehicles sold in the world, and this number is flat or slightly declining.[4] Of these, about 2 million electric vehicles were sold in 2019, but the number of EVs sold in increasing 50% every year.[5] In other words, the number of internal combustion vehicles is clearly decreasing and the growth is only coming from EVs. Looking at their dashboards, car manufacturers are quickly reducing their investment in developing internal combustion vehicles, especially engines.[6] Disinvestment in upstream activity means that internal combustion vehicles will fall behind newer EVs and become less and less appealing. It won’t take 50 years for most light-duty vehicles to be electric – a decade, perhaps.

Don’t Count on Regulatory Barriers for Protection

Telecom carriers fought deregulation and competition, teeth and nails. Back in the 1950s, AT&T went to the US supreme court to prevent customer from using a plastic attachment on the mouthpiece of telephones to increase call privacy – it was called Hush-A-Phone. AT&T owned the telephones and forbid customers from using Hush-A-Phone. However, AT&T lost the court battle, and Hush-A-Phone was sold legally from then on. This landmark decision is seen as the start of telecom deregulation in North America.

The IP telephony network that I mentioned earlier was indeed illegal in some of the countries we operated in. It didn’t matter. We had plenty of partners willing to bypass local monopolies, even if illegal in their countries, and customers willing to make cheaper international calls, even if the quality was not always so great.

Regulatory barriers are only as strong as policy-makers make them. When constituents see an opportunity to save money or simply have choice, they pressure the policy-makers to change the rules – or elect new ones more attuned to moods of consumers. It’s just a matter of time.

Don’t Take Customers Nor Suppliers for Granted

In 1997, at a time when cellular phones were still a luxury and the Internet was still a novelty, an Angus-Reid survey of the Canadian public put Bell Canada #2 among most admired corporations in Canada[7], and it had been among the most trusted companies in Canada for decades. Yet, in 2017, Bell Canada ranked #291 in a University of Victoria brand trust survey[8]. People love their Apple or Samsung phones, are addicted to Facebook to stay in touch with friends, naturally turn to Google for any question, and use Microsoft Skype to see remote family members, but they now mostly hate their phone company.

Obviously, Bell is still around and making money, but one can only wonder how things could have been if Bell had played its hand differently. (In 1997, none of iPhones, Facebook, Google and Skype existed).

Suppliers to electric utilities should also listen to this lesson. Northern Telecom (Nortel), AT&T Bell Labs and Alcatel were among the large traditional equipment vendors to telephone utilities. However, a startup was founded in 1984, designing routing equipment for IT networks used in university networks. Over the years, it expanded into all sorts of datacom and telecom equipment – all telecom companies eventually standardized on this new vendor. Northern Telecom and the others went bankrupt or were merged and acquired to the point they could not be recognized. In the process, some telephone companies were left with unserviceable hardware.

This startup company is called Cisco Systems and is now the largest telecom vendor in the world.

The same pattern is playing out in electricity. On one hand, you have many utilities that do not understand that many customers want choice. On the other hand, you have vendors, like GE and ABB, that are in turmoil.

Will you be the future Google or Cisco of electricity? Or the next Nortel?

Don’t Follow the Herd

Full disclosure: I’m a career business consultant. Caveat Emptor.

The reason for this disclosure is that consultants are great at announcing bold trends that often do not pan out. There is a great herd mentality among consultants, and it carries over to their customers.

Twenty years ago, one of my clients was one of the early Application Service Providers, a business concept where small businesses could access shared personal computer applications over the Internet. The idea was to reduce the cost of maintaining software installed in PCs and to reduce the hardware requirements of PCs. This client was unknowingly fighting the declining cost curve of computers. It went bankrupt (and my last invoices were not paid).

The concept of application service providers was heavily promoted by consultancies like Gartner, who presented it as the future of business computing. I guess that Microsoft disagreed.

I see similar fast-fashion concepts going through the electricity industry. Walking the floor at the Distributech Conference in 2018, it was all about microgrids. In 2019, it was distributed energy resources. We will see what will be fashionable in January 2020.

My recommendation when you hear the same concept over and over again is asking yourself: is this a real trend or am I in an echo chamber? With many new consultants flocking to the electric utility industry – I call them tourists – , you can hear many concepts that are taken for truth but really too complex to be implemented or unlikely in the fragmented regulatory environment that we have.

Closing Thoughts

In the end, keep cool: sound engineering, good economics and great customer service will always win.

Which leads me to offer you this quote:

If I’ve heard correctly, all of you can see ahead to what the future holds but your knowledge of the present is not clear.

—DANTE, Inferno, Canto X

All this being said, have a great Holiday season and see you soon in 2020!

[1] See this previous blog posts, http://benoit.marcoux.ca/blog/lower-and-lower-energy-prices-from-wind-and-solar-pv/, for an in-depth discussion of cost decline in wind and solar energy, accessed 20191220.

[2] See https://skeptics.stackexchange.com/questions/38716/did-mckinsey-co-tell-att-there-was-no-market-for-mobile-phones, accessed 20191220.

[3] See this previous blog post, http://benoit.marcoux.ca/blog/wind-and-solar-pv-defied-expectations/, for a chart of how wrong the IEA has been, accessed 20191220.

[4] See https://www.statista.com/statistics/200002/international-car-sales-since-1990/, accessed 20191220.

[5] See https://www.iea.org/reports/global-ev-outlook-2019 and http://www.ev-volumes.com/country/total-world-plug-in-vehicle-volumes/, accessed 20191220.

[6] See https://www.linkedin.com/posts/bmarcoux_daimler-stops-developing-internal-combustion-activity-6580481304071065600-vRK8, accessed 20191220.

[7] The Fourth Annual “Canada’s Most Respected Corporations” Survey, Angus Reid Group, Inc., 1998, page 5.

[8] The Gustavson Brand Trust Index, Peter B. Gustavson School of Business, University of Victoria, 2017.

---

This thought leadership article was originally shared with Energy Central's Utility Management Community Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Utility Management Community today and learn from others who work in the industry.

-----

Earlier: