RUSSIA'S GAS IS CHEAPER

PLATTS - Gazprom's continued injections of gas into its proprietary storage sites in Europe despite a breakthrough on a new transit deal with Ukraine's Naftogaz suggests the company's 2020 strategy will be to "kill prices" and defend its market share against LNG, according to market players.

The current long-term agreement for transit of Russian gas via Ukraine's gas system expires at the end of December, with a new deal set to be signed before the turn of the year after the two parties made a breakthrough last week.

During the past year, Gazprom had been preparing for potential disruptions on the Ukrainian transit route by filling both proprietary and non-proprietary storage sites across Europe. The major had also encouraged other countries at risk such as Hungary to do the same.

At the same time, Gazprom continued to export high volumes of gas into Europe, optimizing its long-term contracts.

This strategy appears to have continued in the past few days, despite the positive developments in the negotiations for the renewal of the current transit deal reached on Friday, when the governments of Russia and Ukraine, together with the European Commission, agreed a final protocol containing the main elements of a new long-term transit deal.

"It's 90% done. They sent Russia's energy minister Novak to negotiate. If [Gazprom] wanted to agree on something and go back on its word afterwards, they would have sent someone smaller," a UK-based gas trader said.

Markets reacted to the news on Monday morning by ditching the remaining risk premium on the Jan 20 and Q1 20 gas contracts.

"Of course there is still a bit of risk. You will know for sure when the gas is really flowing on January 1. But the communication around the transit deal is very positive. So I would say, the risk is very low," a German gas trader said Monday.

The Dutch TTF Jan 20 contract, which closed Friday at Eur14.125/MWH, started the trading day on Monday at about Eur13.5/MWh, and dipped further to trade at Eur13.145/MWh at 1317 GMT, ICE data showed.

But data from Gas Infrastructure Europe showed on Monday that on Saturday, Austria's Haidach storage facility still registered a 0.09% positive injection trend with 8.88 GWh injected against zero withdrawals, despite being already 98.7% full.

The Jemgun storage site in Germany (97.2% full) saw 233.4 GWh of gas injected against 104.4 GWh withdrawn. In the Netherlands, the Bergermeer facility saw 51 GWh of gas injected and none withdrawn.

Russian flows were also high. Russian nominations at the Velke Kapusany entry point on the Ukraine/Slovakia border for the Monday's gas day were seen at 150 million cu m, against about 120 million cu m imported a year ago, data from S&P Global Platts Analytics show.

Nominations at the Tarvisio entry point on the Austria/Italy border, stood at 60 million cu m on Monday early afternoon against 65.6 million cu m of Russian gas imported from Tarvisio a year ago, although demand in Italy on December 23, 2018 stood at 230 million cu m against 200 million nominated for December 23 this year.

FLOODING THE MARKET

While the premium of the Jan 20 and Q1 20 gas contracts towards the day-ahead equivalents all across Europe is currently favoring storage injections, a company like Gazprom, which produces the gas it sends to Europe, should be more interested in reducing supplies available in Europe to push prices up and increase its own profit.

A reduction of volumes sent to Europe and use of storage withdrawals to serve existing demand, which would push prices up and also save the cost of transport, would make sense.

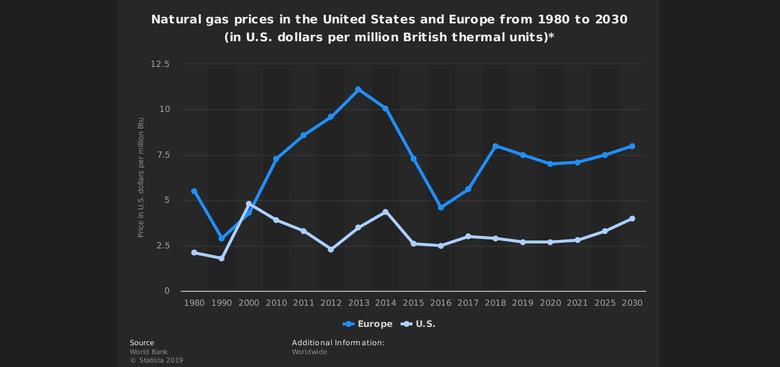

However, by doing the opposite, Gazprom is showing that the strategy chosen for 2020 -- and potentially over the longer term -- is to defend its market share in Europe by flooding the Continent with cheap gas, send alternative sources of supply, in particular LNG, out of the money, traders told S&P Global Platts.

"They have done an agreement very favorable for Ukraine. I didn't expect that. This means that their strategy is of market share. Clearly, it means they want to scuttle LNG this year," the UK-based trader said.

"This year is going to be a massacre. Prices will be killed. I think in the end Gazprom will succeed with 10-20 years of dominance," he added.

According to the trader, the Russian major could live with TTF day-ahead gas prices going as low as Eur5-7/MWh and still make a profit on the gas export business.

"The fight against LNG is clear," an Italian gas trader operating on the TTF said. "But it won't be fought in January. It's a long-term strategy," he added, pointing at Gazprom's storage strategy as a critical element to look at in 2020.

"The key question still open is how Gazprom will use its stocks in January. Will they start withdrawing in January? Or will they keep those stocks full? So far we don't have elements to understand what the choice will be," the Italian trader said.

The Northwest Europe LNG front-month contract was assessed at $4.241/MMBtu by S&P Global Platts at market close on Friday.

-----

Earlier: