JAPAN, RUSSIA LNG INVESTMENT $9 BLN

NIKKEI - A group of Japanese companies and its government are set to launch a new liquefied natural gas project with Russian and U.S. partners in far eastern Russia in a move that may shift the power dynamics of the growing global LNG market.

The project involves Exxon Mobil of the U.S., Russian state oil company Rosneft and Sakhalin Oil and Gas Development, a Japanese consortium that counts Japan’s Ministry of Economy, Trade and Industry as well as Itochu, Japan Petroleum Exploration and Marubeni as shareholders. The parties are in talks to produce LNG from the Sakhalin I Project, which already produces crude oil.

The new project will send gas via a 200-km pipeline to Russia and produce 6.2 million tons of LNG a year, nearly a tenth of Japan’s total LNG procurement.

The initial plan was for Sakhalin 2, a project by Russian gas company Gazprom and Royal Dutch Shell, to sell the gas via pipeline, but it was switched to self-export after a disagreement over pricing. Rosneft CEO Igor Sechin confirmed this policy with Japanese counterparts during a recent visit to Japan.

The project could cost 1 trillion yen ($9.1 billion). The parties plan to make a final investment decision in 2021 and start production in 2027.

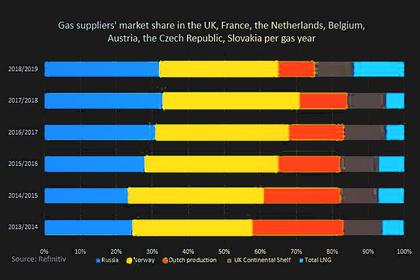

Russia, the world’s second-largest gas producer after the U.S., exports nearly 40% of its domestic production. A big portion goes to Europe, but it is increasing supply to East Asia amid concerns in Europe over becoming too dependent on Russia.

Japan, the world’s largest LNG importer, is looking for greater involvement in projects to secure supply amid the growing clout of China and other countries.

The project will mark the third Russian LNG development project with Japanese investment, after Sakhalin 2 and Arctic LNG 2.

But projects in Russia also carry risks. Mitsubishi and Mitsui were involved in Sakhalin 2, but their ownership in the project, as well as Shell’s, was reduced in 2006-07 after the Russian government raised environmental issues. Gazprom joined as the largest shareholder.

-----

Earlier: