IEA: OIL DEMAND UP 0.9 MBD

IEA - Oil Market Report - December 2019

Highlights

- Global oil demand increased by 900 kb/d y-o-y in 3Q19, the strongest annual growth in a year. Nearly three-quarters of the growth occurred in China. Indian demand rose 135 kb/d, but OECD deliveries fell for the fourth straight quarter and are expected to decline 75 kb/d overall in 2019. For 2019 and 2020 we have left unchanged our global oil demand growth forecasts at 1 mb/d and 1.2 mb/d, respectively.

- Faced with potential oversupply in early 2020, OPEC+ countries agreed to deepen existing cuts to 2.1 mb/d in 1Q20. This implies a reduction in supply of 500 kb/d from current levels. Despite the additional curbs and a reduction in our forecast of 2020 non-OPEC supply growth to 2.1 mb/d, global oil inventories could build by 0.7 mb/d in 1Q20. In November, global oil supplies held steady at 101.36 mb/d, down 1.2 mb/d y-o-y.

- The sharp drop in refining margins in November in all markets revealed the delicate balancing act between global crude oil and product markets. Labour strikes in November in several countries were factors in the downward revision to our 4Q19 throughput forecast, now expected to be flat y-o-y. In 2020, refining throughput growth is also revised down to 1 mb/d, after a 0.2 mb/d decline in 2019.

- OECD commercial stocks drew 32.5 mb in October to 2 904 mb. They were 2.9 mb below the five-year average and covered 60.6 days, one day below the average. Preliminary data for November showed total inventories falling in all regions, by 23.5 mb. Short-term floating storage of crude oil fell 2.1 mb in November to 62 mb. The number of Iranian VLCCs used for floating storage decreased by one to 26.

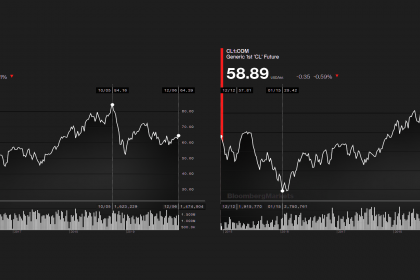

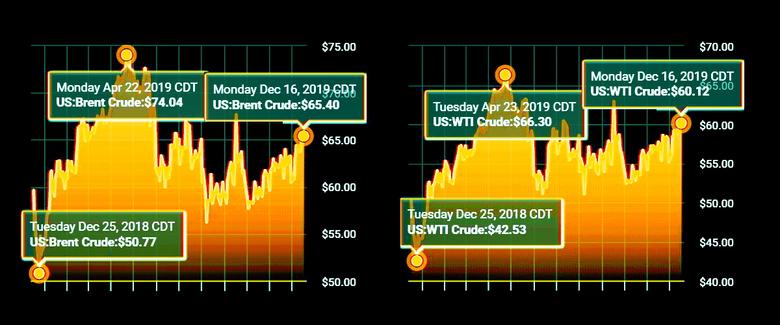

- ICE Brent futures rose above $64/bbl following the OPEC+ meetings. Physical markets appear to have tightened with steeper backwardation for both North Sea Dated and Dubai, and rising differentials for many crudes, particularly sweet grades. Product cracks eased, with the exception of naphtha which was boosted by petrochemical demand. HSFO cracks continued to be pressured by the IMO regulations and fell to record lows.

Oil’s new deal

For the last several months in this Report we have suggested that in early 2020 the oil market is likely to see a significant surplus of supply over demand. On 6 December, countries participating in the OPEC+ agreement took a step to address this imbalance by deepening their cuts from 1.2 mb/d to 1.7 mb/d. Saudi Arabia once again showed its willingness to shoulder a greater burden by volunteering an additional reduction of 0.4 mb/d to take the total cut to 2.1 mb/d, effective 1 January. The voluntary cut by the Saudis has already been partially delivered but the overall effectiveness of the OPEC+ agreement depends on the willingness of all its parties to fully comply, including those whose compliance so far has been less rigorous. This revised deal excludes from the production ceiling 1.5 mb/d of condensate output by non-OPEC producers. Russia, in particular, now has 0.8 mb/d of supply that can legitimately be increased.

If all the countries comply with their new allocations and Saudi Arabia delivers the rest of its voluntary cut of 0.4 mb/d, the fall in production volume versus today will be about 0.5 mb/d. In this Report we have reduced our forecast for non-OPEC production growth next year from 2.3 mb/d to 2.1 mb/d to take account of lower output from participants in the OPEC+ deal and a weaker growth outlook for Brazil, Ghana and the United States. Even so, with our demand outlook unchanged, there could still be a surplus of 0.7 mb/d in the market in 1Q20.

In the meantime, the market has done its own sums and the reaction to oil’s new deal has so far been muted: Brent crude oil was priced at $63/bbl on the eve of the OPEC+ meetings and as we publish this Report the price is $64/bbl.

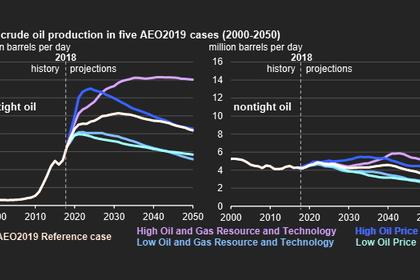

On a historic note, in September, the United States momentarily became a net oil exporter to the tune of 89 kb/d. This is a major milestone on its path to becoming a sustained net exporter, which is likely to be late in 2020 or early in 2021. However, this does not mean that energy independence has been achieved: the United States remains a major crude oil importer. In September, it received 6.5 mb/d of crude oil, with the largest volume coming from Canada and, with exports of 3.1 mb/d, it remained a significant net importer of 3.4 mb/d. Quality issues and greater market competition indicate that the United States will remain a major crude importer. This exposure to international markets highlights the need to insure against disruptions by maintaining emergency stocks, as reconfirmed in the communique issued at the conclusion of the biannual IEA Ministerial Meeting held last week in Paris.

-----

Earlier: