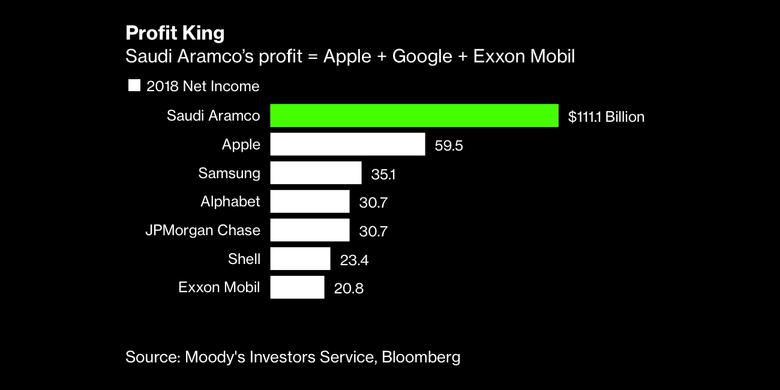

SAUDI ARAMCO IPO $44.3 BLN

WSJ - November 29, 2019 - Saudi Aramco's share sale has attracted bids worth $44.3 billion as of Friday, about 1.7 times the amount the kingdom's government plans to raise in what is on course to be the world's largest listing when it formally prices next week.

Subscriptions to the sale are overwhelmingly from Saudi investors and others in the region, according to the banks arranging the initial public offering, indicating a lukewarm response from international institutions that have balked at the energy giant's valuation of $1.6 to $1.7 trillion set by the Saudi government.

The kingdom is seeking to sell 1.5% of the state-controlled company, known officially as Saudi Arabian Oil Co., and with most of the bids at the top end of the valuation the government is likely to raise $25.6 billion. That would beat out Alibaba Group Holding Ltd.'s 2014 IPO, which raised $25 billion.

The sale is a key element of Crown Prince Mohammed bin Salman's program to open up his country to foreign investors and diversify its oil-dependent economy. The IPO is the culmination of the crown prince's years long effort to sell part of Aramco after first raising the possibility of a listing in 2016. Prince Mohammed has accelerated the much-delayed listing this year, installing loyal officials who backed the share sale and marginalizing those who opposed it.

The prince had hoped to raise up to $100 billion to help fund the economic transformation he has promised the Saudi people but Saudi officials scaled back the size of the offering in recent weeks, in part because of tepid demand from global buyers.

The country's sovereign-wealth fund is set to receive the IPO proceeds to invest in non-oil industries that can create jobs for the country's growing population. The lesser windfall, however, could limit the economic impact of the listing.

In total, the Saudi government plans to sell 0.5% of Aramco to individual investors and the remainder to domestic institutions and international firms registered in the kingdom, known as qualified foreign investors.

The window for retail investors to apply for the listing closed Thursday, and a total 4.9 million people—out of a population of 34 million—applied for shares with a total value of $12.6 billion, according the offering's lead managers.

Institutional investors so far have made subscriptions worth $31.7 billion and have until Dec. 4 to submit bids. Aramco will then formally set the valuation, with the start of trading on the domestic Tadawul stock exchange expected around Dec. 11.

Of the institutional bids, 10.5% or roughly $3.3 billion has come so far from non-Saudis, according to the lead managers. The United Arab Emirates, a key Saudi ally, is likely to invest at least $1.5 billion through its government investment vehicles, and Kuwait is expected to invest about $1 billion, according to people familiar with the process.

Global investors from the U.S. and Europe, however, have grown increasingly skeptical about the listing after the company decided to drop a plan to also list on an international exchange, said a person close to the process. That decision signaled to some investors an unwillingness to open the company up to full scrutiny, the person said.

Aramco earlier this month canceled plans to market the IPO to investors in the U.S., Japan and Europe. The prince's previous target valuation was $2 trillion, but that was lowered when many potential foreign investors turned away. Even $1.6 trillion to $1.7 trillion appears to be too high for many international institutions, some of whom have valued the firm at less than $1.5 trillion.

-----

Earlier: